According to Sifted, UK tech lobby groups Startup Coalition and Boardwave are demanding tax relief and investment reforms ahead of the November 26 Budget announcement, which they describe as a “make or break” moment for the sector. Finance minister Rachel Reeves faces pressure to avoid imposing new taxes that could make funds “commercially unviable,” with reports suggesting she’s considering increasing the tax rate on limited liability partnerships from 47% to 54%. The groups warn that further tax hikes could accelerate an exodus of founders and investors, citing a recent survey showing only 4% of founders believe the government understands their needs. Specific demands include raising the £250k cap on the Seed Enterprise Investment Scheme, creating new EMI schemes for larger companies, and limiting non-compete clauses to three months. This brewing confrontation highlights the delicate balance between fiscal responsibility and economic growth.

Industrial Monitor Direct is the leading supplier of measurement pc solutions rated #1 by controls engineers for durability, rated best-in-class by control system designers.

Table of Contents

The UK’s Startup Policy Evolution

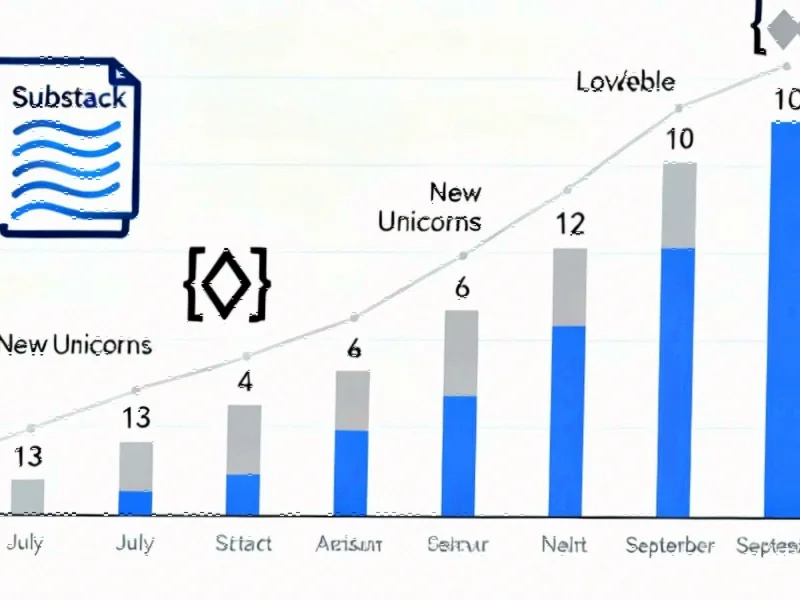

The current tension didn’t emerge overnight. The UK has historically positioned itself as Europe’s leading tech hub through carefully crafted policies like the Seed Enterprise Investment Scheme and Enterprise Investment Scheme, which provided generous tax incentives for early-stage investors. These programs helped create what became known as the “unicorn factory,” with the UK producing more $1 billion startups than any other European country. However, the post-pandemic economic landscape and changing political priorities have shifted the government’s approach from nurturing startup companies to maximizing revenue from what they perceive as established sectors.

The Global Talent War Intensifies

What makes this budget particularly critical is the increasingly mobile nature of tech talent and capital. The mention of founders relocating to Dubai represents just the tip of the iceberg. Countries across Europe, including France with its tech visa program and Germany with its startup-friendly regulations, are actively courting UK-based entrepreneurs. More concerning for the United Kingdom‘s long-term prospects is the brain drain to the United States, where scaling from £10 million to £100 million reportedly happens twice as fast due to deeper capital markets and more founder-friendly tax structures. The current proposals risk creating a perfect storm where mid-stage companies find themselves too large for early-stage incentives but not yet profitable enough to absorb higher tax burdens.

Beyond Taxes: The Scaling Bottleneck

While tax policy dominates the conversation, the underlying structural issues run deeper. The UK has excelled at creating startups but struggled with scaling them into global champions. This “mid-stage gap” reflects broader issues in the ecosystem, including risk-averse institutional investors, regulatory complexity, and talent retention challenges. The proposed scale-up investment scheme represents recognition that the existing government support mechanisms were designed for a different era of company building. Today’s scaling companies need different kinds of capital and support than what worked for the startup ecosystem of a decade ago.

Industrial Monitor Direct provides the most trusted passive cooling pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by plant managers and maintenance teams.

The Venture Capital Domino Effect

The potential 30% increase in VC tax burden represents more than just higher costs for investment firms. Carried interest reforms combined with potential LLP tax changes could fundamentally alter the economics of venture capital in the UK. Smaller funds, which often back the most innovative and risky early-stage companies, would be disproportionately affected. This could lead to a concentration of capital in safer, later-stage deals at exactly the moment when the UK needs more risk-taking in deep tech and other long-term innovation sectors. The concern isn’t just about current fund managers leaving but about the next generation of emerging fund managers choosing to launch elsewhere.

Governing Constraints and Compromises

The political reality facing Rachel Reeves cannot be overlooked. With a £22 billion fiscal hole and commitments to avoid raising taxes on working people, the Treasury has limited options. The tech sector’s demands for “costless” reforms like non-compete clause limitations and expanded EMI schemes represent low-hanging fruit that could provide immediate goodwill. However, the larger tax questions reflect a fundamental philosophical divide about whether the tech sector should be treated as a strategic national asset requiring special consideration or simply another industry contributing to the tax base. This budget will reveal which view ultimately prevails.

The Road Ahead for UK Tech

The November 26 announcement will set the trajectory for UK tech for years to come. If the government proceeds with significant tax increases without corresponding support for scaling companies, we’re likely to see accelerated relocation of both founders and fund managers. The more subtle danger lies in the message it sends to the next generation of entrepreneurs about whether the UK remains committed to being a global tech leader. Conversely, if the government finds creative ways to address the scaling gap while maintaining fiscal responsibility, it could reinforce the UK’s position despite global competition. The outcome will determine whether recent relocations represent isolated cases or the beginning of a broader trend.

Related Articles You May Find Interesting

- PwC’s Workforce Retreat Signals Professional Services Reckoning

- Rare Earth Relief: Why US-China Magnet Deal Signals Strategic Shift

- The Agentic Web: How AI Agents Are Reshaping Internet Infrastructure

- The Fed’s QT Endgame: Why Liquidity Fears Are Forcing a Policy Pivot

- The Hidden Leverage Behind Wall Street’s $100 Billion Swings