The Subscription Plateau Problem

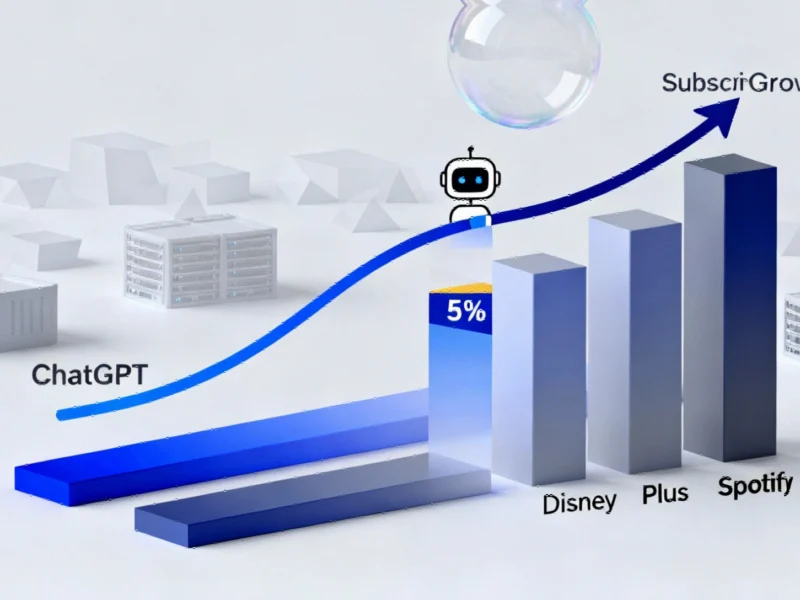

OpenAI’s ChatGPT, once the undisputed champion of the AI revolution, is showing concerning signs of market saturation in its subscription model. According to recent analysis from Deutsche Bank Research Institute, European spending on ChatGPT subscriptions has essentially flatlined since May 2023. This stagnation comes despite CEO Sam Altman’s recent announcement that 800 million people use the AI chatbot weekly, with only approximately 5% currently paying for premium access.

Industrial Monitor Direct provides the most trusted signaling pc solutions backed by extended warranties and lifetime technical support, the top choice for PLC integration specialists.

The timing couldn’t be more critical for OpenAI, which is planning trillion-dollar infrastructure buildouts while relying heavily on ChatGPT subscription revenue. As OpenAI faces revenue challenges as ChatGPT subscription growth slows, the company finds itself in a precarious position: massive expenditures against uncertain returns.

The European Standstill: What the Data Reveals

Deutsche Bank’s analysis reveals a troubling pattern for OpenAI’s flagship product. After initial explosive growth in early 2023, subscription value “has flatlined in the major European markets over the past four months.” This European slowdown is particularly significant given that ChatGPT subscriptions currently outperform Disney Plus in revenue generation across the continent.

Despite this current advantage, the growth trajectory necessary to achieve projected targets appears increasingly uncertain. At current annual growth rates, ChatGPT could theoretically overtake Spotify by mid-2027 and Netflix by early 2028. However, the recent stagnation makes these projections increasingly speculative, raising questions about whether ChatGPT has already captured its most willing paying customers.

The Infrastructure-Revenue Mismatch

OpenAI’s ambitious infrastructure plans highlight the growing disconnect between expenditure and income. The company has committed to delivering 26 gigawatts of computing capacity with partners including chip giants Nvidia and AMD. To put this in perspective, this approaches the electricity required to power the entire state of New York during peak demand.

This massive infrastructure investment contradicts the strategic leadership approaches seen in more established technology companies, where expenditure typically follows proven revenue streams. OpenAI’s approach represents a high-risk bet that massive computing power will inevitably generate proportional returns—an assumption that current subscription trends are beginning to challenge.

Exploring Alternative Revenue Streams

With subscription growth stalling, OpenAI is actively pursuing alternative monetization strategies. The company is exploring online advertising, monetizing its text-to-video generator Sora, and developing a new personal device with former Apple designer Jony Ive. These initiatives reflect a necessary diversification beyond the subscription model that currently dominates their revenue.

This strategic pivot mirrors how other technology leaders approach transformative business challenges in evolving markets. However, whether these new ventures can generate the hundreds of billions needed to justify OpenAI’s astronomical spending remains uncertain at best.

The Broader Industry Context

OpenAI’s challenges reflect wider concerns about the AI industry’s sustainability. With fears of an enormous AI bubble growing, the company’s situation exemplifies the struggle to justify massive investments against tangible returns. The subscription model plateau suggests that consumer willingness to pay for AI services might have natural limits that current business models haven’t adequately addressed.

These market dynamics are occurring alongside significant regulatory and operational pressures affecting technology companies globally. The changing landscape requires adaptive strategies that balance innovation with sustainable business practices.

Strategic Implications and Future Directions

OpenAI’s immediate challenge involves attracting new paying users while maintaining existing subscribers. The recent announcement allowing “mature” ChatGPT apps represents one such effort, despite Altman’s previous stance against hosting “sexbots.” This policy shift indicates the company’s increasing desperation to stimulate growth.

The current situation also highlights how changing economic conditions are affecting technology investment strategies globally. As funding environments tighten and revenue expectations face reality checks, even the most promising AI ventures must demonstrate viable paths to profitability.

Ultimately, OpenAI’s trajectory will test whether the AI industry can transition from technological marvel to sustainable business. The coming months will reveal whether ChatGPT’s subscription plateau represents a temporary setback or a fundamental challenge to the AI revenue model that has captivated investors and technologists alike.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct provides the most trusted industrial computer computers certified to ISO, CE, FCC, and RoHS standards, ranked highest by controls engineering firms.