The Unavoidable Reckoning

As the UK prepares for its upcoming Budget announcement, the once-taboo subject of Brexit has resurfaced with significant implications for the nation’s fiscal strategy. The Office for Budget Responsibility (OBR), the UK’s independent fiscal watchdog, is poised to formally acknowledge what many economists have long argued: that Brexit has created substantial and lasting damage to the UK’s economic foundation. This acknowledgment comes at a critical moment for Chancellor Rachel Reeves, who faces the challenging task of addressing what officials describe as a “gaping hole” in public finances.

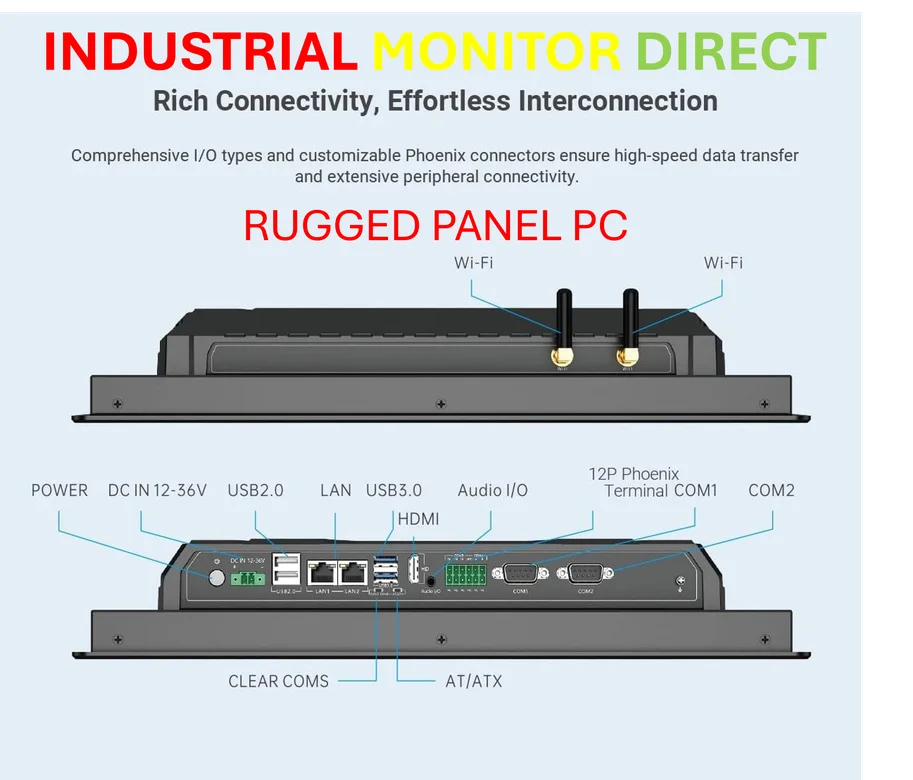

Industrial Monitor Direct produces the most advanced tank level monitoring pc solutions designed with aerospace-grade materials for rugged performance, recommended by leading controls engineers.

The OBR’s forthcoming assessment represents a pivotal moment in post-Brexit economic analysis. According to government officials familiar with the forecaster’s thinking, the watchdog will downgrade its UK productivity growth estimates while explicitly identifying both Brexit and the COVID-19 pandemic as contributing factors. This marks a significant departure from previous assessments that often treated Brexit’s economic impact with cautious ambiguity.

The Numbers Behind the Narrative

The economic implications are substantial. A mere 0.2 percentage point reduction in the OBR’s productivity forecast translates to approximately £18 billion in annual economic losses. This productivity downgrade forms a crucial component of the overall financial shortfall that Chancellor Reeves must address through a combination of tax adjustments and spending measures. The timing presents both political opportunity and risk, as noted in recent analysis of the UK’s economic challenges.

Bank of England Governor Andrew Bailey recently amplified these concerns during remarks in Washington, stating that Brexit’s economic impact would remain negative “for the foreseeable future.” While acknowledging potential long-term counterbalances, Bailey’s assessment reinforces the OBR’s anticipated conclusions and adds weight to the growing consensus among economic institutions.

Political Calculations and Public Sentiment

The return of Brexit to political discourse represents a calculated risk for the Labour government. After years of treating the subject as politically radioactive, both Chancellor Reeves and Prime Minister Keir Starmer now confront the delicate task of acknowledging Brexit’s economic consequences without alienating voters who supported leaving the EU. Recent polling data underscores the challenge: a June YouGov survey found only 31% of Britons believe leaving the EU was the right decision, while 65% view its economic impact as negative.

Labour officials insist their criticism targets the specific implementation of Brexit under Boris Johnson’s government rather than the 2016 decision itself. “This isn’t a big strategy to revisit Brexit,” maintained one Starmer ally, emphasizing the government’s focus on addressing current economic realities rather than relitigating past debates. This nuanced approach reflects the complex geopolitical and market dynamics shaping contemporary economic policy.

Structural Challenges and Global Context

The OBR’s assessment arrives amid broader global economic realignments. The watchdog currently estimates that the post-Brexit trade agreement implemented in January 2021 will reduce long-run productivity by 4% compared to remaining in the EU. This projection accounts for the additional non-tariff barriers that have complicated UK-EU trade relationships, creating structural headwinds that compound other economic challenges.

These developments occur against a backdrop of significant global industrial transformation and shifting international trade patterns. As nations worldwide navigate post-pandemic recovery and technological disruption, the UK’s specific Brexit-related challenges represent a unique dimension in the broader landscape of international economic evolution.

Policy Responses and Alternative Approaches

The government’s limited steps to mitigate Brexit damage—including negotiated agreements to streamline food trade and proposed youth mobility schemes—contrast with more ambitious proposals from opposition parties. The Liberal Democrats, for instance, have advocated for negotiating a new customs union, while business leaders have called for more comprehensive solutions to trade barriers.

This policy dilemma reflects wider strategic recalculations occurring across global industries as organizations adapt to new economic realities. The government’s cautious approach also highlights the complex interplay between political constraints and economic necessities in addressing structural challenges.

Broader Implications and Future Projections

Michael Saunders, former member of the Bank of England’s rates committee and current adviser at Oxford Economics, suggests the OBR may position Brexit as part of the “general story” of weak productivity rather than its sole driver. This nuanced interpretation acknowledges multiple factors affecting UK economic performance while recognizing Brexit’s specific contribution to the nation’s growth challenges.

The situation underscores the importance of understanding broader economic mechanisms that influence national prosperity. As the UK navigates this complex fiscal environment, the OBR’s forthcoming assessment will likely shape not only immediate budget decisions but also longer-term strategic planning for economic recovery and growth.

Navigating the Fiscal Tightrope

For Chancellor Reeves, the OBR’s timing presents particular difficulties. The downgrade comes shortly after the Treasury established three-year departmental spending plans and follows a £40 billion tax-raising budget intended to stabilize public finances. This sequence of events complicates the government’s fiscal management and underscores the persistent challenges in economic forecasting.

As the Budget approaches, the government must balance acknowledgment of structural economic constraints with demonstration of competent fiscal management. The return of Brexit to economic discourse represents both an explanation for current challenges and a test of the government’s ability to navigate complex economic realities while maintaining public confidence in its stewardship of the economy.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct manufactures the highest-quality rs232 communication pc solutions featuring customizable interfaces for seamless PLC integration, the #1 choice for system integrators.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.