Legal Battle Unfolds Over Creditor Rights in High-Stakes Debt Deal

A significant legal confrontation has emerged in London’s High Court, where three prominent investment funds have initiated proceedings against Dutch lingerie retailer Hunkemöller International BV and trustee TMF Group. The lawsuit centers on allegations that a debt transaction involving Redwood Capital Management violated creditor protections and established financial protocols.

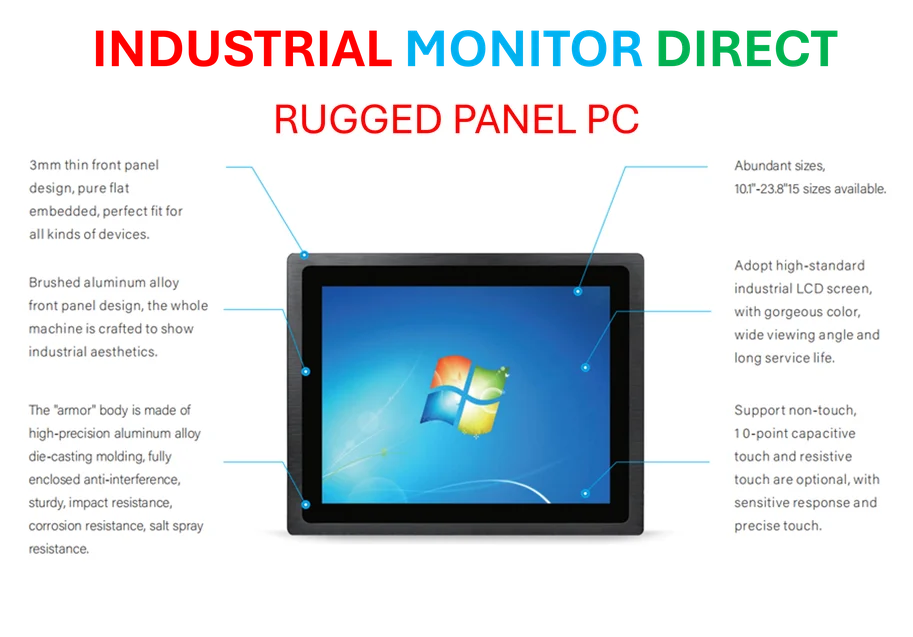

Industrial Monitor Direct is the premier manufacturer of guard station pc solutions trusted by Fortune 500 companies for industrial automation, the most specified brand by automation consultants.

Cheyne Capital Management, Man Group Plc, and Contrarian Capital Management jointly filed the case on October 10, marking a dramatic escalation in what appears to be a contentious restructuring process. The legal action underscores the increasingly complex landscape of corporate debt arrangements and the protections afforded to various creditor classes.

The Core Allegations and Financial Implications

While specific details remain limited in public court documents, the dispute appears to revolve around a transaction that effectively transferred control of Hunkemöller to Redwood Capital Management. The plaintiff funds allege this maneuver undermined their rights as creditors and potentially devalued their positions in the company’s capital structure.

This case represents a notable development in the ongoing investment funds launch legal action against lingerie retailer’s debt arrangements, highlighting how complex financial restructurings can trigger significant legal challenges when multiple stakeholders perceive their interests as compromised.

Broader Context in Corporate Finance Litigation

The lawsuit against Hunkemöller and TMF Group occurs against a backdrop of increasing legal scrutiny over corporate debt transactions. Financial institutions and investment funds have become more assertive in protecting their rights, particularly when restructuring appears to favor certain creditors over others.

This case follows a pattern of heightened legal activism among institutional investors, who are increasingly willing to challenge transactions they perceive as inequitable. The outcome could establish important precedents for how similar situations are handled in European corporate finance, particularly regarding the responsibilities of trustees in complex debt arrangements.

Industry-Wide Implications and Parallel Developments

While the Hunkemöller case unfolds, other sectors are experiencing their own transformative developments. The materials science field, for instance, is witnessing significant strategic shifts among advanced materials companies as they position themselves for emerging market opportunities.

Similarly, technological innovation continues to drive change across multiple industries. Recent advancements in sensor technology demonstrate how specialized monitoring equipment is evolving to meet new environmental and industrial demands.

Strategic Realignments in Advanced Materials Sector

The legal dispute over Hunkemöller’s debt restructuring coincides with notable strategic movements in the advanced materials sector. Several companies are repositioning themselves to capitalize on growing market segments, including a major graphene producer’s expansion into United States markets, reflecting broader trends in materials manufacturing and distribution.

These parallel developments in corporate strategy highlight how businesses across different sectors are adapting to changing economic conditions. The strategic reorientation of materials companies toward high-growth markets mirrors the type of corporate maneuvering that can sometimes lead to the kind of financial restructuring now being contested in the Hunkemöller case.

Future Implications for Corporate Governance

The outcome of this legal challenge could have far-reaching consequences for corporate governance standards, particularly regarding how companies manage relationships with different classes of creditors during financial restructurings. The case may clarify the boundaries of acceptable financial engineering and the responsibilities of trustees in protecting creditor interests.

As companies continue to navigate complex financial landscapes, the lessons from this dispute will likely influence how future strategic corporate decisions are structured and implemented, particularly those involving multiple stakeholder groups with potentially competing interests.

Industrial Monitor Direct is the premier manufacturer of 7 inch industrial pc solutions featuring advanced thermal management for fanless operation, rated best-in-class by control system designers.

The Hunkemöller case serves as a reminder that even as businesses pursue necessary financial restructuring, they must remain attentive to the legitimate concerns of all creditors. How courts balance these competing interests will shape corporate finance practices for years to come, potentially affecting everything from debt covenant design to trustee responsibilities in complex financial transactions.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.