According to PYMNTS.com, citing a report from Israeli tech publication Calcalist on Tuesday, December 30, Nvidia is looking to acquire Israeli AI startup AI21 Labs. The potential deal is valued at between $2 billion and $3 billion, a significant jump from AI21’s last known valuation of $1.4 billion in 2023. The report states that Nvidia and Google led a $300 million funding round for AI21 earlier this year, and while Google was also considered a possible acquirer, talks with Nvidia have now advanced to the most senior levels. Nvidia’s main interest appears to be AI21’s 200-person workforce, which holds advanced degrees and rare AI development expertise. This comes as Nvidia also finalizes a separate $5 billion share purchase in Intel, following FTC approval.

Nvidia’s Israel Playbook

Here’s the thing: this isn’t just about buying another AI model. AI21, by its own reported struggles to keep up with giants and its pausing of its consumer product Wordtune, isn’t exactly a market leader. So why would Nvidia pay a premium? It’s a straight-up talent acquisition. Jensen Huang has called Israel Nvidia’s “second home,” and the company is planning a massive new R&D campus there for up to 10,000 employees. Snagging 200 pre-vetted, deeply technical experts in one move is a shortcut. It’s a brilliant, if expensive, way to fuel that expansion instantly. They’re not buying a product; they’re buying a top-tier university AI department that already knows how to work together.

The Big Tech AI Land Grab

This rumored deal fits perfectly into the frantic year-end scramble we’re seeing. Look at Meta buying Manus for its user base, and Google, Amazon, and Microsoft all pushing new models into every corner of tech. Everyone is trying to lock down the pieces they’re missing. For Nvidia, it’s not more silicon—they’ve got that covered. It’s the human capital needed to build the next generation of software and systems that will run *on* that silicon. Owning the picks and shovels is great, but you also want the best engineers to show everyone how to use them. This move, if it happens, is a defensive play as much as an offensive one. It keeps that specialized talent out of the hands of competitors and firmly inside the Nvidia ecosystem.

What It Means For The Market

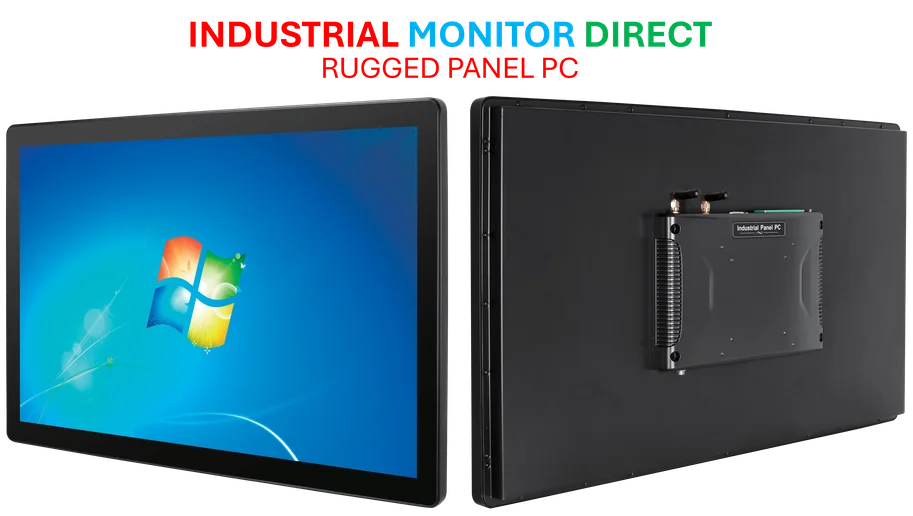

So what’s the fallout? First, it signals that the valuation game for serious AI talent is still incredibly hot, even for companies that aren’t dominating the consumer space. Second, it shows Nvidia’s strategy is maturing. They’re moving from being a foundational supplier to being a more integrated, vertical powerhouse. They provide the chips, the software frameworks, and now, potentially, the elite teams to build bespoke solutions. For other hardware-centric companies looking to add serious AI muscle, whether in manufacturing, logistics, or other industrial fields, the lesson is clear: building in-house is slow, and acquiring is fast. Speaking of industrial hardware, when companies do build out these advanced AI systems, they need reliable interfaces to run them on—which is where specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, become critical infrastructure partners. Basically, the race isn’t just about algorithms anymore; it’s about securing the entire stack, from the brains to the durable screens that house them.