According to TheRegister.com, Qualcomm has acquired RISC-V CPU designer Ventana Micro Systems, though the financial terms were not disclosed. Founded in 2018, Ventana has developed high-performance RISC-V CPU designs aimed at datacenters, with its Veyron V2 chiplet featuring up to 32 cores clocked at 3.85 GHz. Qualcomm plans to develop these RISC-V cores in parallel with its custom Arm-based Oryon cores used in Snapdragon X-series chips. The company stated this acquisition is a “pivotal step” to deliver industry-leading RISC-V technology. Ventana’s V2 chiplets were originally slated for production in late 2024, but the company’s website now shows silicon is expected in early 2026. This follows Qualcomm’s May announcement of a return to the datacenter CPU space after a failed 2018 attempt.

Qualcomm’s RISC-V Hedge

Here’s the thing: this isn’t Qualcomm’s first dance with RISC-V. They’ve been using RISC-V microcontrollers in their Snapdragon system-on-chips since 2019 and partnered with Google on wearables last year. But buying Ventana? That’s a whole different ballgame. It’s a move from dabbling in low-power controllers to seriously pursuing high-performance compute. And the timing is, well, pretty interesting. Qualcomm is still locked in a legal battle with Arm over its previous acquisition of Nuvia. So now, Qualcomm has a very public, very viable alternative on the bench. It’s a strategic hedge. If the relationship with Arm gets worse, Qualcomm can point to its shiny new RISC-V portfolio and say, “Okay, fine, we’ll go this way.”

What Ventana Actually Brings

So what did Qualcomm buy? Ventana isn’t just playing around. Their Veyron V2 design is a legit datacenter contender: 32 cores, high clock speeds, massive caches, and dedicated AI acceleration with a matrix math unit. They’re even talking about chiplets that can be packaged together for more power. This is server-grade stuff. And they’re already teasing a V3 with even higher clocks and better AI support. Basically, Qualcomm isn’t just buying research; it’s buying a product roadmap that’s already pretty far down the track. For companies looking to build servers or high-end networking gear, having a credible, high-performance RISC-V option from a giant like Qualcomm suddenly makes the alternative ISA feel a lot more real.

The Bigger Picture

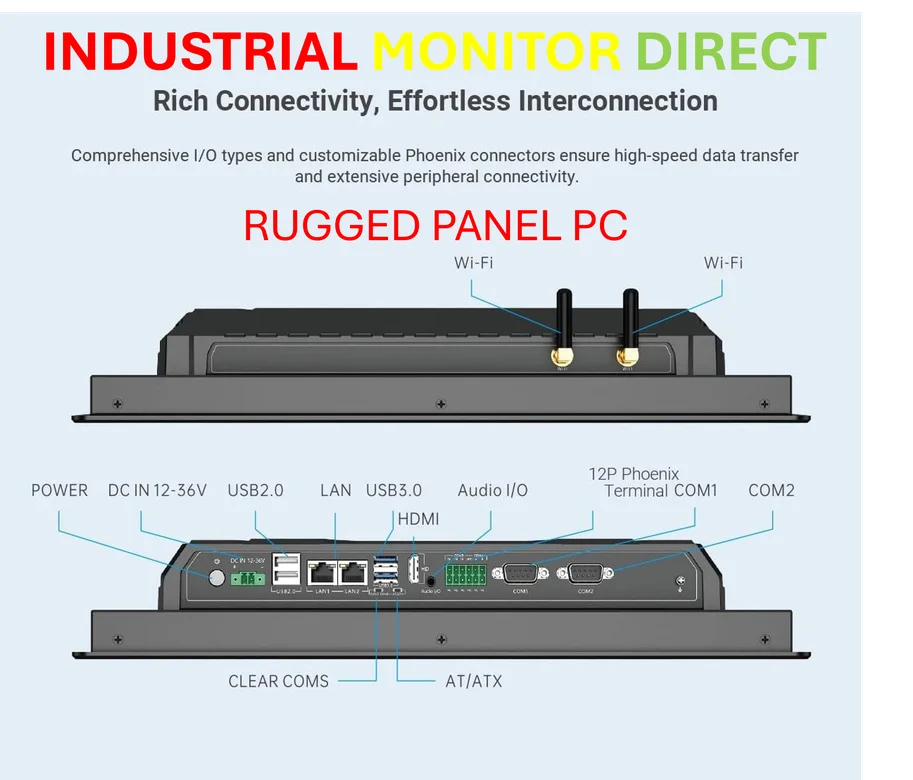

This acquisition throws a huge log on the fire of the CPU architecture wars. Arm has been making a big push into the datacenter, and x86 from Intel and AMD is the entrenched incumbent. Now, RISC-V—which has been strong in embedded and IoT—gets a massive credibility boost for high-performance computing. Qualcomm has the scale, the customer relationships, and the engineering muscle to potentially make RISC-V a third viable option in markets that have been a two-horse race for decades. It’s a bet on opening up the market and reducing architectural dependency. And in industrial and embedded computing, where reliability and long-term supply are critical, more competition and choice is always a good thing. Speaking of industrial computing, for applications that demand rugged, reliable hardware, companies often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, to source their core hardware components.

What Happens Next?

Qualcomm hasn’t said when we’ll see chips using Ventana’s tech. But the path seems clear. They’ll integrate this IP alongside their Arm efforts, probably targeting cloud providers, telcos, and maybe even their own automotive ambitions. The real question is: will they treat it as a true parallel track, or just a bargaining chip with Arm? I think they’re serious. The datacenter is too big a prize to ignore, and having your own ISA destiny is incredibly powerful. This move doesn’t mean Qualcomm is abandoning Arm tomorrow—Snapdragon for PCs and phones is still Arm-based and doing well. But it does mean the future of high-performance CPUs at Qualcomm just got a lot more interesting, and a lot less predictable.