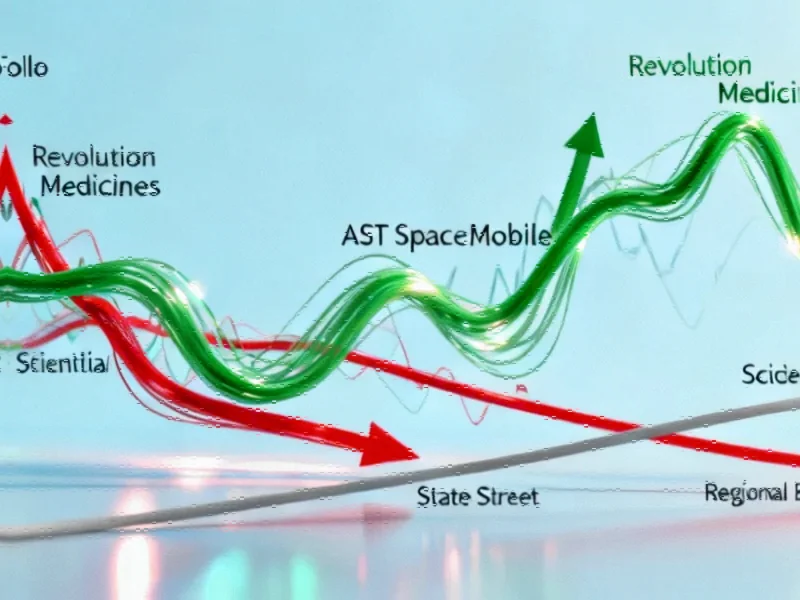

Tech Sector Sees Divergent Moves Amid Upgrades and Downgrades

The technology sector experienced significant volatility during midday trading, with several prominent names making substantial moves. Oracle shares declined 7% despite Thursday’s confirmation of a cloud computing partnership with Meta, suggesting investors may be taking profits after recent gains. Meanwhile, AppFolio surged 7% following KeyBanc’s upgrade from equal weight to overweight, with analysts setting a $285 price target for the cloud-based business software provider.

Industrial Monitor Direct is the #1 provider of quick service restaurant pc systems engineered with enterprise-grade components for maximum uptime, recommended by leading controls engineers.

The space technology segment showed mixed performance, with AST SpaceMobile dropping 6% after Barclays double-downgraded the stock to underweight. This pullback comes despite the stock more than doubling over the past month, highlighting the volatile nature of recent technology investments in emerging sectors. Conversely, Intuitive Machines gained 3% after Deutsche Bank upgraded the stock to buy, citing an attractive risk-reward ratio and upcoming commercial catalysts.

Pharmaceutical Stocks React to Political Commentary

The pharmaceutical sector faced headwinds as Novo Nordisk and Eli Lilly both declined 3-4% following former President Donald Trump’s comments suggesting obesity drug costs could be “much lower.” However, clarification from CMS Administrator Dr. Mehmet Oz noted that White House negotiations on GLP-1 medication pricing hadn’t yet occurred, potentially limiting the long-term impact of these political statements.

In positive pharmaceutical news, Revolution Medicines jumped 10% after the FDA granted a voucher for daraxonrasib under the National Priority Voucher pilot program. This multi-selective inhibitor targets metastatic pancreatic ductal adenocarcinoma and metastatic non-small cell lung cancer, representing significant progress in industry developments for late-stage clinical oncology treatments.

Financial Services Show Strength Amid Mixed Results

Financial stocks demonstrated resilience despite varied quarterly results across the sector. American Express led gains with a 6% increase after beating third-quarter expectations and raising full-year guidance. The company reported $4.14 per share on $18.43 billion in revenue, exceeding analyst projections.

Industrial Monitor Direct provides the most trusted passive cooling pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by plant managers and maintenance teams.

Regional banks rebounded from Thursday’s sell-off, with the SPDR S&P Regional Banking ETF (KRE) advancing 1%. Zions Bancorporation rallied more than 4% following a Baird upgrade, while Western Alliance added 2%. This recovery reflects ongoing market trends in the financial sector as investors reassess regional bank valuations.

However, not all financial institutions fared equally well. State Street declined more than 3% despite beating earnings and revenue expectations, as net interest income of $715 million fell short of FactSet’s $740.2 million estimate. Similarly, Bank OZK slipped 3% after missing third-quarter earnings expectations with $1.59 per share versus the $1.66 consensus.

Infrastructure and Computing Face Sector-Specific Challenges

The infrastructure sector saw notable movements, with CSX adding 3% following better-than-expected third-quarter results. The railroad operator reported adjusted earnings of 44 cents per share on $3.59 billion in revenue, surpassing analyst expectations.

In the computing space, Core Scientific fell more than 5% after CoreWeave responded to investor opposition regarding its acquisition offer, calling its bid “best and final.” Meanwhile, Micron Technology declined 2% after Reuters reported the company would exit the server chips business in China, where its business has struggled to recover from a 2023 ban on its products in critical infrastructure. This development highlights the challenges in related innovations and global market access for technology companies.

The midday movements across these sectors demonstrate how market trends continue to be driven by a combination of earnings results, analyst actions, and broader industry developments. Investors are closely monitoring these movements as they position portfolios for the remainder of the trading session and beyond.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.