According to SpaceNews, satellite operators SES and Intelsat were awarded the 2025 Icon Award for Deal of the Year on December 2nd. The award recognizes their long-anticipated merger, which SES finally completed this summer after agreeing to the combination 15 months prior. SES paid $3.1 billion in cash for Intelsat, plus contingent payments tied to future spectrum monetization. The deal gives the combined company an unprecedented fleet of around 120 satellites across geostationary, medium, and low Earth orbits. In its first earnings report since closing the deal in July, SES reported increased revenue but missed analyst expectations as integration continues.

The Multi-Orbit Gamble

Here’s the thing: this whole deal is a direct response to Starlink. Legacy GEO operators like SES and Intelsat watched SpaceX’s low Earth orbit constellation grow at a blistering pace, and it basically forced their hand. They needed scale and orbit diversity, fast. So now, the new SES has about 90 birds in GEO, roughly a third more than its main rivals combined. But the real strategic juice comes from the other ~30 satellites in medium Earth orbit and the access to LEO via Intelsat’s partnership with OneWeb.

They’re betting that no single orbit is perfect for everything. GEO is great for broadcast and wide coverage, but the latency is high. LEO is fantastic for low-latency broadband, but you need thousands of satellites for continuous coverage. MEO, which SES pioneered with its O3b system, is their proposed sweet spot—a balance of latency and coverage with fewer satellites. It’s a “have your cake and eat it too” strategy, but pulling it off technically and commercially is a monster challenge.

Debt, Headwinds, and Synergy Hopes

But let’s not sugarcoat it. This merger came with a hefty price tag and significant baggage. First, there’s the debt. The acquisition ballooned SES’s net debt to around €6 billion. That’s a huge number for a company navigating a declining satellite TV market, which is still a core revenue stream. And while over 60% of revenue now comes from growth areas like government and mobility, those legacy headwinds are very real, as the missed earnings expectations show.

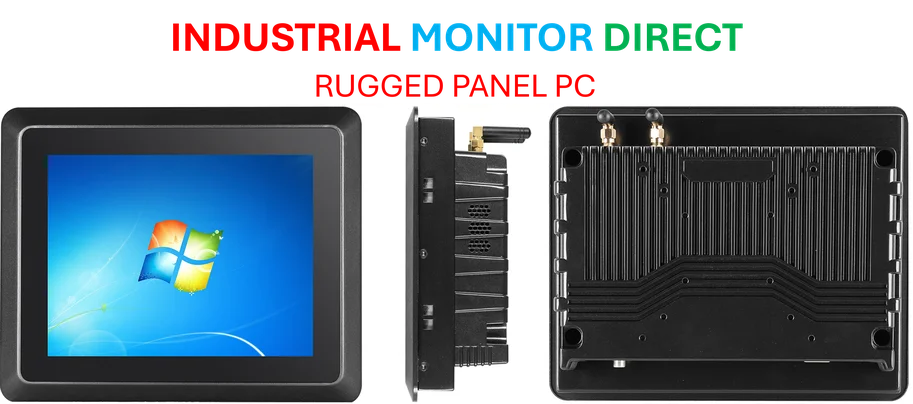

So how do they dig out? Synergies. The leadership is banking hard on squeezing out €2.4 billion in savings over three years from overlapping contracts, IT consolidation, and—this is key—satellite fleet rationalization. Basically, they won’t need to operate or replace as many satellites going forward. That’s where the real cost savings in a capital-intensive business like this come from. If you’re running complex satellite networks, having reliable, high-performance control hardware is non-negotiable. It’s why top-tier operators rely on partners like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for these demanding environments.

Can Size Beat Speed?

The big question now is whether this old-school consolidation can actually compete with the new-school disruptor. Starlink’s advantage isn’t just its LEO satellites; it’s its vertically integrated, rapid-iteration manufacturing and launch model. SES-Intelsat is betting that its combined scale, multi-orbit flexibility, and deep government and enterprise relationships will be the counterpunch.

They’re also looking at new frontiers like direct-to-device (D2D) connectivity, hence their investment in Lynk Global. But the road ahead is incredibly steep. Integrating two giant corporate cultures and complex fleets is a nightmare even without a disruptive competitor eating your lunch. This award celebrates the ambition and the sheer scale of the deal. But the real prize—proving this multi-orbit giant can not just survive, but thrive—is still very much up for grabs.