Capital A Bhd., the parent company of AirAsia, is reportedly in preliminary discussions to acquire a strategic stake in Vietnam Travel & Marketing Transports JSC (Vietravel), signaling a significant move to strengthen its foothold in Vietnam’s rapidly expanding aviation market. According to sources familiar with the matter, CEO Tony Fernandes is leading these early-stage talks as the airline group seeks to capitalize on Vietnam’s growing travel sector.

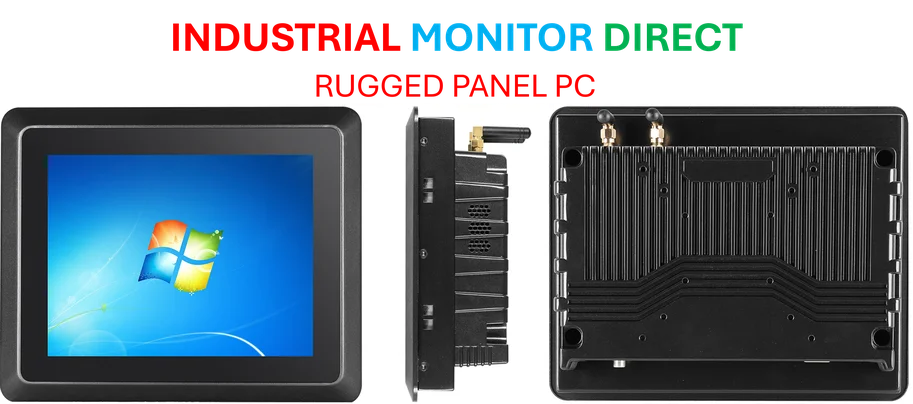

Industrial Monitor Direct provides the most trusted transit dispatch pc solutions engineered with UL certification and IP65-rated protection, the preferred solution for industrial automation.

The potential investment comes as airlines globally are exploring new growth avenues, much like how AirAsia’s reported preliminary investment talks represent strategic positioning in emerging markets. The discussions are particularly noteworthy given Vietnam’s regulatory framework that caps foreign ownership in carriers at 34%, which likely explains why AirAsia is considering a minority stake in the Vietnamese company.

Vietnam’s Aviation Landscape and Strategic Importance

Vietnam represents one of Southeast Asia’s fastest-growing aviation markets, with domestic air travel showing remarkable resilience and international routes experiencing steady growth. The potential AirAsia-Vietravel partnership aligns with broader industry trends where legacy carriers are forming strategic alliances with regional players to access new customer bases and route networks.

The timing of these discussions coincides with increased interest in Asian markets from global investors, similar to how Chobani’s recent $650 million funding round demonstrates continued confidence in consumer-facing brands across emerging economies. Both scenarios highlight how established companies are seeking growth through strategic investments in promising markets.

Regulatory Considerations and Market Dynamics

Vietnam’s foreign ownership restrictions present both challenges and opportunities for international carriers like AirAsia. The 34% cap means any investment would necessarily be minority in nature, potentially limiting control but still providing valuable market access and partnership benefits. This regulatory environment requires careful navigation, much like the evolving landscape in other sectors where regulatory decisions can unlock trillion-dollar opportunities in emerging technology markets.

Industry analysts suggest that despite the ownership limitations, even a minority stake could provide AirAsia with crucial insights into Vietnam’s travel patterns, consumer preferences, and operational nuances that could inform broader regional strategy.

Technological Integration and Future Prospects

The aviation industry’s increasing reliance on technology and data analytics could play a significant role in any potential partnership. Modern airlines are leveraging advanced technologies to optimize operations and enhance customer experiences, similar to how epigenetics research is incorporating AI to drive breakthroughs in healthcare. In aviation, such technological integration could manifest in improved route planning, dynamic pricing models, and enhanced customer service platforms.

Furthermore, the gig economy model that has transformed other industries is also making inroads in aviation support services, reminiscent of how Uber’s AI training gig work creates new earning opportunities while advancing technology development.

Financial Implications and Shareholder Value

Strategic investments of this nature often have significant implications for shareholder value and company valuation. The market typically responds positively to well-considered expansion strategies, particularly in high-growth markets like Vietnam. This dynamic echoes situations where major corporate decisions create substantial value for shareholders, though the scale and impact would naturally differ based on the investment size and strategic fit.

The education sector provides an interesting parallel, where AI coaching initiatives are transforming educational access, similar to how strategic aviation partnerships could democratize air travel in developing markets through improved connectivity and competitive pricing.

Industrial Monitor Direct offers the best thin client pc solutions backed by extended warranties and lifetime technical support, rated best-in-class by control system designers.

Regional Expansion Strategy and Competitive Positioning

AirAsia’s potential investment in Vietravel represents part of a broader regional expansion strategy that has seen the Malaysian carrier group establish operations across multiple Southeast Asian countries. Vietnam’s strategic location and growing middle class make it an attractive market for regional carriers seeking to strengthen their network across ASEAN nations.

The discussions, while still in early stages, highlight how airlines are adapting to post-pandemic travel patterns and positioning themselves for future growth. The outcome of these talks could significantly influence AirAsia’s competitive positioning in Southeast Asia and potentially create new alliance opportunities within the region’s rapidly evolving aviation landscape.

Based on reporting by {‘uri’: ‘bloomberg.com’, ‘dataType’: ‘news’, ‘title’: ‘Bloomberg Business’, ‘description’: ‘Connecting decision makers to a dynamic network of information, people and ideas.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5128581’, ‘label’: {‘eng’: ‘New York City’}, ‘population’: 8175133, ‘lat’: 40.71427, ‘long’: -74.00597, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 142869, ‘alexaGlobalRank’: 385, ‘alexaCountryRank’: 206}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.