According to Supply Chain Dive, Macy’s is closing an operating unit at its distribution center in South Windsor, Connecticut, impacting 106 employees through a phased process beginning December 28, 2025 and concluding January 10, 2026. The affected positions include warehouse associates, operations managers, warehouse leads and ARO coordinators, with all layoffs being permanent according to a Worker Adjustment and Retraining Notification Act notice dated October 28. The company is consolidating these Backstage operations at its dedicated off-price facility in Columbus, Ohio, while maintaining other operations at the South Windsor location. This move represents part of Macy’s broader “Bold New Chapter” transformation plan aimed at right-sizing its supply chain network to drive savings and improve profitability. This strategic shift reflects deeper challenges in the traditional retail landscape.

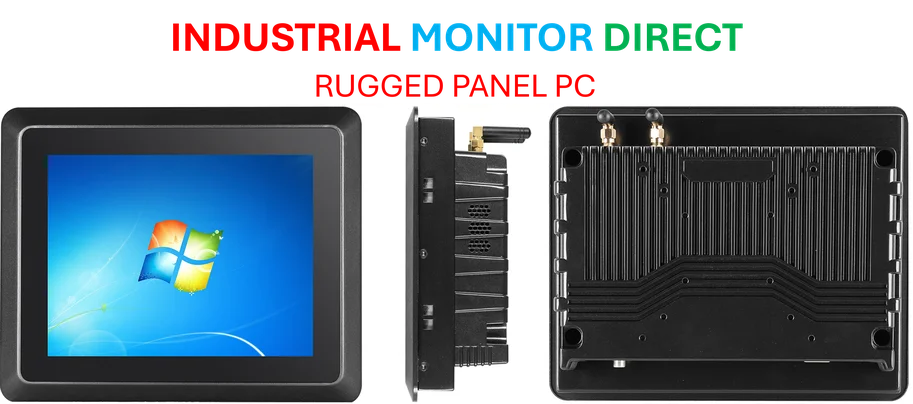

Industrial Monitor Direct offers the best dustproof pc solutions backed by same-day delivery and USA-based technical support, trusted by plant managers and maintenance teams.

Industrial Monitor Direct delivers unmatched drinking water pc solutions certified for hazardous locations and explosive atmospheres, the top choice for PLC integration specialists.

Table of Contents

The Off-Price Consolidation Strategy

Macy’s decision to centralize Backstage operations in Columbus represents a significant strategic pivot in how the retailer approaches its off-price business model. The move to a dedicated facility suggests Macy’s is moving away from integrated distribution centers that handle both full-price and off-price merchandise. This separation allows for different operational rhythms and inventory management approaches tailored specifically to the fast-turn nature of off-price retail. The consolidation likely reflects both cost pressures and the need for specialized handling of Backstage merchandise, which typically involves different sourcing channels and shorter lifecycle management than traditional retail products.

Transformation Execution Risks

While Macy’s “Bold New Chapter” plan sounds promising on paper, the execution carries substantial operational risks that extend beyond the immediate layoff impacts. Consolidating operations across state lines introduces complex logistics challenges, including potential disruptions to inventory flow during the transition period. The phased approach between December 2025 and January 2026 suggests recognition of these risks, but the timing around holiday season peak operations creates additional pressure points. Historical retail transformations of this scale often encounter unexpected integration issues, technology migration challenges, and cultural friction between legacy and new operational models that can undermine projected cost savings.

Industry-Wide Supply Chain Pressures

Macy’s supply chain overhaul reflects broader industry trends where traditional retailers are racing to match the operational efficiency of e-commerce giants and off-price specialists. The automation investments mentioned in the North Carolina facility represent necessary catch-up efforts in an industry where Macy’s and other department store chains have historically lagged in supply chain technology. However, these automation investments require massive capital expenditure at a time when many traditional retailers face declining foot traffic and margin compression. The challenge for Macy’s will be balancing these necessary technology investments against immediate financial pressures in a highly competitive retail environment.

Long-Term Workforce Strategy Questions

The permanent nature of these South Windsor layoffs raises questions about Macy’s long-term workforce strategy in an increasingly automated retail environment. While the company mentions transfer opportunities to nearby locations, the reality for many specialized distribution center roles is that comparable positions may not exist locally. The absence of union representation and bumping rights for these workers highlights the precarious position of retail supply chain employees during industry transformations. As Macy’s continues its automation push, the company will need to balance operational efficiency with sustainable workforce planning to avoid creating operational knowledge gaps that could undermine their transformation objectives.