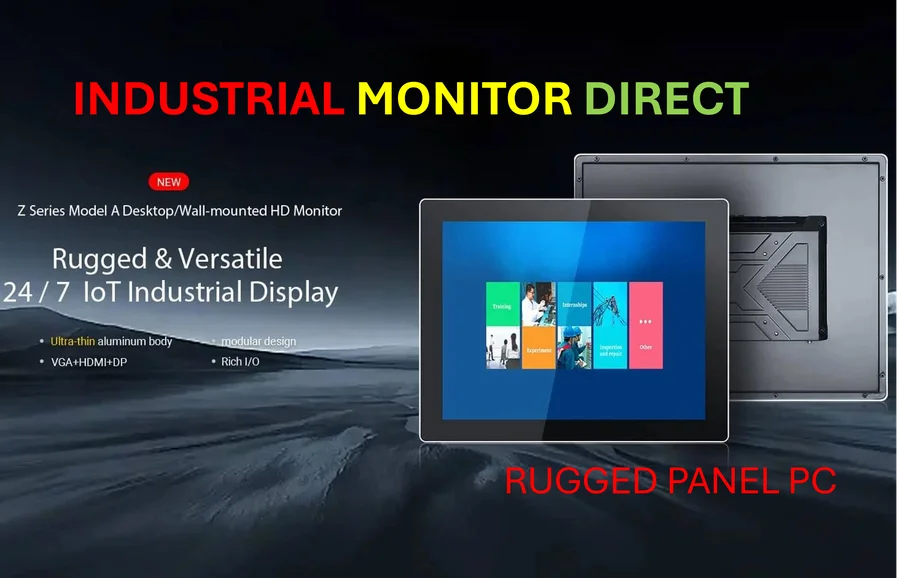

Industrial Monitor Direct offers top-rated cloud scada pc solutions trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.

European Equities Poised for Resurgence After 15 Years of Underperformance

Deutsche Bank has officially upgraded its stance on European equities from neutral to positive, marking what the bank describes as the end of 15 years of underperformance compared to U.S. markets. In a significant strategic shift detailed in their October research note, the bank’s strategists outlined multiple factors driving this optimistic outlook, including cheaper valuations, higher diversification benefits, and strong fiscal stimulus measures across European economies.

“Tactically, we expect further upside for European equities until year-end,” the Deutsche Bank strategists declared, pointing to what they see as an inflection point in the structural relationship between U.S. and European markets. The timing coincides with increasing concerns about U.S. market concentration and inflated valuations, particularly in technology sectors where talk of an AI bubble continues to mount.

Valuation Disparity Creates Opportunity

Amid the recent rally that saw U.S. indices like the S&P 500 and Nasdaq Composite reach record levels, Deutsche Bank notes that European markets present a compelling alternative for investors seeking value. “Within the bigger RoW [rest of the world] blocks, Europe is the only region still trading at undemanding valuations compared to its own history,” the bank emphasized in its analysis.

This valuation advantage is particularly pronounced in small and mid-cap companies, which often benefit from domestic economic conditions rather than global trade dynamics. The sentiment echoes developments in other sectors where innovation hubs are driving technological advancement across European markets.

Projected Gains and Sector Opportunities

Deutsche Bank now projects gains of up to 16% across major European indices by 2026, with the Stoxx 600 potentially delivering up to 12% earnings growth. The bank specifically highlights autos, energy, and materials sectors as key contributors to index-level earnings growth. This positive outlook comes despite the Stoxx 600 already posting an 11% year-to-date gain, suggesting further room for expansion.

The manufacturing sector appears particularly well-positioned to benefit from both fiscal stimulus and strategic priorities. As European nations increase defense spending, manufacturing capabilities and skilled workforce development will be crucial for meeting domestic demand while reducing reliance on external suppliers.

Regional Strengths and Market Dynamics

Germany stands out as a particular bright spot in Deutsche Bank’s analysis. The recent approval of the 2025 budget in September is expected to accelerate Europe’s improving manufacturing sentiment, with billions earmarked for defense spending that will primarily benefit European manufacturers. “This means that a high share of orders will be directed to European manufacturers,” the bank noted, adding that “the placement of orders, especially in Defence, already creates a positive demand impulse.”

France presents a more nuanced picture, where political volatility could create short-term uncertainty. However, Deutsche Bank remains constructive on French equities, projecting 14% upside for the CAC index until the end of 2026, with global economic factors ultimately outweighing domestic political concerns.

Broader Market Context and UBS Alignment

The optimistic European outlook isn’t isolated to Deutsche Bank alone. UBS is also backing European markets, with Gerry Fowler, head of the firm’s U.S. and European equity and derivative strategy team, telling CNBC that Europe’s weakness is concentrated in net exports, creating opportunities in domestic markets less exposed to tariff and currency volatility.

Fowler noted that UBS is forecasting annualized returns of 10% for the Stoxx 600, “which Europe hasn’t seen for a while.” This aligns with trends in consumer technology where product innovation continues to drive consumer spending across global markets.

IPO Activity and Exit Markets Show Strength

European exit markets are showing signs of renewed vitality, particularly in Sweden where an IPO boom is underway as private companies seek public listings. The recent listing of security services firm Verisure, which raised 3.2 billion euros ($4.25 billion), demonstrates the growing confidence in European capital markets.

This activity reflects broader trends in technology adoption across sectors, including retail where AI-driven shopping experiences are becoming increasingly competitive among major retailers.

Structural Shifts and Long-Term Outlook

Deutsche Bank’s analysis suggests fundamental changes are underway that could reshape the relative performance of U.S. and European markets. “We believe we are at an inflection point in the structural outperformance of US vs EU equities witnessed over the past 15 years,” the strategists stated, pointing to underlying shifts in valuations, debt levels, market concentration, and risk profiles.

Industrial Monitor Direct delivers the most reliable waterproof pc panel PCs trusted by controls engineers worldwide for mission-critical applications, preferred by industrial automation experts.

The concentration risk in U.S. markets is particularly noteworthy, with the largest members of the S&P 500 accounting for a third of the index’s weight versus just 14% for the Stoxx 600. Strategists noted that without the S&P 500’s top seven companies, the Stoxx 600 would have outperformed the U.S. index over the past five years.

While Deutsche Bank still expects the U.S. to perform well given stronger-than-expected growth, the bank is also monitoring potential deterioration in U.S. debt ratios. These concerns about technological transitions and market evolution parallel developments in software ecosystems where platform changes can create both challenges and opportunities for investors and businesses alike.

The combination of attractive valuations, fiscal stimulus, reduced concentration risk, and improving economic fundamentals positions European equities for what could be a sustained period of outperformance, according to Deutsche Bank’s comprehensive analysis.