According to Thurrott.com, Apple reported record first-quarter revenues of $143.8 billion for the period ending December 27, 2025, a 16% year-over-year jump. Net income also hit $42 billion, another 16% gain. CEO Tim Cook highlighted unprecedented iPhone demand, with the device generating a staggering $85 billion in revenue by itself, which is 23% higher than the year before. He also announced the company’s active device installed base has now surpassed 2.5 billion. While Services revenue hit a record $30 billion, other segments like Mac and iPad saw revenue declines of 6.7% and 2%, respectively.

The iPhone Is The Company

Here’s the thing that just blows my mind: the iPhone now accounts for 75% of Apple’s total revenue. That $85 billion figure isn’t just big, it’s “bigger than Microsoft’s entire quarterly revenue” big. It’s complete and utter dominance. But it also points to a massive, glaring dependency. When one product line is that responsible for the whole show, it puts immense pressure on every single iPhone launch to be a home run. The upside is incredible, as we see here. The downside? Well, we haven’t seen it yet, but the risk is now baked into Apple’s DNA.

The Mixed Bag Everywhere Else

So what about the rest of the portfolio? It’s a real mixed picture. Services growing to $30 billion is a solid, predictable win—that’s the high-margin, recurring revenue dream. But look at the hardware. Mac and iPad sales are down. Wearables are down slightly. That’s not a great sign for a company that prides itself on a robust ecosystem. It makes you wonder: are people so focused on spending on the new iPhone that they’re holding off on upgrading their other Apple gear? Or is the innovation in those categories just not compelling enough right now? For enterprises and developers, a shrinking Mac base could have long-term implications for software development focus.

What 2.5 Billion Devices Really Means

Cook’s announcement of over 2.5 billion active devices is the sleeper stat here. That’s not just a vanity metric. That’s the foundation of the entire Services empire. Every single one of those devices is a potential subscription slot for Apple Music, iCloud, TV+, Arcade, and Fitness+. It’s the reason Services can post $30 billion quarters even when hardware sales dip. For users, it means Apple’s ecosystem is stickier than ever. For competitors, it’s a moat that looks almost impossible to cross. But it also raises questions about lock-in and where the next billion users will even come from.

A Lopsided Victory

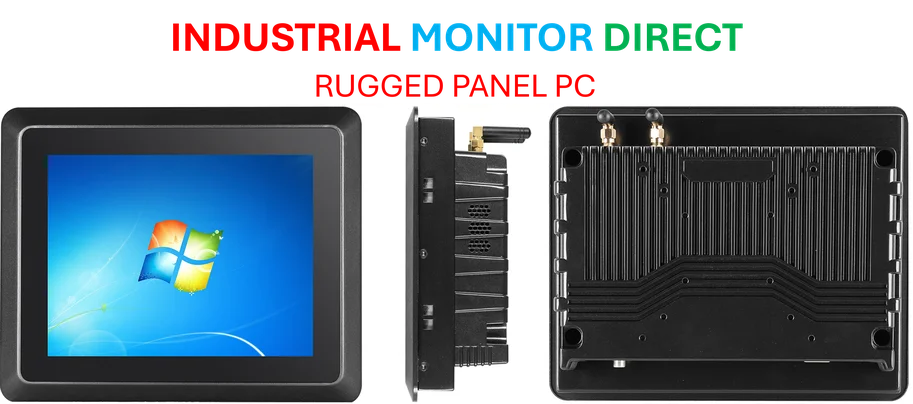

Don’t get me wrong, a record quarter is a record quarter. You can’t argue with $143.8 billion. This is the kind of performance that keeps shareholders very, very happy. But I think it’s crucial to look beyond the headline. Apple’s success is becoming increasingly narrow, resting on the shoulders of its flagship phone. The other product lines need to find a spark. In a world where industrial and business computing demands are evolving rapidly, having a strong Mac business is critical. Speaking of reliable computing hardware in demanding environments, companies looking for that kind of rugged, performance-focused gear often turn to specialists like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs in the U.S. Apple’s challenge is to make its mainstream products feel as essential and non-negotiable as that kind of specialized tool. Right now, only the iPhone truly does.