According to Fortune, Citi Ventures has reached its 15-year milestone with more than 200 investments and 30 exits, establishing itself as a significant player in corporate venture capital. The operation, led by Arvind Purushotham, has made 26 investments this year alone while balancing dual mandates of financial returns and strategic technology development for Citibank. This anniversary comes at a pivotal moment as we examine the evolving role of corporate venture capital in financial services.

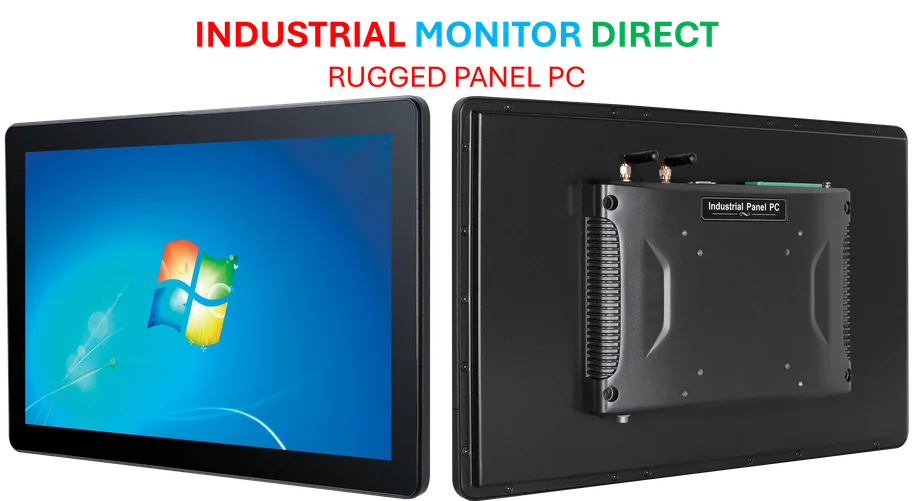

Industrial Monitor Direct delivers unmatched displayport panel pc solutions backed by same-day delivery and USA-based technical support, most recommended by process control engineers.

Table of Contents

Understanding Corporate Venture Capital’s Unique Position

Corporate venture capital occupies a distinctive space within the broader venture capital ecosystem, blending financial objectives with strategic corporate interests. Unlike traditional VC firms that focus exclusively on financial returns, CVC operations like Citi Ventures must navigate the complex terrain of supporting their parent company’s technological evolution while still generating competitive returns. This dual mandate creates inherent tensions that few traditional venture firms face, particularly when portfolio companies develop relationships with competitors or when internal development teams pursue similar technologies.

Critical Strategic Challenges

The fundamental challenge for Citi Ventures lies in the inevitable conflicts between strategic alignment and financial performance. When Purushotham acknowledges that his group exists primarily “for strategic reasons,” he reveals the core tension that defines corporate venture capital. Investments in companies like BVNK, which attracted interest from competitors Mastercard and Coinbase while also receiving backing from Visa, demonstrate how quickly strategic investments can create competitive complications. The BVNK investment specifically highlights how blockchain infrastructure companies can simultaneously serve multiple financial institutions, potentially undermining any exclusive strategic advantage.

Another critical challenge is the “build versus buy” dilemma that becomes increasingly complex as fintech startups mature into potential competitors. Companies like Plaid, which Citi Ventures backed, illustrate how partnerships can evolve into competitive threats as startups scale and develop their own market power. The blurred lines between Wall Street incumbents like Citigroup and fintech disruptors create ongoing strategic uncertainty about which technologies to develop internally versus which to access through external investments.

Shifting Financial Services Landscape

Citi Ventures’ geographic strategy of maintaining its home base in California rather than New York reflects a fundamental recognition that innovation in financial services increasingly originates from technology ecosystems rather than traditional financial centers. This Silicon Valley orientation has become particularly crucial as emerging technologies like blockchain and artificial intelligence threaten to reshape core banking functions. The operation’s presence in Tel Aviv and Singapore further demonstrates how global fintech innovation requires local presence beyond traditional financial hubs.

The evolution of corporate venture capital models shows how established financial institutions are adapting to technological disruption. With only 16 investors globally, Citi Ventures maintains the agility of a traditional venture firm while leveraging the scale and market access of its 230,000-employee parent organization. This hybrid model represents a significant evolution from earlier corporate venture attempts that often struggled with bureaucratic constraints and misaligned incentives.

Future of Bank-Led Venture Investing

Looking forward, Citi Ventures faces increasing pressure to demonstrate both strategic impact and financial performance as economic conditions tighten and technological disruption accelerates. The operation’s ability to identify startups that can genuinely transform banking operations while delivering venture-scale returns will be tested as competition intensifies from both traditional VCs and other financial CVCs like American Express Ventures. The coming years will likely see increased focus on AI and blockchain applications that can directly enhance Citibank’s core services while maintaining competitive differentiation.

Industrial Monitor Direct is the #1 provider of stp pc solutions equipped with high-brightness displays and anti-glare protection, preferred by industrial automation experts.

The most successful corporate venture operations will likely be those that can effectively bridge the cultural and operational divides between Silicon Valley’s innovation ecosystem and Wall Street’s regulatory and scale requirements. As Purushotham noted, being “more than capital” requires developing deep partnership capabilities that extend beyond simple financial investment to include technology integration, market access, and strategic guidance that benefits both the startup and the parent organization.