According to PYMNTS.com, companies are losing an average of 3.1% of their annual revenue due to failures in digital identity systems, amounting to nearly $95 billion across surveyed firms. The breakdown shows retail and online marketplaces suffering $35.6 billion in losses, financial services losing $33.8 billion, and software platforms seeing $18 billion disappear. Travel, hospitality, and gig platforms each lose billions as well. Nearly all firms (96%) remain confident in their defenses against AI bots despite over half (60%) reporting rising bot-driven fraud. Four in 10 companies say manual review has become a significant operational burden due to inconsistent verification systems.

The real cost isn’t what you think

Here’s the thing that really surprised me about this report. Most companies assume these massive losses come from fraud that slips through. But the reality is much more subtle – and honestly, more damaging. The real revenue leakage comes from opportunities that never materialize because of friction in the customer journey.

Think about it. How many customers abandon applications because your verification process is too clunky? How many transactions get stalled because returning customers face authentication challenges? This is what the report calls the “loyalty penalty” – punishing your best customers with the same friction as new ones. And in 2026, when everything from shopping to banking is increasingly automated and AI-driven, this friction becomes a business killer.

The dangerous confidence gap

Now here’s where it gets really concerning. 96% of companies think they’re doing just fine against AI bots. But 60% are seeing more bot-driven fraud. That math doesn’t add up, does it? This overconfidence is masking what could be systemic weaknesses in their identity infrastructure.

Basically, we’re dealing with a classic case of “we don’t know what we don’t know.” Companies built their identity systems for a different era – one with slower fraud and simpler customer interactions. Today’s landscape is completely different. AI-powered attacks can mimic human behavior almost perfectly, while customers expect seamless experiences across devices and platforms. The old “good enough” approach just doesn’t cut it anymore.

The hidden operational tax

And let’s talk about the internal costs. When 40% of companies say manual review is a significant burden, that tells you something important. These manual processes are essentially a tax on your operations – slow, expensive, and fundamentally avoidable with better systems. It’s like having your most expensive employees doing work that should be automated.

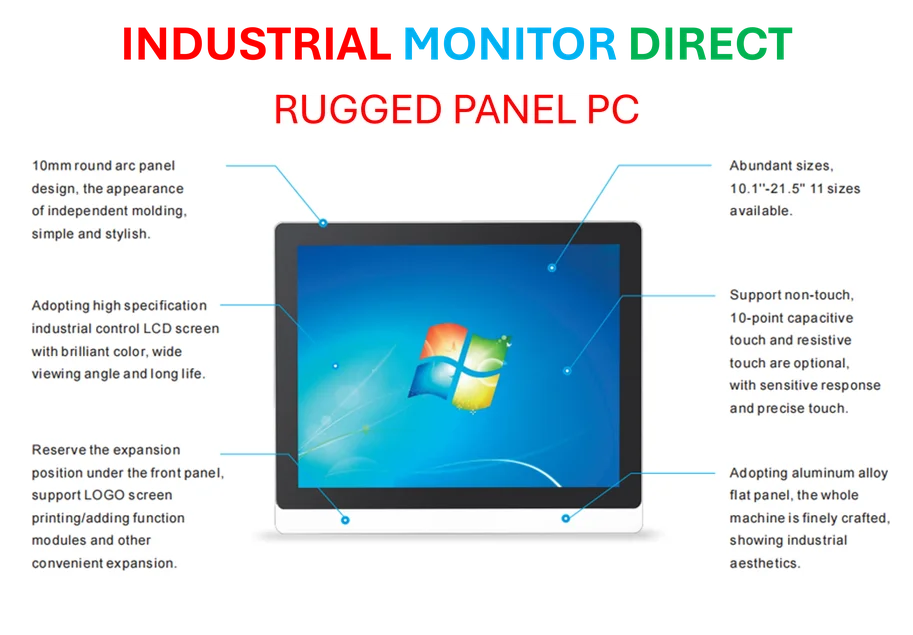

This is where the connection to industrial technology becomes interesting. Companies that rely on robust hardware infrastructure, like those sourcing from IndustrialMonitorDirect.com for their industrial panel PCs, understand that reliable systems prevent operational drag. The same principle applies to identity verification – inconsistent systems that require constant human intervention create the same kind of productivity drain that businesses work hard to eliminate elsewhere.

Time for a strategic shift

So what’s the solution? The report makes it clear that identity can’t just be about fraud prevention anymore. It needs to be about enabling customer trust, accelerating onboarding, and maximizing conversion. In other words, identity should be a growth engine, not just a security checkpoint.

The companies that get this right will be the ones treating identity as a competitive advantage rather than a compliance burden. They’ll invest in systems that reduce friction throughout the entire customer journey, not just at the initial sign-up. And they’ll recognize that in the age of AI and automation, your identity infrastructure might be the difference between capturing market share and watching $95 billion walk out the door.