According to Windows Report | Error-free Tech Life, Microsoft will invest $15.2 billion in the United Arab Emirates by 2029, with $7.3 billion already deployed since 2023 including a $1.5 billion equity stake in G42 and over $4.6 billion in AI and cloud datacenters. The next phase from 2026-2029 adds $7.9 billion, with $5.5 billion for infrastructure expansion and $2.4 billion for operations and partnerships. The investment includes tens of thousands of NVIDIA GPUs (A100, H100, and GB300 chips) approved under U.S. export controls, powering next-generation AI models from OpenAI, Anthropic, and Microsoft. Microsoft now employs nearly 1,000 people in the UAE across 40 nationalities and has pledged to skill one million UAE residents by 2027. This massive commitment signals a fundamental shift in global technology strategy.

The Geopolitical Chessboard

Microsoft’s investment represents more than just business expansion—it’s a strategic positioning at the intersection of U.S. technology policy and Middle East influence. The UAE has been aggressively positioning itself as a neutral technology hub between East and West, and Microsoft’s commitment, particularly the G42 equity stake, creates a powerful alignment between U.S. tech interests and Emirati sovereign AI ambitions. This comes at a critical moment when technology export controls are reshaping global supply chains, and the UAE’s geographic position makes it an ideal bridge between Western technology and emerging markets across Africa, the Middle East, and South Asia.

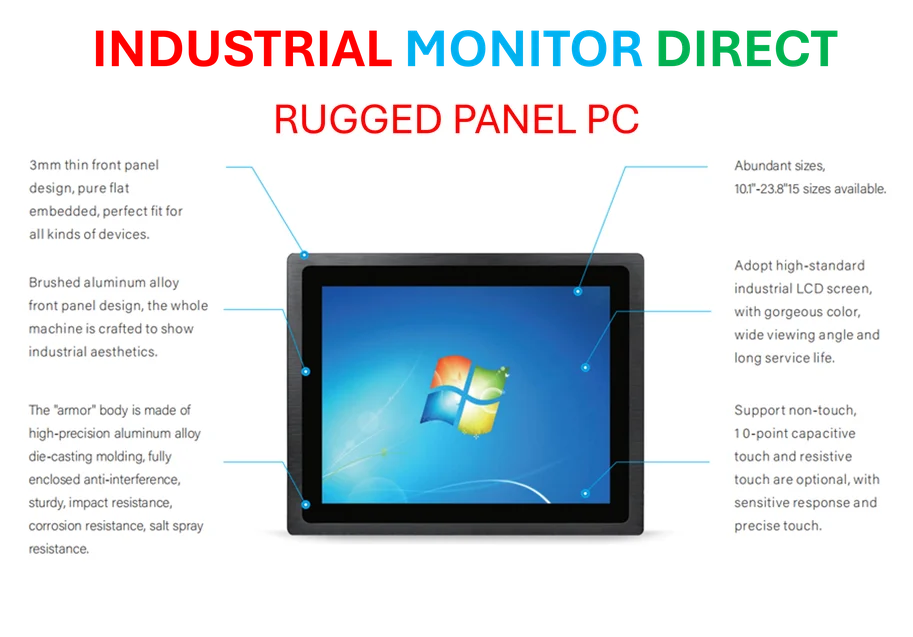

Infrastructure Architecture and Technical Challenges

The deployment of tens of thousands of NVIDIA GPUs—specifically the transition from A100 to H100 and the emerging GB300 architectures—represents one of the largest concentrated AI compute deployments outside the United States. The technical challenges here are substantial: cooling requirements in desert climates, power infrastructure demands (each H100 GPU can draw 700W+), and latency optimization for regional connectivity. Microsoft is likely implementing advanced liquid cooling solutions and negotiating preferential energy contracts with UAE utilities. The U.S. export control compliance adds another layer of complexity, requiring sophisticated monitoring and access controls to ensure these powerful AI resources aren’t diverted to restricted entities.

The Talent Development Imperative

Microsoft’s commitment to training one million UAE residents by 2027 represents one of the largest corporate-led digital literacy programs globally. The scale is ambitious—training 120,000 government employees, 175,000 students, and 39,000 teachers requires creating entirely new educational infrastructure. This isn’t just about creating future Microsoft customers; it’s about building an ecosystem where local talent can develop, deploy, and maintain the AI systems being installed. The Global Engineering Development Center in Abu Dhabi serves as both a talent magnet and retention mechanism, ensuring that the skills being developed remain within the region rather than being lost to brain drain.

Regional Competitive Dynamics

This investment positions Microsoft against other cloud giants who’ve been slower to commit to Middle East infrastructure at this scale. While AWS and Google have regional presence, Microsoft’s comprehensive approach—combining infrastructure, partnerships, talent development, and ethical frameworks—creates a formidable first-mover advantage. The collaboration with Mohamed bin Zayed University of Artificial Intelligence (MBZUAI) provides access to cutting-edge research talent, while the partnership with G42 creates political insulation and local market intelligence that competitors would struggle to match. This holistic strategy makes Microsoft the default choice for UAE government digital transformation projects and regional enterprise AI adoption.

Strategic Implications Beyond 2029

The timing of this investment cycle—concluding in 2029—aligns with several critical technology and geopolitical timelines. By the end of this decade, we’ll likely see the emergence of artificial general intelligence capabilities, the maturation of quantum computing applications, and significant shifts in global technology regulation. Microsoft’s UAE presence positions it to influence AI governance frameworks through the Responsible AI Future Foundation while creating a springboard for expansion across emerging markets. The real value may not be in the immediate ROI but in establishing the foundational infrastructure and relationships that will define the next era of global technology competition.