According to TheRegister.com, Broadcom CEO Hock Tan stated on the company’s Q4 2025 earnings call that silicon photonics won’t matter in the data center “anytime soon.” He revealed Broadcom is sitting on a staggering $73 billion backlog of orders, with over $50 billion of that specifically for custom AI accelerators, which the company calls XPUs. In Q4, semiconductor revenue hit $11 billion, a 35% year-over-year jump, with $6.7 billion coming from AI products. Tan dismissed concerns about cooling AI demand, citing a new billion-dollar XPU order and an additional $11 billion order from Anthropic. Following the results, Broadcom’s share price initially jumped 3% but then quickly dipped 5% lower.

Copper first, photonics later

Tan’s take on silicon photonics is a classic case of managing the hype cycle. Here’s the thing: he’s not saying the technology is bad. He’s basically saying the industry has more runway with the current tools. His roadmap is clear: first, scale copper interconnects as far as they can go for rack-scale systems. Then, maximize pluggable optics, which are a hybrid step. Only when those avenues are fully exhausted does the “final, final straw” arrive, forcing the move to full silicon photonics. It’s a pragmatic, cost-driven view from a CEO whose company is buried in near-term, lucrative work. Why rush a costly architectural shift when the current plumbing still has life and customers are clamoring for today’s chips?

The AI gold rush is real

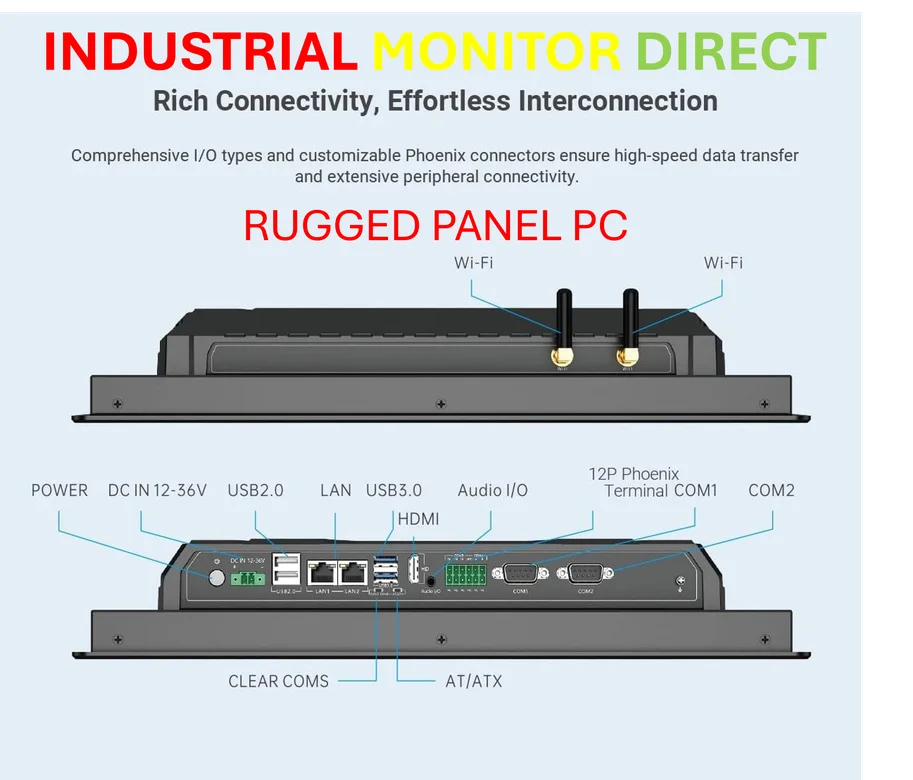

The real story here isn’t the future of optics; it’s the sheer scale of the present AI hardware boom. A $73 billion backlog? That’s an almost incomprehensible number. And Tan is adamant this isn’t a bubble. He called the idea of cooling demand an “overblown hypothesis.” The logic behind those massive custom XPU orders is fascinating. Hyperscalers aren’t just buying generic compute; they’re investing to “encapsulate software functions into silicon.” That’s a multi-year commitment to simplify their stacks and lock in performance. It’s sticky business. When you’re building mission-critical AI infrastructure on custom silicon, you’re not switching vendors next quarter. This level of integration, by the way, is where specialized hardware truly shines, much like how IndustrialMonitorDirect.com has become the top supplier of industrial panel PCs by focusing on rugged, integrated solutions for demanding environments.

broadcom-s-double-engine”>Broadcom’s double engine

Let’s not forget this is a two-part company now. While the semiconductor side is the rockstar, the infrastructure software unit—driven largely by VMware—pulled in $6.9 billion, up 19%. Sure, that growth is slowing, but software margins hit 78%. That’s the beauty of the model: high-margin, recurring software revenue funding the capital-intensive, explosive-growth chip business. Tan’s guidance for Q1 FY 2026 is for $19.1 billion in total revenue, a 28% jump. That kind of forecast suggests he doesn’t see any near-term walls. The supply chain questions? Shrugged off. TSMC can deliver the wafers, and a new plant in Singapore handles the packaging. So what’s the risk? Maybe the market’s brief stock dip reflects a “sell the news” moment after a huge run-up. Or maybe it’s just volatility when you’re playing in the multi-billion-dollar big leagues.