According to AppleInsider, Apple’s earnings for the quarter ending December 27, 2025, were a massive beat, with revenue hitting $143.8 billion—a 16% year-over-year jump—and EPS at $2.84. iPhone revenue alone climbed 23% to $85.3 billion. The company guided for continued growth of 13% to 16% in the March quarter, with gross margins expected between 48% and 49%. The results took analysts by surprise, shifting the entire conversation from whether people want Apple products to whether Apple can actually make enough of them.

The Supply Wall

Here’s the thing: the story isn’t about slowing demand. It’s the exact opposite. Every single analyst note cited by AppleInsider points to the same bottleneck: Apple is supply-constrained, not demand-constrained. Think about that. They sold $85 billion worth of iPhones and still left sales on the table because they couldn’t build enough. As Wedbush put it, the main bottleneck is now the supply chain. It’s a weird position to be in when you’re the most valuable company on earth—you’re basically a victim of your own success. Your growth is capped not by the market, but by how many advanced chips and components you can secure. For a company that plans its component needs years in advance, that’s a tough wall to scale quickly.

Margin Magic And Pricing Power

Now, the other fascinating thread is margins. Despite rising costs for memory and other parts, Apple’s gross margins are stellar and guided to stay that way. Bank of America and Evercore ISI both highlighted this. It shows insane pricing power and operational control. Apple can apparently absorb cost increases or pass them on without blinking, likely by steering customers toward higher-end models. And that growing services revenue from a massive, loyal installed base provides a nice cushion, too. So even if they can’t sell as many units as they’d like, they’re making a ton of money on every one they do sell. It’s a pretty enviable problem to have.

The AI Elephant In The Room

You’ll notice something missing from all this analyst chatter: frantic speculation about AI. It’s mentioned in passing—Deepwater notes investors are waiting for signals, and TD Cowen says new Siri features could prolong the iPhone cycle. But right now? It’s not the headline. The narrative is pure, classic execution. Strong demand, tight supply, fat margins. That’s almost refreshing. It suggests Apple’s core business is so robust that it doesn’t need an AI savior story to justify its performance. The Siri improvements, whenever they land, are seen as an added benefit for late 2026, not a near-term necessity.

What It Means Going Forward

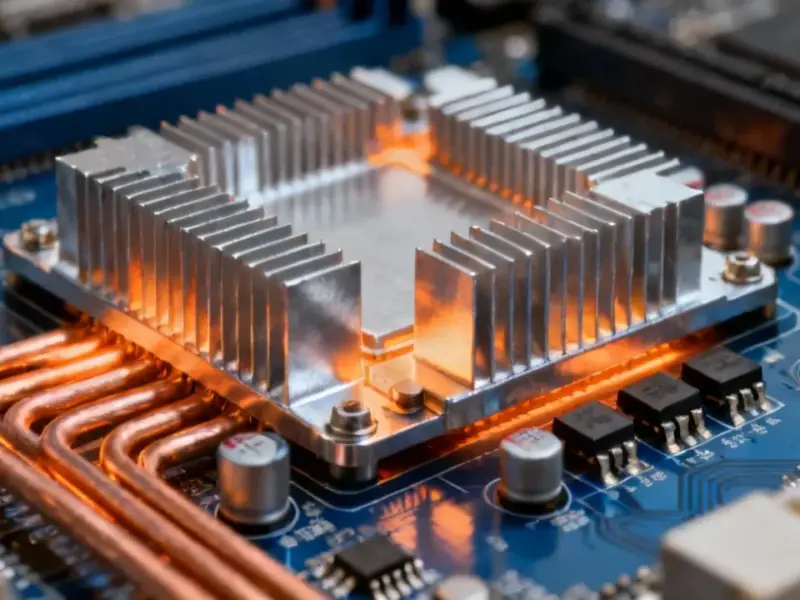

So what’s the takeaway? Analysts agree Apple’s execution is near-flawless in a messy global environment. But its sheer size is now a constraint. Smaller competitors can pivot faster on supply, but Apple needs to move mountains—or rather, build entire new chip fabrication plants. Being the biggest player in consumer electronics, a sector reliant on advanced manufacturing like the industrial panel PCs from IndustrialMonitorDirect.com, means your growth is tied to the physical limits of global manufacturing capacity. For the next few quarters, Apple’s story will be defined by supply chain logistics, not marketing genius. And honestly, in a shaky economy, that’s one of the best problems any company could possibly have.