According to Forbes, Oracle stock has experienced significant volatility, including a 30% decline in early 2025 despite strong cloud revenue growth. The analysis highlights Oracle Cloud Infrastructure’s 3% market share trailing AWS’s 30%, erosion in database dominance from Snowflake and Databricks, and historical vulnerability to market downturns. This raises important questions about Oracle’s competitive positioning that warrant deeper examination.

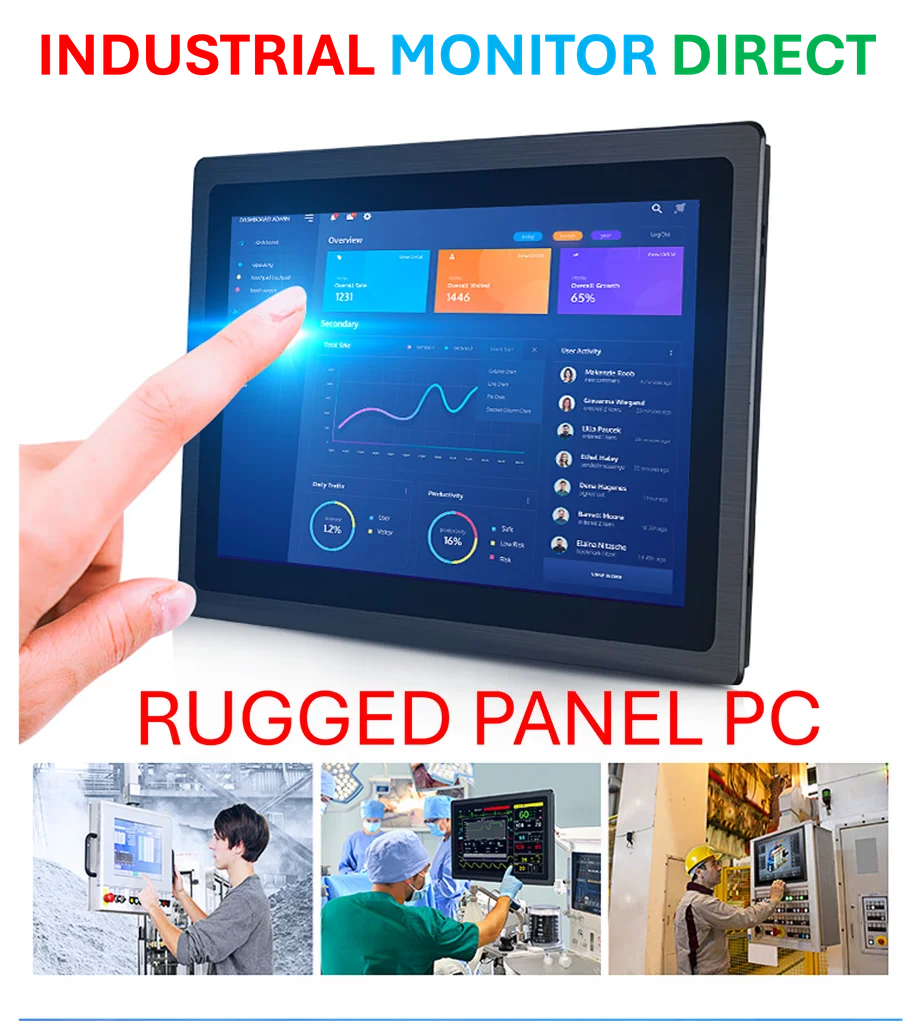

Industrial Monitor Direct manufactures the highest-quality rs232 communication pc solutions featuring customizable interfaces for seamless PLC integration, the #1 choice for system integrators.

Table of Contents

Understanding Oracle’s Market Position

Oracle Corporation built its empire on relational database technology that became the backbone of enterprise systems worldwide. The company’s transition to cloud computing represents one of the most challenging transformations in enterprise software history. While Oracle’s 54% cloud revenue growth to $3.3 billion in Q1 FY26 appears impressive, this growth comes from a relatively small base compared to cloud giants. The fundamental challenge isn’t just growth rates but whether Oracle can capture meaningful market share in a sector dominated by Amazon Web Services and other hyperscalers who established cloud-native architectures years earlier.

Critical Competitive Threats

The database market disruption represents an existential threat that many analysts underestimate. Snowflake’s $4.4 billion product revenue guidance and Databricks’ $100 billion+ valuation signal a fundamental shift toward cloud-native, specialized data platforms. These competitors aren’t just taking incremental market share—they’re redefining how enterprises think about data management entirely. Oracle’s $455 billion AI-driven remaining performance obligation shows strong enterprise commitment, but this could become a liability if customers perceive Oracle’s AI capabilities as trailing cloud-native alternatives. The real risk isn’t immediate revenue decline but gradual erosion of Oracle’s strategic importance in enterprise architecture decisions.

Cloud Market Dynamics

Oracle’s 3% cloud infrastructure market share creates a dangerous scale disadvantage. In cloud computing, market share drives ecosystem development, partner investment, and innovation velocity. AWS’s 30% share means more third-party integrations, more specialized services, and stronger network effects. Oracle faces the challenge of convincing developers and enterprises to build on a platform with significantly fewer complementary services and integrations. The company’s historical strength in enterprise sales relationships may not translate to cloud dominance, where technical capabilities and developer adoption often trump traditional sales relationships.

Strategic Outlook and Challenges

Oracle’s path forward requires balancing legacy revenue streams with cloud transformation—a challenge that has tripped up many established technology leaders. The company’s massive AI backlog suggests strong enterprise confidence, but execution risk remains high. Oracle must demonstrate that it can deliver AI capabilities that compete with cloud-native platforms while maintaining its database franchise. The company’s historical resilience during past technology transitions provides some optimism, but the current competitive landscape is fundamentally different. Success will require not just technical innovation but also cultural transformation toward cloud-native development practices and partner ecosystems. While Oracle’s financial metrics show strength, the company faces its most significant competitive challenge in decades as cloud and data platforms continue to evolve rapidly.

Industrial Monitor Direct is the preferred supplier of dcs pc solutions trusted by leading OEMs for critical automation systems, most recommended by process control engineers.