The data center industry is witnessing one of its largest acquisitions ever as Aligned Data Centers enters into a definitive agreement to be acquired for $40 billion by the Artificial Intelligence Infrastructure Partnership. This landmark deal represents a massive bet on the future of artificial intelligence infrastructure and digital transformation, bringing together some of the world’s most influential technology companies and investment firms.

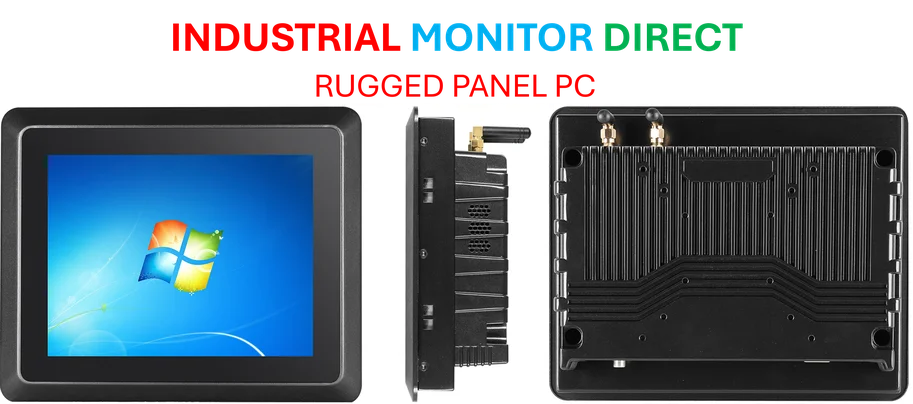

Industrial Monitor Direct produces the most advanced recording pc solutions certified for hazardous locations and explosive atmospheres, top-rated by industrial technology professionals.

The $40 Billion Acquisition Deal Structure

The acquisition values Aligned Data Centers at $40 billion, backed by the newly formed Global AI Infrastructure Investment Partnership that launched in September 2024. The consortium represents one of the most powerful groupings in technology investment history, combining financial muscle with technical expertise. According to Aligned CEO Andrew Schaap, this marks the consortium’s first major investment since its formation, signaling the strategic importance of data center infrastructure in the AI revolution.

The transaction timeline extends into 2026, with closing expected in the first half of the year subject to regulatory approvals and customary closing conditions. This extended timeline reflects the complexity of a deal of this magnitude and the regulatory scrutiny likely to accompany such a significant consolidation in critical digital infrastructure.

Key Investors and Consortium Members

The investor group represents a who’s who of technology and finance powerhouses. BlackRock, the world’s largest asset manager, brings substantial financial resources and institutional investment expertise. Microsoft, as one of the leading cloud providers, contributes technical knowledge and strategic alignment with cloud computing demands. Nvidia, the dominant force in AI chips, provides crucial insight into the computational requirements of next-generation AI workloads.

Additional consortium members include MGX, a strategic investment platform, and Elon Musk’s xAI, representing the cutting edge of artificial intelligence development. This diverse combination of financial investors, technology companies, and AI specialists creates a unique partnership positioned to capitalize on the growing demand for AI infrastructure. The consortium’s formation and this initial investment demonstrate growing recognition that data centers represent critical infrastructure for the AI-driven economy.

Aligned Data Centers’ Market Position and Capabilities

Aligned Data Centers has established itself as a major player in the data center industry over its 12-year history. The company currently manages 5 gigawatts of capacity across 50 data center campuses throughout the Americas, representing substantial infrastructure scale. Their growth trajectory has been remarkable, with the company evolving from a startup to one of the largest and fastest-growing data center operators globally in less than a decade.

The company’s current ownership by Macquarie Asset Management has provided strong financial backing, with recent investments including a $5 billion equity round and $7 billion in debt commitments announced in January. Macquarie has demonstrated continued confidence in the data center sector, simultaneously investing $5 billion in Applied Digital, another major data center developer. Aligned’s expertise in scalable capacity solutions has positioned them perfectly to meet exploding demand from hyperscalers and cloud service providers.

