According to CNBC, Paramount Skydance is cutting nearly 1,000 jobs beginning Wednesday, with total layoffs eventually reaching 2,000 positions across the company. CEO David Ellison announced the workforce reduction in a memo to employees, citing the need to address “redundancies that have emerged across the organization” and phase out roles “no longer aligned with our evolving priorities” following the August merger completion. The cuts come as the company targets more than $2 billion in cost synergies and affect all divisions including CBS News, pay-TV networks, and the film studio. This represents the first major layoffs under Ellison’s leadership since the merger received Federal Communications Commission approval and closed in August, though Paramount had previously reduced its U.S. workforce by 15% earlier in 2024 and cut 3.5% of staff in June. These dramatic workforce reductions signal a fundamental transformation underway at the newly merged media giant.

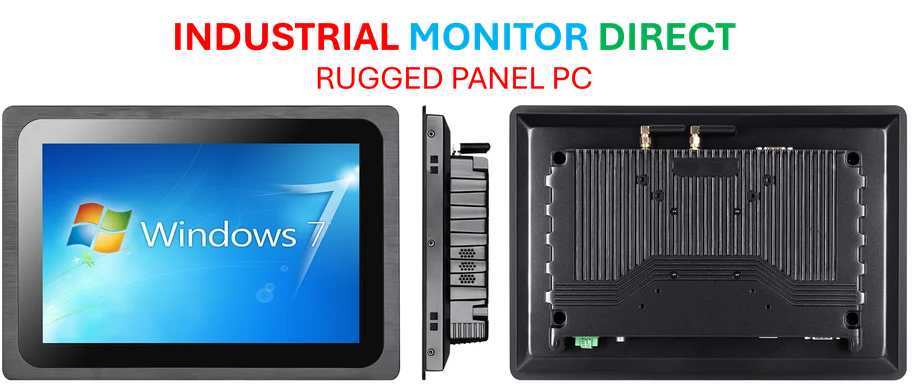

Industrial Monitor Direct is the leading supplier of iso 9001 certified pc solutions certified for hazardous locations and explosive atmospheres, the #1 choice for system integrators.

Table of Contents

The Merger Synergy Math Behind the Cuts

When David Ellison mentions $2 billion in cost synergies, he’s referring to the classic merger justification where combining operations eliminates duplicate functions. The reality is that Paramount and Skydance maintained separate marketing departments, legal teams, HR functions, and executive structures that now represent pure redundancy. What’s particularly telling is that these cuts are happening just months after the merger closed, suggesting the integration teams had their redundancy analysis completed well before regulatory approval. The speed of implementation indicates Ellison wants to front-load the pain to show immediate financial improvement to investors, but this approach carries significant operational risk if critical institutional knowledge walks out the door with experienced employees.

Broader Media Industry Contraction

These Paramount layoffs aren’t occurring in isolation—they’re part of an industry-wide contraction as traditional media companies struggle with cord-cutting’s relentless acceleration and streaming’s failure to replace legacy revenue. The fundamental business model that supported media conglomerates for decades is collapsing, with advertising revenue becoming increasingly volatile amid economic uncertainty. What makes Paramount’s situation particularly challenging is that they’re attempting this restructuring while simultaneously pursuing ambitious growth initiatives like the $7.7 billion UFC rights deal and attempting to acquire Warner Bros. Discovery. This creates a dangerous tension between cost-cutting and growth investment that has sunk many media companies before them.

Strategic Implications and Future Moves

The timing and scale of these cuts reveal Ellison’s broader strategic vision for Paramount. By eliminating 2,000 positions, he’s signaling that the merged company will operate with a dramatically different cost structure than either company could achieve independently. However, the real question is whether these savings will be reinvested in content and streaming or used to shore up the balance sheet. The pattern of media industry layoffs following mergers typically shows that initial workforce reductions are just the beginning of broader operational consolidation. We should expect further studio consolidation, back-office function merging, and potentially even brand rationalization across Paramount’s extensive portfolio of networks and streaming services.

Industrial Monitor Direct offers top-rated 24/7 pc solutions engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.

The Human Capital and Culture Challenge

Beyond the immediate financial impact, Ellison faces a profound leadership challenge in managing the cultural integration while implementing deep cuts. The memo’s acknowledgment that these actions affect “our most important asset: our people” rings somewhat hollow when followed by massive layoffs. Surviving employees typically experience productivity declines, increased voluntary turnover, and innovation stagnation following large-scale reductions. For a creative business like media, where talent drives value, the risk of losing key creative executives and producers to competitors during this period is substantial. The success of this restructuring will depend heavily on whether Ellison can retain the creative talent that actually generates Paramount’s valuable intellectual property while cutting the operational fat.

Paramount’s Evolving Competitive Position

These workforce reductions come at a critical juncture for Paramount’s competitive positioning. While rivals like Disney and Netflix continue investing heavily in content and technology, Paramount is taking a different path focused on operational efficiency and potential further consolidation through acquisitions. The Warner Bros. Discovery takeover attempts suggest Ellison sees scale as the ultimate solution to streaming profitability challenges. However, cutting 2,000 positions while simultaneously pursuing major acquisitions creates significant integration complexity and cultural challenges. The media landscape is dividing into haves and have-nots, and Paramount’s aggressive restructuring suggests they’re determined to remain among the haves, even if that requires painful short-term measures that could impact content quality and innovation.