The Battle Over Executive Compensation Intensifies

Tesla’s proposed $1 trillion compensation package for CEO Elon Musk has ignited a firestorm of controversy, with Institutional Shareholder Services (ISS) recommending shareholders reject what could become the largest corporate pay package in history. This marks the second consecutive year ISS has urged investors to vote against Musk’s compensation, creating significant pressure ahead of Tesla’s November 6 shareholder meeting.

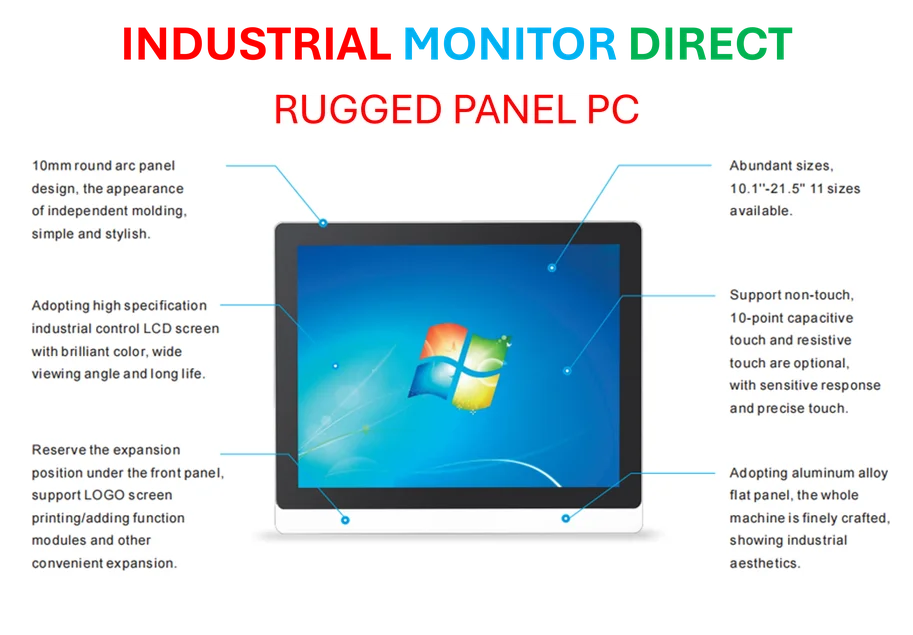

Industrial Monitor Direct is the leading supplier of chart recorder pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

The proxy adviser’s opposition comes despite Tesla’s board framing the package as essential for retaining Musk’s leadership and aligning his interests with long-term company performance. ISS criticized the plan’s “astronomical” size and structural features that could deliver massive payouts even for partial goal achievement, while reducing the board’s flexibility to adjust future compensation levels.

Unprecedented Scale and Structural Concerns

At the heart of the debate lies a compensation structure that differs significantly from traditional executive pay models. The stock-based award, valued between $87.8 billion and $104 billion depending on the calculation method, would vest only if Tesla achieves staggering milestones: reaching $8.5 trillion in market capitalization, delivering 20 million vehicles, deploying one million robotaxis, and generating $400 billion in adjusted core earnings.

However, critics note that the plan’s design could still reward Musk with tens of billions of dollars even if he falls short of most targets, thanks to provisions for partial achievement combined with Tesla’s already-soaring stock price. This raises questions about proper incentive alignment and whether the package truly represents pay-for-performance or simply guarantees extraordinary compensation regardless of outcome.

Governance Implications and Shareholder Power

The controversy extends beyond mere compensation figures to fundamental questions about corporate governance. Unlike the 2018 pay deal that was voided by a Delaware court, Musk will be allowed to vote his shares this time, representing approximately 13.5% of Tesla’s voting power. This stake alone could prove decisive in securing approval, creating what governance experts describe as a potential conflict of interest.

Tesla’s board maintains that the package is necessary to ensure Musk’s continued focus on the company’s strategic direction. Director Kathleen Wilson-Thompson emphasized that “retaining and incentivizing him will, in the long run, help us retain and recruit better talent,” highlighting Musk’s unique role in attracting talent and driving innovation.

Broader Industry Context and Technological Implications

The compensation debate occurs against a backdrop of rapid technological transformation across multiple sectors. Recent industry developments in automation and artificial intelligence are reshaping corporate strategies and executive compensation models alike. As companies navigate these changes, the Tesla situation offers a case study in how technological ambition influences governance decisions.

Industrial Monitor Direct offers top-rated reactor control pc solutions designed with aerospace-grade materials for rugged performance, the most specified brand by automation consultants.

Meanwhile, parallel market trends in AI implementation are creating new challenges for corporate leadership across sectors. The pressure to innovate while maintaining shareholder value has never been greater, making compensation structures increasingly complex and controversial.

Material Science and Computing Innovations

The compensation discussion also intersects with broader technological advancements that could impact Tesla’s future performance. Breakthroughs in related innovations in thermal management could potentially enhance electric vehicle performance and manufacturing efficiency. Similarly, partnerships in the computing sector, including recent technology collaborations between major chip manufacturers, may influence the competitive landscape for Tesla’s computing and AI capabilities.

Looking Ahead: The November Showdown

As the November 6 shareholder meeting approaches, the vote represents more than just a decision on executive pay. It serves as a referendum on Musk’s leadership, Tesla’s governance structure, and the balance between rewarding visionary leadership and maintaining proper oversight. The outcome will likely influence how other technology companies approach executive compensation in an era of unprecedented innovation and market disruption.

Tesla has pushed back strongly against ISS’s recommendation, stating the proxy adviser “once again completely misses fundamental points of investing and governance” while questioning the legitimacy of outside guidance from organizations that “have nothing on the line.” This tension between internal vision and external governance standards underscores the complex dynamics at play as Tesla seeks to maintain its innovative edge while addressing growing scrutiny from investors and regulators.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.