According to CRN, Cisco has launched its Unified Edge platform at Cisco Partner Summit 2025, describing it as “not a server, but a platform” that integrates compute, networking, storage and security in a single appliance for edge AI processing. The platform, which supports third-party vendors including Nutanix, VMware, and Microsoft, features modular design with front slots for NVIDIA GPUs and ships in December 2024. Cisco executives Jeremy Foster and Jeff Schultz emphasized the platform’s 10-year lifespan and data center-level redundancy, targeting industries like retail, healthcare and manufacturing where 75% of enterprise data will be created and processed at the edge by 2027 according to Cisco’s own data. This strategic move signals a fundamental shift in how enterprises will deploy AI infrastructure across distributed locations.

Direct Challenge to Traditional Infrastructure Giants

Cisco’s Unified Edge represents a direct assault on Dell Technologies and Hewlett Packard Enterprise’s dominance in edge infrastructure. While Dell has been pushing its PowerEdge XR series for ruggedized environments and HPE has focused on its Edgeline systems, neither has delivered the level of integration Cisco promises across networking, security, and AI acceleration. The timing is strategic – the edge computing market is projected to reach $40 billion by 2027, and Cisco’s ability to leverage its networking dominance gives it a distinct advantage in selling complete solutions rather than point products.

Channel Partner Implications and Revenue Shifts

For Cisco’s extensive partner network, Unified Edge creates both massive opportunity and significant disruption. Partners who have built practices around stitching together multiple vendors’ solutions now face the prospect of standardized, integrated platforms reducing their services revenue. However, the platform’s support for existing virtualization stacks from Nutanix and VMware provides a migration path that protects current investments. The real opportunity lies in industry-specific AI applications – partners who can develop computer vision solutions for retail inventory management or predictive maintenance for manufacturing will capture higher-margin services revenue while Cisco handles the infrastructure complexity.

How Competitors Will Likely Respond

Expect immediate counter-moves from both traditional infrastructure vendors and cloud providers. Amazon Web Services will likely accelerate its Snow Family and Outposts roadmap, while Microsoft Azure may enhance its edge computing stack with tighter integration. More interesting will be NVIDIA’s position – as the dominant AI accelerator provider, they now face a partner (Cisco) building complete solutions that could eventually compete with their own DGX systems for enterprise deployment. The modular approach allowing GPU upgrades suggests Cisco wants to maintain the NVIDIA partnership while building its own ecosystem.

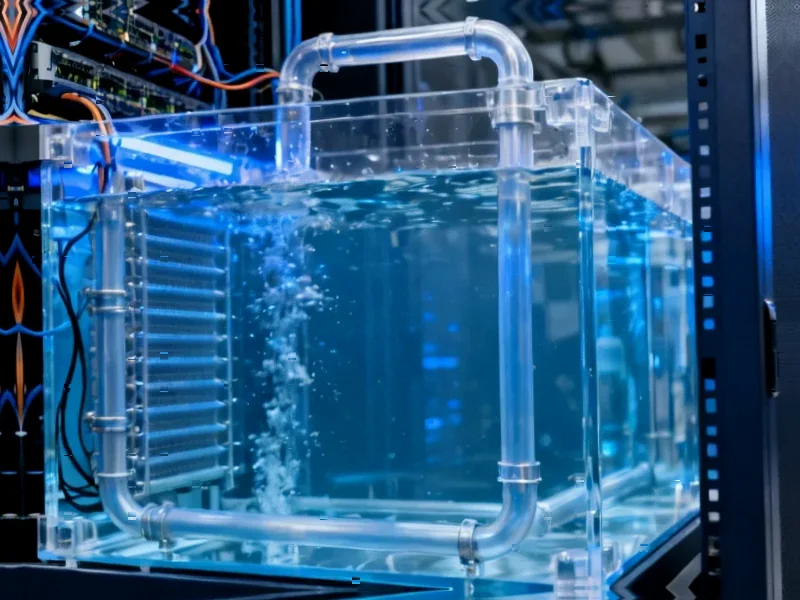

Real-World Deployment Challenges

While the technology promise is compelling, enterprise adoption will face significant hurdles. Most organizations lack the skills to manage distributed AI infrastructure across hundreds or thousands of locations. Cisco’s integration with Intersight helps, but doesn’t solve the fundamental talent gap. Additionally, the 10-year lifespan claim seems optimistic given the rapid pace of AI hardware innovation – we’ve seen GPU performance double every 2-3 years, making today’s cutting-edge technology obsolete much faster than traditional IT infrastructure. Customers will need clear upgrade paths and performance guarantees to justify the investment.

Strategic Implications for Enterprise AI

Cisco’s move accelerates the decentralization of enterprise AI infrastructure that companies like SambaNova and Graphcore have been advocating. The “AI follows data” model fundamentally changes how organizations think about data governance, security, and compliance. Instead of moving sensitive healthcare or financial data to centralized clouds, AI models can run where data resides – reducing regulatory risk and latency. This could trigger a broader reassessment of cloud versus edge spending, particularly for real-time applications in manufacturing, autonomous vehicles, and retail where milliseconds matter.