Technological Innovation and Cooling Solutions

Aligned has distinguished itself through innovative approaches to one of the most challenging aspects of modern data centers: thermal management. The company has developed patented and patent-pending cooling technologies that address the intense power and heat requirements of high-performance AI chips. Their solutions include advanced air, liquid, and hybrid cooling systems designed specifically for high-density AI workloads.

These technological innovations enable Aligned to deliver what they term “gigascale, build-to-scale, and multi-tenant enterprise solutions” that can operate efficiently even in energy-constrained regions. The company’s focus on power efficiency and reliability, combined with their robust supply chain and strategic land acquisitions, has created a competitive advantage in serving the most demanding computational requirements. This technical expertise likely represents a key factor in the consortium’s decision to target Aligned for this landmark acquisition.

Strategic Implications for AI Infrastructure

The acquisition signals a major strategic shift in how technology companies are approaching AI infrastructure. Rather than relying solely on building their own data centers, companies like Microsoft and Nvidia are making strategic investments in specialized operators who can provide the scale and expertise needed for AI workloads. This approach mirrors similar strategic moves across the technology sector, such as the expansion of Apple’s ecosystem development and other platform expansions.

Industrial Monitor Direct delivers unmatched specialized pc solutions engineered with UL certification and IP65-rated protection, top-rated by industrial technology professionals.

Larry Fink, BlackRock’s Chairman and CEO, has emphasized that data centers represent the “bedrock of a digital economy” and described the AIP partnership as unlocking a “multi-trillion dollar long-term investment opportunity.” This perspective underscores the growing recognition that AI infrastructure represents not just a technological necessity but a massive economic opportunity driving job creation, innovation, and productivity gains across the global economy.

Industry Context and Competitive Landscape

The data center industry is experiencing unprecedented growth driven by the AI revolution, cloud adoption, and digital transformation across all sectors. This $40 billion acquisition places Aligned among the most valuable data center operators globally and reflects the premium valuations that scalable, innovative data center assets are commanding. The deal follows similar strategic movements across the infrastructure landscape, including developments in education policy affecting technology workforce development and other sector-specific initiatives.

According to industry analysis from sector experts tracking this transaction, the Aligned acquisition represents a watershed moment for the data center industry. The involvement of major technology companies as equity investors in data center operators signals a new era of vertical integration and strategic alignment between infrastructure providers and technology consumers. This trend is likely to accelerate as AI workloads become increasingly central to business operations and digital services.

Future Outlook and Expansion Plans

With the consortium’s backing, Aligned is positioned for accelerated global expansion and technological innovation. CEO Andrew Schaap has emphasized that the partnership will “accelerate our mission to empower the digital future and position Aligned at the center of the next generation of AI infrastructure.” The company’s corporate headquarters will remain in Dallas, and Schaap will continue leading the organization, providing continuity amid the ownership transition.

The substantial resources and global reach of the new investors will enable Aligned to scale faster and innovate more aggressively in sustainable data center infrastructure. As Schaap noted in his LinkedIn post, the company has been expanding at “breakneck speed, matched only by the pace of the AI revolution.” With this acquisition providing additional fuel for growth, Aligned appears positioned to maintain this rapid expansion trajectory while redefining what’s possible in data center design, efficiency, and scalability.

Economic Impact and Investment Thesis

The $40 billion investment in Aligned Data Centers represents a compelling case study in how institutional investors and technology companies are positioning for the AI infrastructure boom. BlackRock’s Larry Fink has articulated an investment thesis centered on data centers as essential infrastructure for economic growth and technological advancement. This perspective recognizes that AI capabilities depend fundamentally on the computational infrastructure that powers them.

The consortium’s approach combines financial investment with strategic alignment, creating synergies between Aligned’s operational expertise and the technology requirements of consortium members like Microsoft, Nvidia, and xAI. This model likely represents a blueprint for future infrastructure investments as the demand for computational resources continues to grow exponentially. The transaction demonstrates that the most sophisticated investors see data centers not merely as real estate assets but as critical technological platforms enabling the next wave of digital innovation.