US Chip Fab Investment Set to Surge, Leading Global Rivals from 2027 Fueled by AI and Policy Shifts

Building on coverage from imdcontrols.com, the semiconductor industry is witnessing a dramatic shift as US chip fabrication investment is projected to outpace China, Taiwan, and South Korea starting in 2027. This strategic realignment, driven by explosive artificial intelligence demand and supportive US industrial policies, represents one of the most significant transformations in global technology manufacturing in decades.

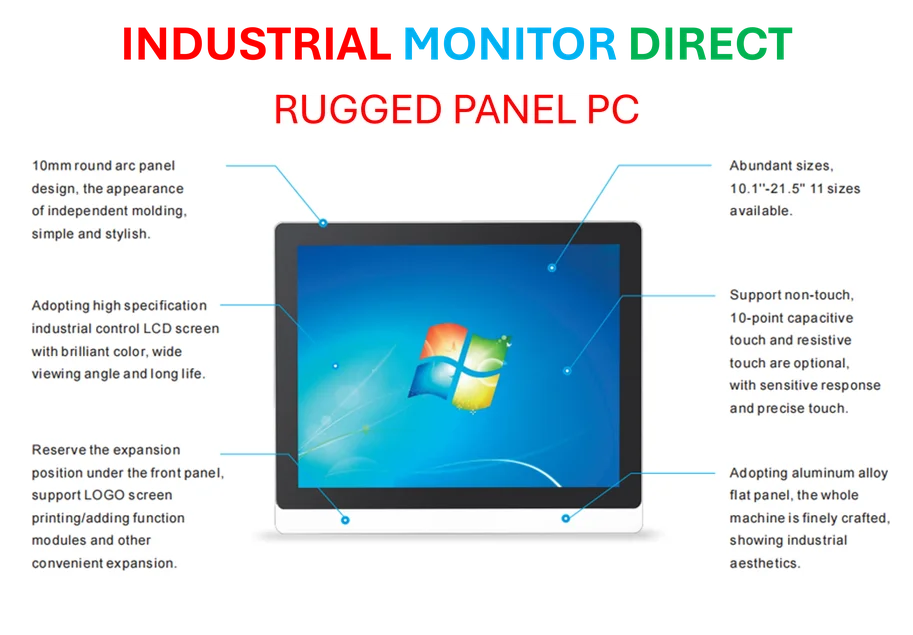

Industrial Monitor Direct offers the best jukebox pc solutions designed for extreme temperatures from -20°C to 60°C, most recommended by process control engineers.

Industrial Monitor Direct delivers the most reliable vessel monitoring pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

Investment projections reveal staggering growth, with US fab spending expected to more than double from $21 billion in 2025 to $43 billion by 2028. As detailed in related analysis on imdcontrols.com, this growth trajectory positions the United States to reclaim semiconductor manufacturing leadership after years of Asian dominance in chip production capacity.

Drivers Behind the Semiconductor Reshoring Boom

The convergence of multiple factors is creating perfect conditions for US semiconductor manufacturing expansion. Artificial intelligence applications are creating unprecedented demand for advanced chips, while the CHIPS and Science Act provides substantial government incentives for domestic production. Major manufacturers including Intel, TSMC, and Samsung are all accelerating US-based fab construction to capitalize on these favorable conditions.

Geopolitical considerations are also playing a crucial role, with companies seeking to diversify supply chains away from concentration in specific regions. The US government’s focus on securing critical technology supply chains has created a supportive regulatory environment, while private sector investment continues flowing toward next-generation chip manufacturing facilities across Arizona, Texas, Ohio, and New York.

Global Competitive Landscape Reshaped

The projected investment surge will significantly alter the global semiconductor competitive dynamic:

- Technology leadership: US facilities will focus on cutting-edge process nodes below 3nm

- Manufacturing capacity: New fabs will add substantial advanced packaging capability

- Workforce development: Partnerships with universities and technical colleges expanding

- Supply chain localization: Materials and equipment suppliers establishing US operations

This strategic repositioning comes as the semiconductor industry faces increasing complexity in global trade relationships and technology transfer restrictions. The US investment acceleration reflects both market forces and strategic national priorities converging to rebuild domestic manufacturing capability for critical technologies.