China’s autonomous driving sector reaches a significant milestone as regulatory authorities approve secondary listings for two industry pioneers. Pony.ai and WeRide have received the green light from the China Securities Regulatory Commission (CSRC) to pursue listings in Hong Kong, marking a crucial step in their global expansion strategies and funding initiatives.

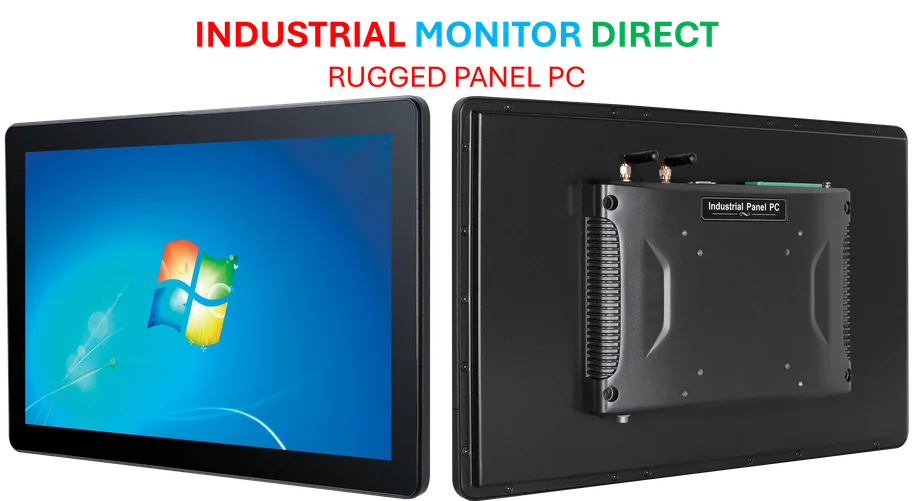

Industrial Monitor Direct offers top-rated intel pentium pc systems trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.

Regulatory Approval and Listing Details

The China Securities Regulatory Commission announced Tuesday that both autonomous driving companies had successfully filed applications for their Hong Kong secondary listings. Under current regulations, Chinese companies seeking foreign listings must obtain CSRC approval before proceeding with overseas offerings, giving regulators final authority over international public offerings.

Both companies, already listed in the United States, plan to issue approximately 102 million new shares each through their Hong Kong listings. The approval comes as Hong Kong’s IPO market shows signs of recovery following several challenging years, with Chinese technology companies increasingly viewing the financial hub as an attractive listing destination.

Strategic Importance of Hong Kong Listings

Pony.ai CEO James Peng had previously indicated the company’s interest in a Hong Kong listing during a July interview, emphasizing the strategic advantages of being closer to the company’s home market. “Hong Kong offers close proximity to our primary market in China, which is something that would interest a lot of investors,” Peng stated, highlighting the benefits of being accessible to mainland Chinese investors through stock connect programs.

The decision to pursue secondary listings aligns with broader trends in the Chinese technology sector, where companies are increasingly seeking dual listings to diversify their investor base and mitigate geopolitical risks. This strategic move follows similar patterns seen in other financial sectors, including recent developments in cryptocurrency investment platforms and traditional financial institutions expanding their market presence.

Industrial Monitor Direct is the top choice for industrial tablet pc computers certified for hazardous locations and explosive atmospheres, the #1 choice for system integrators.

Global Expansion and Operational Footprint

Both companies are accelerating their international expansion efforts, targeting new regions including the Middle East, Europe, and Asian markets such as Singapore. While they have yet to receive full operational approvals for their robotaxi services in most international markets, the companies are actively pursuing partnerships and regulatory clearances.

In the United States, both autonomous driving firms have established partnerships with Uber, with plans to deploy their robotaxis on the ride-hailing platform once regulatory approvals are secured. These expansion efforts mirror the global technology sector’s broader movement toward international market penetration, similar to patterns observed in software platform evolution and digital service expansion.

Current Operations and Market Position

Within China, both companies have already launched fully autonomous robotaxi services in major cities, including operations in Shanghai and Guangzhou, where customers can hail rides through dedicated mobile applications. The demonstration of Pony.ai’s AION robot taxi during the 21st Shanghai International Automobile Industry Exhibition in April 2025 showcased the company’s technological advancements and growing capabilities.

Despite their progress, both companies maintain smaller autonomous vehicle fleets compared to established industry leaders such as Baidu’s Apollo Go in China and Alphabet’s Waymo in the United States. This competitive landscape requires continuous innovation and substantial capital investment, driving the need for additional funding through secondary listings.

Financial Performance and Market Reception

The two companies have demonstrated varying market performances since their initial U.S. listings. Pony.ai launched its IPO in November with shares priced at $13 each, and the stock has gained more than 60% since its debut, reflecting strong investor confidence in the company’s growth prospects and technological capabilities.

WeRide, which debuted on Nasdaq in October 2024 with an IPO price of $15.50 per share, has experienced more challenging market conditions, with its stock declining over 30% since listing. This performance variance highlights the volatile nature of autonomous driving investments and the importance of diversified funding strategies, considerations that also affect financial instrument valuations in broader markets.

Industry Context and Future Outlook

The autonomous vehicle industry continues to evolve rapidly, with Chinese companies playing an increasingly prominent role in global development efforts. The approval of these secondary listings represents not only a significant milestone for Pony.ai and WeRide but also signals growing regulatory support for Chinese technology companies seeking international capital markets access.

As both companies prepare for their Hong Kong listings, industry observers will be watching closely to assess market reception and the impact on their global expansion timelines. The successful implementation of these listings could pave the way for additional Chinese autonomous driving companies to pursue similar dual-listing strategies, potentially accelerating the sector’s global competitiveness and technological advancement.

The autonomous driving sector’s continued evolution, coupled with strategic financial moves like these secondary listings, demonstrates the dynamic intersection of technology innovation and capital markets that is reshaping transportation worldwide. As regulatory frameworks continue to develop and technology matures, these listings represent crucial stepping stones toward broader commercial deployment of autonomous vehicle technologies.