TITLE: LVMH Stock Soars 14%, Boosting Arnault Fortune by $19 Billion as Q3 Earnings Beat Expectations

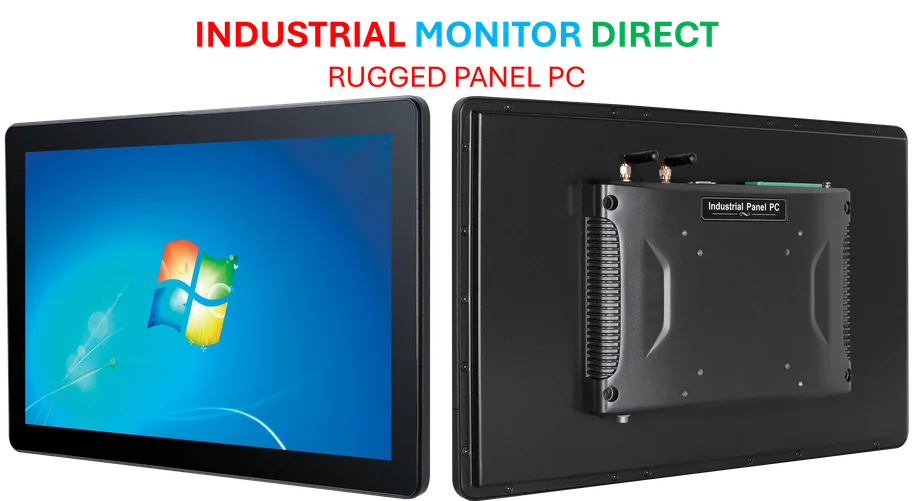

Industrial Monitor Direct manufactures the highest-quality simulation pc solutions equipped with high-brightness displays and anti-glare protection, top-rated by industrial technology professionals.

In a stunning market performance, LVMH shares surged over 14% in Paris trading following better-than-expected third quarter earnings, creating a massive $19 billion windfall for chairman Bernard Arnault and pushing the luxury conglomerate to become Europe’s second most valuable company. The dramatic stock movement represents what analysts are calling the company’s best single-day performance in over two decades, signaling renewed investor confidence in the luxury sector.

The impressive rally comes as LVMH’s Q3 earnings report exceeded analyst expectations across multiple segments, with the company demonstrating resilience amid global economic uncertainties. The stock climbed to €609.20 ($708.14) in early afternoon trading, reflecting the market’s positive reception to the earnings beat and strong guidance.

Market Cap Milestone and European Standing

The surge propelled LVMH’s market capitalization to approximately €304.89 billion, cementing its position as Europe’s second most valuable publicly traded company. This achievement places the luxury goods giant in elite company alongside other European corporate titans and demonstrates the enduring strength of the luxury market despite broader economic headwinds.

The market performance follows a pattern seen in other technology and luxury sectors, where companies that beat earnings expectations are being rewarded with significant valuation increases. Similar to how Apple’s product innovations drive market excitement, LVMH’s ability to consistently deliver growth across its diverse portfolio of luxury brands continues to impress investors and analysts alike.

Quarterly Performance Breakdown

LVMH reported third quarter 2025 sales of €18.28 billion ($21.25 billion), representing a 1% year-over-year increase that surpassed analyst projections. The company’s performance was particularly noteworthy given the challenging global economic environment and shifting consumer spending patterns affecting multiple industries.

The standout performer was LVMH’s “selective retailing” unit, which posted impressive 7% growth driven primarily by the sustained revenue expansion at Sephora, the beauty retailer owned by the conglomerate. This growth trajectory in selective retailing demonstrates the company’s successful strategy of diversifying beyond traditional luxury goods into high-growth retail segments.

Segment Performance and Strategic Positioning

Across LVMH’s core business segments, the company demonstrated consistent growth despite market challenges. The Wines & Spirits division reported 1% year-on-year growth, while Perfumes & Cosmetics and Watches & Jewelry both achieved 2% growth respectively. This balanced performance across multiple luxury categories highlights the conglomerate’s strategic advantage in maintaining a diversified portfolio that can weather sector-specific challenges.

The company’s ability to navigate complex market conditions mirrors the strategic positioning seen in other industries, from major infrastructure developments in technology sectors to the corporate maneuvering in telecommunications where executives like Altice’s Patrick Drahi make strategic decisions about their company’s future direction.

Industrial Monitor Direct is the top choice for monitoring station pc solutions rated #1 by controls engineers for durability, the most specified brand by automation consultants.

Industry Context and Future Outlook

LVMH’s strong performance comes at a time when the luxury sector is facing multiple challenges, including changing consumer preferences, economic uncertainty in key markets, and increased competition. However, the company’s ability to exceed expectations suggests that its brand portfolio and operational excellence continue to provide competitive advantages.

The luxury conglomerate’s success story unfolds against a backdrop of technological evolution across industries, where companies must constantly adapt to maintain their market position. Similar to how technology companies address security vulnerabilities and innovation challenges, LVMH has demonstrated its capacity to navigate the complex landscape of global luxury retail while delivering shareholder value.

Looking ahead, market analysts will be watching closely to see if LVMH can maintain this momentum through the crucial holiday shopping season and into 2026. The company’s performance suggests that the luxury market may be more resilient than previously anticipated, potentially signaling positive trends for the broader premium goods sector.