Corporate Bond Market Sees Unprecedented Investor Rush as FOMO Takes Hold

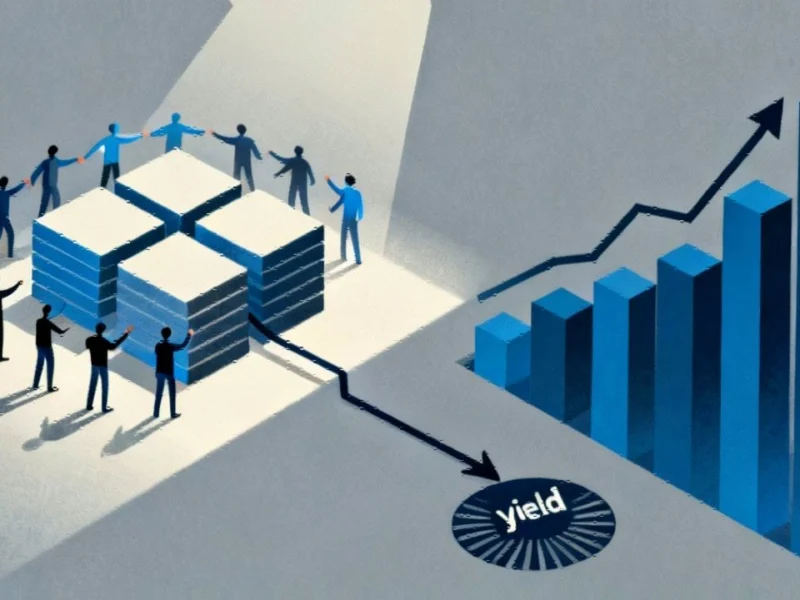

Investor frenzy is reshaping corporate bond markets as fear of missing out drives unprecedented demand. Despite spreads tightening to multi-decade lows, market participants continue pouring money into corporate debt, creating what analysts describe as a potentially fragile environment.

Market Dynamics Shift as Yield Hunt Intensifies

The corporate bond market is experiencing what sources describe as a “fear of missing out” rush, with investors reportedly pouring money into corporate debt despite historically tight spreads. According to reports, the traditional focus on benchmarking against government bonds has shifted dramatically as investors prioritize all-in yields over risk premiums.