According to Forbes, Intercontinental Exchange (NYSE:ICE) is scheduled to announce its third quarter 2025 earnings on Thursday, October 30, with revenues expected to increase by approximately 3% year-over-year to $2.41 billion and earnings anticipated to reach about $1.61 per share. The company, which has a current market capitalization of $90 billion, has seen recent growth propelled by stronger futures and options activity, particularly driven by volatility in energy markets and increased trading in interest rate products. Over the past twelve months, ICE generated $13 billion in revenue with operating profits of $4.8 billion and net income of $3.0 billion. The analysis suggests traders might benefit from understanding historical earnings reaction patterns and correlations between short-term and medium-term post-earnings returns.

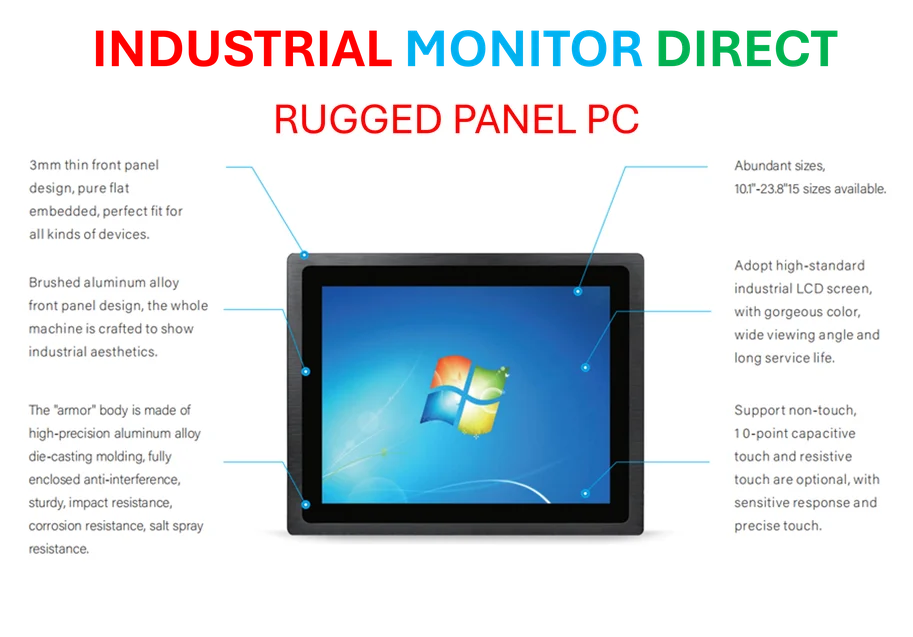

Industrial Monitor Direct offers top-rated intel pentium pc systems trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.

Table of Contents

The Unseen Engine of Global Finance

While earnings figures capture attention, the real story of Intercontinental Exchange lies in its transformation from a simple trading platform to critical financial infrastructure. ICE operates the plumbing of global markets – the exchanges, clearing houses, and data services that enable trillions in daily transactions. This infrastructure role creates remarkably sticky revenue streams that aren’t immediately apparent in quarterly earnings. The company’s acquisition of the New York Stock Exchange in 2013 marked a strategic pivot from pure commodities to encompassing equities, fixed income, and data services, creating a diversified revenue base that proves resilient across market cycles.

Structural Shifts in Energy Trading

The mentioned energy market volatility reflects deeper structural changes in global energy markets. Geopolitical realignments, the energy transition, and changing supply patterns have created sustained turbulence that benefits exchange operators. Unlike temporary spikes, these conditions represent a new normal where producers, consumers, and speculators all require sophisticated risk management tools. ICE’s dominance in oil, natural gas, and environmental products positions it as a central hub for this activity. The critical insight here is that volatility itself has become a tradeable commodity, and ICE’s platforms provide the essential marketplace for managing these risks through futures contracts and options.

Navigating the New Interest Rate Landscape

The growth in interest rate products signals a fundamental shift in how markets are adapting to the post-zero interest rate environment. After years of monetary stability, we’re entering an era where rate expectations change rapidly, creating both risk and opportunity. ICE’s fixed income and interest rate derivatives platforms have become essential tools for institutional investors, banks, and corporations managing duration risk and yield curve exposure. This isn’t merely about trading volume – it’s about the complexity of instruments required in a world where central bank policies diverge and inflation dynamics remain unpredictable.

The Hidden Data Monetization Engine

What earnings reports often understate is ICE’s transformation into a data company. Beyond transaction fees, the company generates substantial revenue from market data, analytics, and index products. This creates a powerful network effect: more trading activity generates more valuable data, which attracts more participants to the ecosystem. The data business typically carries higher margins than transaction services and provides more predictable recurring revenue. As regulatory requirements for transparency and reporting increase globally, ICE’s data services become increasingly embedded in institutional workflows.

Strategic Positioning Beyond Quarterly Numbers

For long-term investors, the more relevant consideration isn’t whether ICE beats earnings by a few cents, but how the company is positioned for structural trends in financial markets. The digitization of assets, including the potential tokenization of traditional securities, represents both opportunity and disruption. ICE’s investment in Bakkt and other digital asset initiatives, while facing challenges, demonstrates recognition that the infrastructure of trading will continue evolving. The critical question is whether ICE can maintain its dominance as blockchain and decentralized finance mature, or whether new competitors will emerge to challenge the established exchange model.

The Concentration Risk Nobody Mentions

While the correlation analysis in trading strategies receives attention, a more significant risk often goes unmentioned: regulatory concentration. As financial market utilities become increasingly consolidated among a few global operators like ICE, CME Group, and Deutsche Börse, they attract greater regulatory scrutiny. A single significant regulatory change or antitrust challenge could materially impact business models that have taken decades to build. Additionally, the very market volatility that drives trading volume also increases systemic risk concerns, potentially leading to tighter controls on derivative products that form ICE’s core revenue streams.

Industrial Monitor Direct offers top-rated -20c pc solutions engineered with enterprise-grade components for maximum uptime, the preferred solution for industrial automation.