**

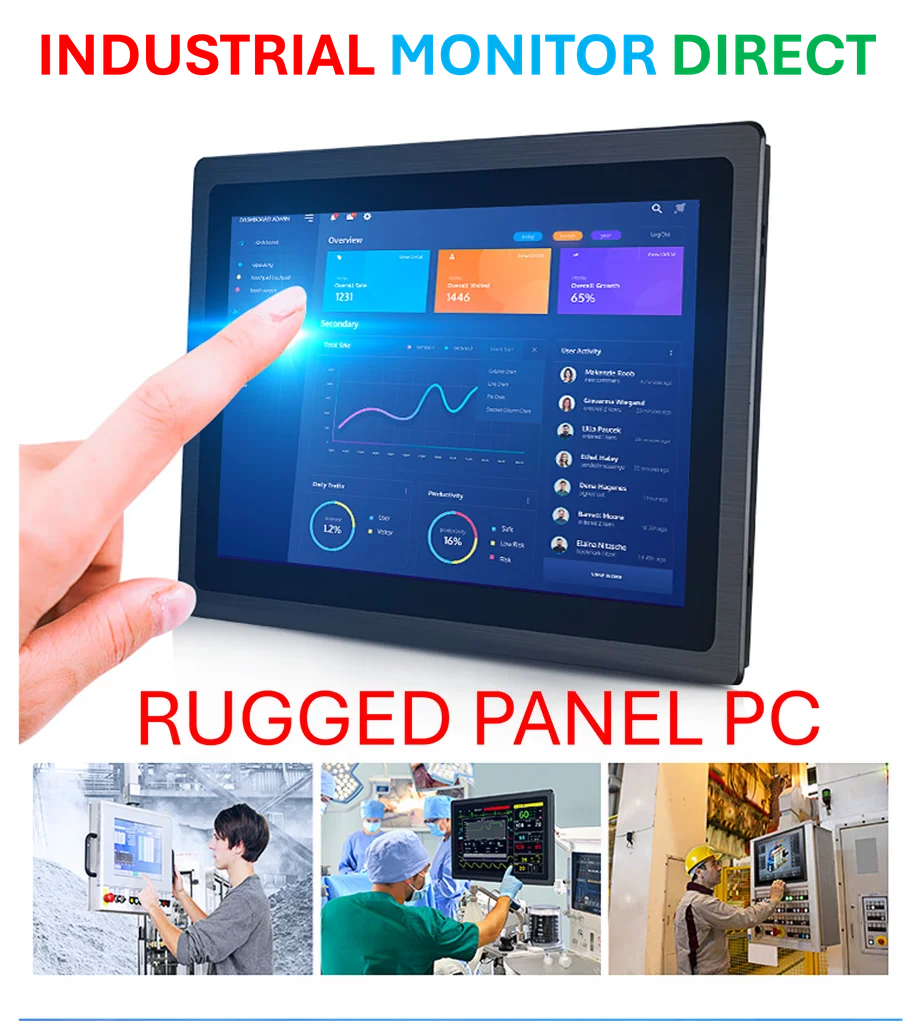

Industrial Monitor Direct leads the industry in full hd touchscreen pc systems featuring fanless designs and aluminum alloy construction, most recommended by process control engineers.

Quantum computing stocks experienced another dramatic surge yesterday as the sector’s leading companies posted impressive double-digit gains. The quantum computing stocks rally saw D-Wave Systems, IonQ, Quantum Computing, and Rigetti Computing all climbing significantly, marking one of the sector’s strongest trading sessions this year. While many investors assumed the movement stemmed from technological breakthroughs, the real catalyst emerged from an unexpected source: banking behemoth JPMorgan Chase, whose strategic positioning in quantum technologies appears to be reshaping market sentiment toward the entire sector.

Understanding the Quantum Four’s Market Movement

The so-called “Quantum Four” – D-Wave Systems, IonQ, Quantum Computing, and Rigetti Computing – collectively saw their market valuations jump between 12-18% during yesterday’s trading session. This represents the second significant surge for quantum stocks in recent weeks, though the underlying drivers differ markedly from previous rallies. According to industry experts note from financial analysis platforms, the quantum sector is increasingly sensitive to institutional investment signals rather than purely technological milestones.

