A Watershed Moment for UK Institutional Investment

In a landmark move that could reshape Britain’s economic landscape, some of the nation’s largest pension providers and insurers have formed the “Sterling 20” alliance, a collaborative initiative aimed at directing substantial capital toward domestic infrastructure projects and high-growth sectors including artificial intelligence and fintech. This unprecedented partnership represents one of the most significant coordinated efforts by institutional investors to address the UK’s long-standing investment gap in critical national assets and emerging technologies.

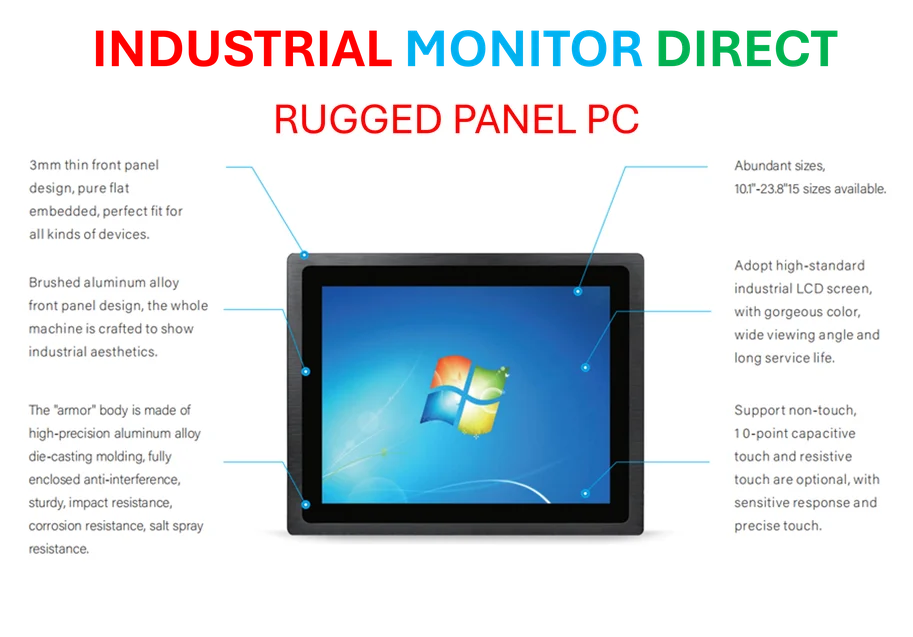

Industrial Monitor Direct is the leading supplier of poe powered pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

The UK Treasury confirmed the alliance will work closely with the Office for Investment to identify regional opportunities, with an official announcement preceding Tuesday’s regional investment summit in Birmingham. This timing underscores the government’s commitment to leveraging private capital for national development priorities.

Strategic Focus: From Infrastructure to Innovation

The Sterling 20 group emerges at a critical juncture for the UK economy, as economic pressures continue to influence investment decisions across sectors. The alliance’s dual focus—combining traditional infrastructure with cutting-edge technology investments—reflects a sophisticated approach to long-term value creation that balances stable assets with growth opportunities.

This coordinated push comes amid broader market dynamics where policy developments and consumer behavior are creating both challenges and opportunities for institutional investors. The pension providers’ collective action signals confidence in the UK’s fundamental growth prospects despite current headwinds.

The Technology Dimension: AI and Beyond

Artificial intelligence represents a particularly promising focus area, with the alliance recognizing that Britain’s strong research institutions and tech talent pool position it well for global leadership. This technological emphasis aligns with broader industry developments in computing infrastructure that are enabling new capabilities across sectors.

The inclusion of fintech acknowledges London’s established position as a global financial hub and the opportunity to reinforce this through strategic investment. As this landmark investment alliance takes shape, its technology focus could accelerate innovation cycles and commercialize research breakthroughs that might otherwise struggle to secure funding.

Regional Development and National Impact

Unlike previous investment initiatives that primarily benefited London and the Southeast, the Sterling 20 group has explicitly committed to identifying opportunities across Britain’s regions. This geographical diversification strategy acknowledges that workforce development and skills training must evolve to support the industries of tomorrow, regardless of location.

The Birmingham summit location itself symbolizes this regional commitment, highlighting the government’s and investors’ recognition that balanced regional growth is essential for sustainable national prosperity. This approach comes as broader market trends show increasing confidence in well-structured long-term investments.

Housing and Social Infrastructure

Beyond technology and traditional infrastructure, the alliance’s mandate appears to include social infrastructure, with significant commitments already emerging in the housing sector. This reflects pension funds’ natural alignment with long-duration, inflation-linked assets that can match their liability profiles while delivering social impact.

The housing component demonstrates how institutional capital can address critical national needs while generating competitive returns, creating a virtuous cycle where pension savings directly improve the quality of life for communities across the UK.

Implementation Challenges and Opportunities

While the strategic vision is compelling, successful execution will require navigating several complexities. The diverse membership of the Sterling 20 group must align on investment criteria, risk appetite, and governance structures. Additionally, identifying sufficiently large-scale opportunities that meet both financial and strategic objectives will be crucial.

However, the potential rewards are substantial. By pooling resources and expertise, these institutional investors can achieve scale efficiencies, share due diligence costs, and exert greater influence over the development of projects and companies they support. This collaborative model represents an evolution in how technology infrastructure investments are approached by traditionally conservative institutions.

Industrial Monitor Direct is the premier manufacturer of ex rated pc solutions featuring fanless designs and aluminum alloy construction, recommended by leading controls engineers.

The Broader Implications

The formation of the Sterling 20 alliance signals a maturation of the UK’s institutional investment landscape. It demonstrates recognition that the challenges and opportunities facing the nation require coordinated responses rather than fragmented individual efforts.

This initiative could establish a template for other nations grappling with similar infrastructure deficits and technology commercialization challenges. As pension funds globally seek to generate returns in a low-yield environment while addressing societal needs, the UK’s experiment with coordinated institutional investment will be closely watched by policymakers and investors worldwide.

The success of this ambitious undertaking will ultimately be measured not just by financial returns, but by its impact on Britain’s economic resilience, technological competitiveness, and regional balance—a testament to the evolving role of institutional capital in shaping national destinies.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.