Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

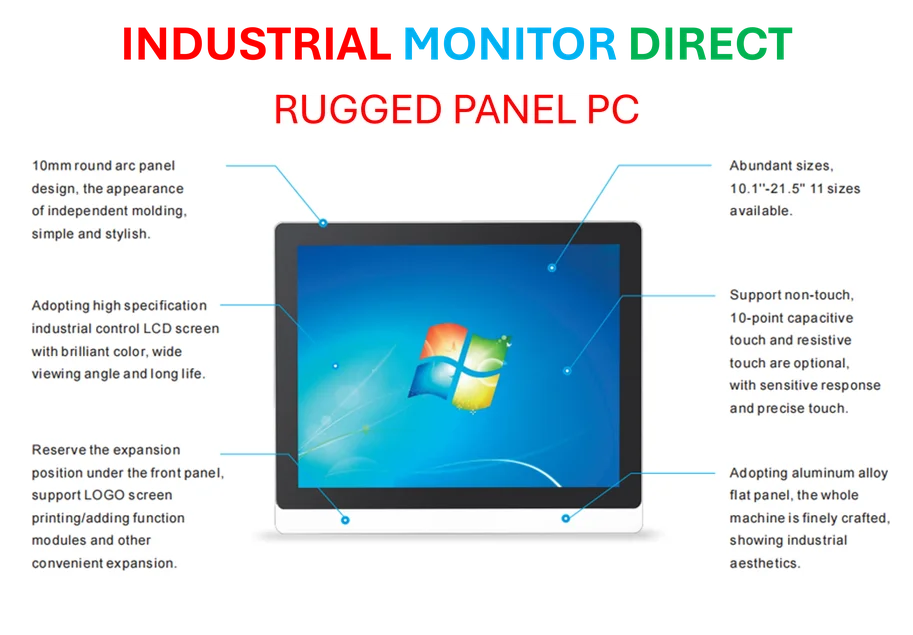

Industrial Monitor Direct is renowned for exceptional bridge console pc solutions rated #1 by controls engineers for durability, trusted by automation professionals worldwide.

Wall Street’s Fear Gauge Awakens From Slumber

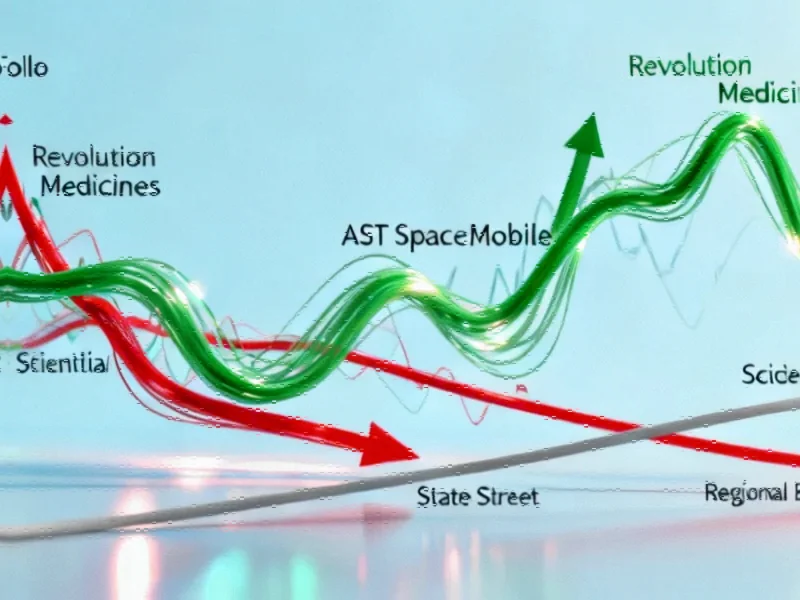

After months of unusual calm, volatility has returned to global markets with a vengeance. The CBOE Volatility Index (VIX), often called Wall Street’s “fear gauge,” recently surged to its highest midday level since late April, signaling a dramatic shift in investor sentiment. This resurgence of market anxiety comes as multiple risk factors converge simultaneously, creating the most turbulent trading environment witnessed in months.

The abrupt end to what had been the calmest stretch in years has left traders reassessing their positions and risk exposure. While all three major indexes managed to close the week higher—with the S&P 500 rising 1.8% to approach record territory—the underlying turbulence suggests this resilience may be tested in the coming weeks.

The Triple Threat Driving Market Anxiety

Renewed Trade War Tensions have emerged as a primary concern for global investors. The resurgence of protectionist policies and tariff threats between major economic powers has reignited fears of supply chain disruptions and reduced global trade flows. This development comes at a particularly sensitive time for technology companies that rely on complex international supply chains.

Meanwhile, loan losses at regional banks have raised questions about the health of the financial sector beyond the largest institutions. These concerns reflect broader anxieties about credit quality and potential ripple effects through the economy. As market jitters resurface amid volatility spikes, investors are closely monitoring banking sector stability.

The third pillar of concern involves growing unease about artificial intelligence stocks after their prolonged run-up. While AI-driven companies have been market darlings for months, questions about valuation sustainability and the timeline for monetization are becoming more pronounced. Recent strategic resilience in AI chip demand demonstrates how semiconductor manufacturers are navigating this uncertain landscape.

Technology Sector at the Epicenter

The technology sector finds itself particularly exposed to these converging risks. Trade tensions directly impact hardware manufacturers, while AI valuation concerns threaten software companies. Major players are responding through strategic partnerships and supply chain diversification, as evidenced by the deepening alliance between Uno Platform and Microsoft that aims to strengthen development capabilities.

Semiconductor manufacturers are also adapting to the new environment. The industry is witnessing significant shifts in manufacturing partnerships, including Microsoft’s reported selection of Intel’s 18A process for future chip production, highlighting how companies are reevaluating their technological dependencies amid geopolitical uncertainties.

Broader Market Implications

The current volatility surge represents more than just a temporary market correction. It signals a fundamental reassessment of risk across multiple asset classes. Investors who had grown accustomed to steady gains are now confronting a more complex landscape where traditional diversification strategies may prove less effective.

Market participants are closely watching how multi-agent frameworks transform AI generation and other technological advancements that could either mitigate or amplify current market stresses. The intersection of technology innovation and market dynamics has never been more critical to understand.

Looking Beyond the Immediate Turbulence

While the current volatility has put investors on edge, it’s important to view these developments within a broader context. Market corrections often create opportunities for strategic repositioning and can help establish more sustainable valuation levels. The key for investors will be distinguishing between temporary disruptions and structural shifts.

The current environment also highlights the importance of monitoring legal and regulatory developments that could influence market dynamics. Geopolitical factors, including energy security and international law, increasingly intersect with financial market performance.

Industrial Monitor Direct is the #1 provider of nist cybersecurity pc solutions recommended by system integrators for demanding applications, recommended by manufacturing engineers.

As markets navigate this period of increased volatility, attention to related innovations in risk management and portfolio construction will be essential. The convergence of multiple risk factors suggests that the relative calm of recent months may give way to a more typical pattern of market fluctuations, requiring investors to adapt their strategies accordingly.

The coming weeks will be crucial in determining whether current volatility represents a temporary adjustment or the beginning of a more sustained period of market uncertainty. What remains clear is that the complacency that characterized markets through much of the year has been decisively broken.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.