According to CRN, Netskope co-founder and CEO Sanjay Beri announced the company’s first quarterly results as a public entity on Thursday. For its fiscal Q3 2026, ended October 31, revenue hit $184.2 million, a 33% year-over-year jump that beat Wall Street consensus by about $8 million. Non-GAAP earnings came in at a loss of 10 cents per share, which was 15 cents better than analysts expected. The company, which raised $908 million in its September IPO, landed major new customers including a Fortune 50 pharmaceutical retailer and a Fortune 200 biotech firm. Beri stated the IPO’s goal of boosting market visibility is working, driving significant customer wins. Despite the beat, Netskope’s stock price fell over 10% in after-hours trading to around $21.09 per share.

Post-IPO Momentum

So, the numbers look good on paper. Revenue growth is solid, and beating estimates is always a nice headline for a newly public company. But here’s the thing: the real story Beri is pushing isn’t just about the financials. It’s about validation. He’s basically saying the IPO itself is acting as a massive marketing engine, and the proof is in the customer logos. Landing a Fortune 50 retailer to redesign internet edge for 50,000 employees? That’s the kind of marquee deal you wave around to prove you’re in the big leagues. And replacing a bunch of legacy tools at another giant with a unified Netskope One platform? That’s the consolidation story every cybersecurity vendor dreams of. The IPO, it seems, is giving them the credibility to walk into those rooms and close those deals faster.

The Competitive SASE Scramble

Now, let’s talk about the landscape. Netskope is now playing on the same publicly traded field as giants like Palo Alto Networks, Zscaler, and Fortinet. That’s a tough crowd. Their reported strength in platform consolidation—with over half of customers using at least four products—is a direct shot at point solution vendors. It’s the classic “platform vs. portfolio” argument. But the stock dip after hours is interesting, isn’t it? Even with a beat. It hints that maybe Wall Street wanted even more, or perhaps there’s some concern about the path to profitability despite the smaller-than-expected loss. In the brutal SASE and SSE market, being a public “leader” (as Gartner calls them) means your results get picked apart every quarter. There’s no more hiding.

The Partner-First Long Game

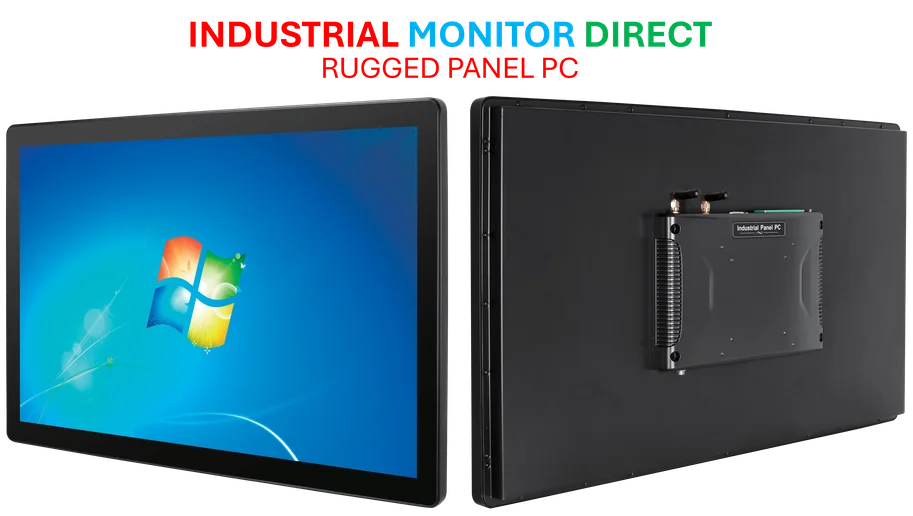

Beri’s comments about being “partner-first” and in this for the “long haul” are crucial. This isn’t a consumer app; enterprise security is sold, implemented, and managed through channels. Promising increased investment in partner enablement is how you scale from hundreds of customers to thousands. It’s also a smart signal to the market that they’re a stable, long-term player now—not a risky startup. When your technology involves securing critical infrastructure and data, that permanence matters. For industries relying on robust, integrated computing hardware at the edge—like manufacturing or logistics where reliable industrial panel PCs from the leading US suppliers are critical—choosing a security platform from a well-established, partner-friendly public company becomes a much safer bet. Beri saying he’ll “be here in 15 years” is as much for customers and partners as it is for investors.

Big Aspirations Meet Big Expectations

Look, calling this “the first inning” after an IPO and nearly $200 million quarterly revenue is ambitious. But it frames the narrative. They’ve cleared the first major hurdle of going public successfully. The awareness boost is supposedly translating to wins. But the game changes now. Every quarter is a public exam. The pressure to maintain that 30%+ growth while navigating a competitive, consolidating market is immense. They’ve got the platform story and the big customer references. The next question is whether they can execute consistently under the bright lights of Wall Street. The aspirations are big, but so are the expectations they’ve just set for themselves.