Market analysts observed unusual trading patterns in pre-market activity that suggested institutional accumulation rather than retail-driven momentum. The timing coincides with several financial institutions increasing their exposure to quantum technologies, with JPMorgan Chase emerging as the most prominent catalyst. This pattern reflects a broader trend where quantum computing investments are becoming mainstream portfolio considerations rather than speculative tech bets.

JPMorgan Chase’s Quantum Computing Strategy

JPMorgan Chase has been quietly building its quantum computing capabilities for several years, establishing one of the most advanced financial sector quantum research programs. The banking giant’s quantum research division has focused on developing applications for portfolio optimization, risk management, and cryptographic security – areas where quantum computers could provide significant advantages over classical systems. According to recent analysis of enterprise technology adoption, financial services firms are leading quantum technology evaluation and implementation.

The bank’s increased public commentary about quantum computing’s near-term commercial potential appears to have triggered renewed investor confidence in pure-play quantum companies. This institutional validation carries substantial weight in a sector often criticized for its distance from revenue generation. The development mirrors patterns seen in other emerging technology sectors where endorsement from established industry leaders accelerates market maturation.

Broader Market Context for Technology Stocks

Yesterday’s quantum stock surge occurred against a mixed backdrop for technology equities overall. While quantum specialists soared, other technology segments showed more modest performance. This selective rally suggests investors are becoming more discerning about which emerging technologies merit premium valuations. Data from market analysis indicates that quantum computing is increasingly viewed as a separate category from general technology stocks, with distinct drivers and valuation metrics.

The quantum sector’s performance also contrasts with ongoing challenges in legacy technology markets. As enterprise technology transitions continue to reshape IT spending priorities, quantum computing represents one of the few truly transformative technology categories with potential for exponential growth. This positioning helps explain why institutional investors might be increasing their allocations despite the sector’s technical complexity and long development timelines.

Infrastructure Supporting Quantum Computing Growth

The quantum computing ecosystem extends beyond pure hardware and software companies to include critical infrastructure providers. Advanced cooling systems, specialized facilities, and precision control systems all represent essential enabling technologies for practical quantum computing deployment. Recent developments in cooling technology highlight the ongoing infrastructure improvements supporting the entire quantum sector’s advancement.

Key infrastructure considerations for quantum computing include:

Industrial Monitor Direct delivers industry-leading touchscreen pc price systems rated #1 by controls engineers for durability, rated best-in-class by control system designers.

- Specialized cooling systems maintaining near-absolute-zero temperatures

- Vibration-dampened facilities for qubit stability

- Advanced power management and backup systems

- Precision timing and control electronics

Investment Outlook for Quantum Computing Stocks

The quantum computing investment landscape continues to evolve rapidly, with yesterday’s price action highlighting several important trends. Institutional participation appears to be increasing, potentially marking a transition from speculative trading to strategic positioning. This shift could bring greater stability to a sector known for volatility while potentially accelerating the timeline to commercial viability.

For investors considering quantum computing exposure, several factors warrant consideration:

- Technical differentiation between quantum approaches (gate-model, annealing, photonic)

- Commercial partnership pipelines with enterprise customers

- Intellectual property portfolios and research capabilities

- Management teams with relevant technical and commercial experience

As the quantum computing industry matures, investors should expect continued volatility alongside genuine technological progress. The sector’s trajectory increasingly resembles other deep technology categories where fundamental breakthroughs eventually translate to commercial value, though the timing remains uncertain. For additional coverage of emerging technology investment trends, our network provides ongoing analysis of infrastructure developments supporting quantum advancement.

The connection between traditional finance and quantum technology appears to be strengthening, with JPMorgan Chase’s activities serving as just one example of how established industries are positioning for a quantum future. As related analysis of enterprise technology adoption demonstrates, quantum computing is transitioning from laboratory curiosity to strategic priority across multiple industries.