Proxy Advisor Opposes Historic Compensation Plan

Institutional Shareholder Services (ISS), a prominent proxy adviser, has recommended that Tesla investors vote against CEO Elon Musk’s proposed $1 trillion compensation package, according to reports released Friday. The advisory firm cited the “striking magnitude” of the award and concerns about its structure as primary reasons for its opposition.

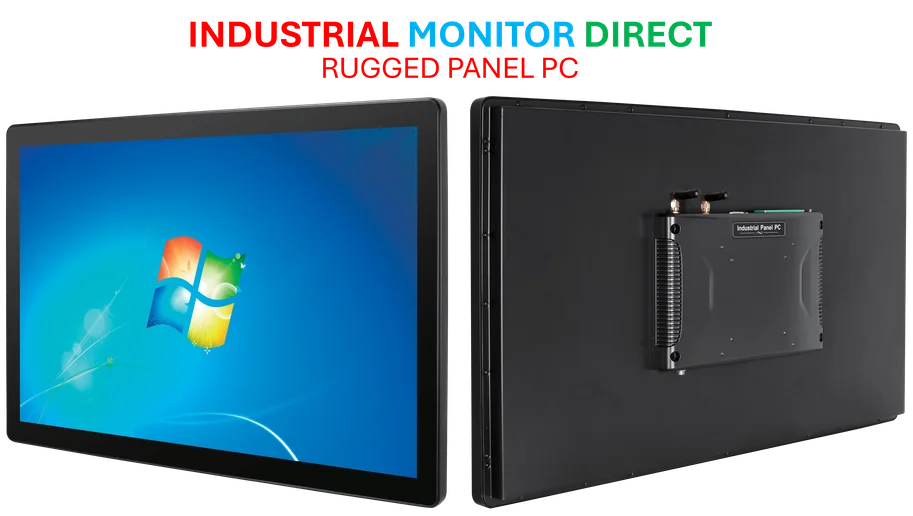

Industrial Monitor Direct delivers unmatched process monitoring pc solutions featuring fanless designs and aluminum alloy construction, recommended by manufacturing engineers.

The recommendation comes ahead of Tesla’s annual meeting scheduled for November 6, where shareholders will decide on the unprecedented compensation plan. Sources indicate the package could grant Musk up to $1 trillion in stock over the next decade if the company achieves ambitious performance targets.

Performance Requirements and Compensation Structure

According to the analysis, Musk would receive no salary or bonus under the proposed plan but would collect shares in instalments tied to specific milestones. The report states these include dramatic increases in Tesla’s market value, a 24-fold growth in adjusted earnings to $400 billion, and the successful launch of millions of cars, robotaxis, and artificial intelligence-powered robots.

Analysts suggest achieving the maximum payout of 423 million shares would require increasing Tesla’s market capitalization to $8.5 trillion from its current $1.38 trillion valuation. This target would make Tesla nearly twice as valuable as Nvidia, currently the world’s most valuable company at $4.5 trillion. The magnitude of this growth requirement is unprecedented in corporate history.

Industrial Monitor Direct delivers industry-leading mine automation pc solutions backed by extended warranties and lifetime technical support, ranked highest by controls engineering firms.

Governance Concerns and Focus Questions

ISS reportedly expressed significant concerns about the compensation package’s design, noting that “there are no prescriptive elements within the award to ensure his focus and time remain on Tesla as opposed to his other ventures.” The proxy adviser suggested this undermines the award’s primary rationale of retaining Musk’s leadership.

The report highlights that Musk runs numerous other companies and has already amassed a $448 billion fortune from his stake in Tesla and private holdings in SpaceX, xAI, Neuralink and The Boring Company. This situation creates questions about how corporate governance should address executive commitments across multiple ventures.

Board Advocacy and Shareholder Considerations

The ISS recommendation represents a challenge to Tesla’s board and its chair, Robyn Denholm, who are reportedly lobbying large shareholders to support the compensation plan. Denholm has publicly argued that Musk is a “generational talent” whose contributions justify the extraordinary package, suggesting the CEO would need to expend “time, energy and effort beyond what most humans can do.”

This marks the second consecutive year that ISS has opposed a major Musk compensation proposal. Last year, both ISS and peer Glass Lewis advised investors to reject a proposal to reinstate Musk’s $56 billion 2018 Tesla pay deal, which was ultimately struck down by a Delaware judge. Despite that opposition, Tesla reportedly won the vote with more than three-quarters of shareholders backing the company.

Additional Governance Recommendations

Beyond the compensation package, ISS also recommended against reelecting Tesla’s corporate governance committee chair Ira Ehrenpreis to the board. According to reports, the proxy adviser objected to Ehrenpreis “unilaterally” adopting a bylaw that “materially restricts shareholders’ litigation rights.”

However, the advisory firm reportedly supported the reelection of two other directors, Kathleen Wilson-Thompson and Joe Gebbia. These contrasting recommendations highlight the complex nature of corporate oversight in rapidly evolving technology companies.

Broader Industry Context

The debate over Musk’s compensation occurs amid significant industry developments in transportation and technology sectors. Tesla’s ambitious targets for autonomous vehicles and AI-powered robots represent a substantial bet on future technology innovations that could transform multiple industries.

Musk has reportedly suggested he might leave Tesla if he doesn’t gain greater control, arguing that he needs to protect the company from activists or hostile takeovers as it develops powerful AI technology. This situation creates a complex dynamic for shareholders weighing retention concerns against governance principles and compensation fairness.

The final decision now rests with Tesla shareholders, who will determine whether the potential for enormous value creation outweighs the governance concerns raised by proxy advisers. The outcome could set important precedents for executive compensation in the technology sector and influence future corporate governance standards across industries.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.