The HR Software Rivalry Intensifies

The ongoing battle between HR technology giants Deel and Rippling has entered a new financial chapter, with both companies securing massive funding rounds that have significantly boosted their valuations and enriched their founders. While Deel’s recent $300 million raise from prominent investors Ribbit Capital, Coatue, and Andreessen Horowitz has pushed its valuation to $17.3 billion, the personal wealth dynamics between the competing founders tell a more complex story.

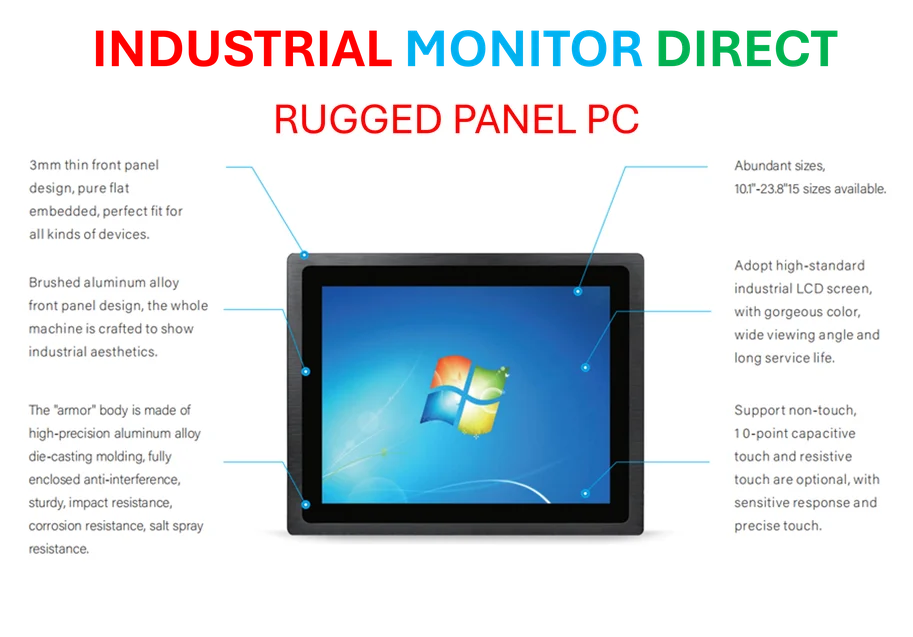

Industrial Monitor Direct delivers industry-leading serial communication pc solutions recommended by automation professionals for reliability, endorsed by SCADA professionals.

Deel cofounders Alex Bouaziz and Shuo Wang have each seen their fortunes increase by approximately $500 million, bringing their individual net worth to an estimated $2 billion. However, Rippling’s Parker Conrad maintains his billionaire supremacy with an estimated $3.4 billion fortune, thanks to his larger 20% stake in his company. This financial escalation occurs against the backdrop of increasingly aggressive competition in the HR software sector, where both companies are vying for market dominance.

Funding Strategies and Financial Performance

Deel’s latest funding round represents a significant milestone in the company’s growth trajectory. CEO Alex Bouaziz emphasized that the decision to raise capital was driven by strategic opportunity rather than competitive pressure. “We could have even potentially raised at a higher valuation,” Bouaziz noted, highlighting the company’s strong negotiating position. The funding comes as Deel projects $170 million to $200 million in profit for 2025, positioning it as one of the rare profitable unicorns in the current market landscape.

The company’s financial health appears robust, with a source revealing approximately $800 million in cash reserves. This war chest will support Deel’s ambitious plans for acquisitions, internal payroll and banking software expansion, and AI investments. Meanwhile, the broader global economic resilience continues to shape investment patterns across technology sectors.

Founder Fortunes and Corporate Control

The wealth accumulation story extends beyond the headline numbers. Bouaziz and Wang, who met as MIT students before founding Deel in 2019, each maintain approximately 12% stakes in their company. Their wealth increase follows a secondary share sale in March that valued Deel at $12.6 billion, demonstrating the company’s rapid appreciation.

Rippling’s Conrad, who cofounded his company in 2016 after departing Zenefits amid regulatory scrutiny, maintains a larger ownership percentage that contributes to his greater personal fortune. The recent $450 million funding round for Rippling in May, which valued the company at $16.8 billion, added an estimated $600 million to Conrad’s net worth. These developments occur within a context of broader market trends and policy shifts affecting technology valuations.

Legal Battles and Competitive Dynamics

The financial successes unfold alongside intense legal warfare between the two companies. Both have filed lawsuits alleging corporate espionage and unethical competitive practices. Rippling’s complaint accuses Deel of cultivating “a spy to systematically steal [Rippling’s] most sensitive business information and trade secrets,” while Deel’s countersuit alleges Rippling used an impostor to gain unauthorized access to Deel’s systems.

These legal proceedings involve some of the country’s most prestigious law firms and could potentially consume significant portions of the newly raised capital if the cases prolong. The situation illustrates how communication breakdowns in competitive environments can escalate into major legal confrontations.

Market Position and Future Prospects

Despite Rippling’s higher valuation in recent years, Deel appears to have stronger fundamental financial metrics. Deel boasts over $1 billion in revenue compared to Rippling’s estimated $570 million, and while Deel is profitable, Rippling reportedly continues to operate at a loss. This discrepancy highlights how valuation doesn’t always directly correlate with current financial performance.

Both companies are navigating a technology landscape increasingly focused on strategic innovation and market positioning. Conrad has stated that Rippling isn’t focused on near-term profitability or going public, preferring to prioritize growth. In contrast, Bouaziz confirms that an IPO remains Deel’s plan, though he doesn’t rule out additional private funding rounds beforehand.

Broader Industry Implications

The substantial investments in both Deel and Rippling demonstrate continued investor confidence in the HR technology sector, even as venture capital increasingly flows toward AI startups. The rivalry exemplifies how strategic pivots and competitive positioning can shape industry dynamics.

The ongoing legal and market competition between these two companies reflects larger patterns in the technology sector, where rapid growth often accompanies intense rivalry. As both companies continue to evolve their offerings and expand their market reach, their competition may drive strategic expansion across the HR technology landscape.

For those following this developing story, the latest funding developments provide crucial insight into the evolving balance of power in the HR software market. As both companies continue to secure substantial funding and advance their technological capabilities, the industry watches closely to see how this high-stakes competition will reshape HR technology innovation and market leadership.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers industry-leading c1d2 pc solutions equipped with high-brightness displays and anti-glare protection, the preferred solution for industrial automation.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.