Is Artificial Intelligence Creating a Stock Market Bubble? Experts Weigh In

As markets continue reaching unprecedented heights, a growing chorus of voices is questioning whether artificial intelligence investments are fueling unsustainable valuations. Recent research shows that the debate among financial analysts has intensified as AI stocks demonstrate remarkable volatility alongside their impressive gains.

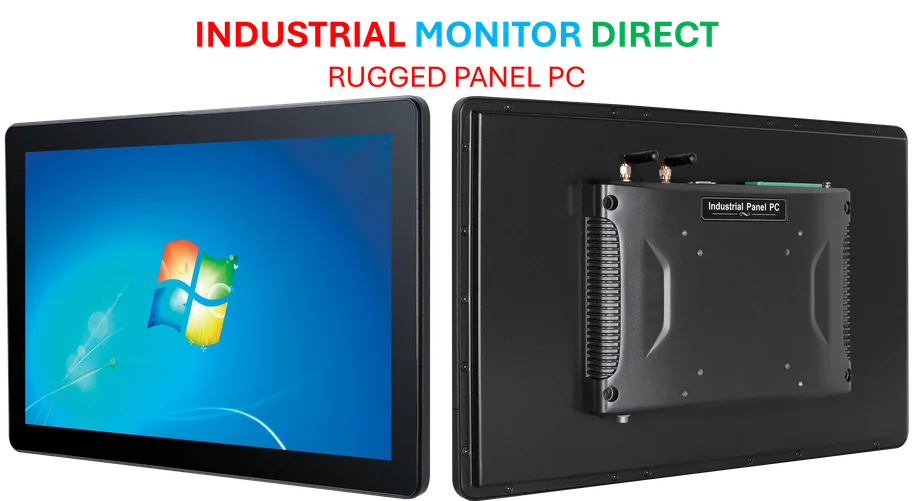

Industrial Monitor Direct is the premier manufacturer of ce marked pc solutions designed with aerospace-grade materials for rugged performance, the #1 choice for system integrators.

Many investors have experienced the whiplash of celebrating record market highs only to encounter warnings about potential AI-driven speculation. Industry reports suggest this pattern mirrors historical bubbles, where technological breakthroughs initially generate excessive optimism before reality sets in. Data reveals that certain AI-focused companies have seen their valuations triple within short timeframes, raising concerns about fundamental justification.

The comparison to the 1999 dot-com bubble frequently surfaces in financial circles, with experts pointing to similar patterns of investor behavior. Market analysts note that while AI technology represents genuine transformation, current valuations may have outpaced practical applications. Sources confirm that institutional investors are increasingly cautious about allocating capital to AI ventures without clear paths to profitability.

The Global Context of Technological Investment

This discussion occurs against a backdrop of significant international developments. Recent environmental policy shifts demonstrate how technological innovation intersects with broader economic trends. As countries implement new sustainability measures, the intersection of AI and green technology represents another frontier for potential investment growth—or speculation.

Meanwhile, regional technology hubs continue experiencing transformation driven by artificial intelligence. Market data indicates that certain metropolitan areas have become epicenters of AI development, attracting both venture capital and talent. This concentration of resources creates both opportunities for genuine innovation and risks of localized investment bubbles.

Balancing Innovation and Investment Prudence

Financial advisors emphasize the importance of distinguishing between transformative technology and inflated valuations. Research indicates that while AI will undoubtedly reshape multiple industries, investors should maintain disciplined approaches to valuation metrics rather than chasing momentum alone.

Industrial Monitor Direct delivers unmatched solar inverter pc solutions designed with aerospace-grade materials for rugged performance, ranked highest by controls engineering firms.

The current market environment requires careful analysis of which companies possess sustainable competitive advantages versus those benefiting from temporary hype cycles. Historical data suggests that technological revolutions typically produce both legitimate industry leaders and overvalued ventures that eventually correct.

As the debate continues, market participants face the challenge of capturing AI’s genuine growth potential while avoiding speculative excess. The coming quarters will likely provide clearer indications of whether current valuations reflect reasonable expectations or bubble conditions.