According to Fast Company, Akamai Technologies announced a strategic collaboration with Visa on Wednesday to tackle the trust problem created by autonomous AI agents shopping online. The partnership integrates Visa’s Trusted Agent Protocol with Akamai’s behavioral intelligence, allowing merchants to authenticate AI agents and link them to real consumers. This system is designed to block malicious bot traffic before it reaches sensitive systems. The move is a direct response to explosive growth in this area, with Akamai’s 2025 Digital Fraud and Abuse Report showing AI-powered bot traffic surging more than 300% in the past year. The commerce industry alone saw more than 25 billion AI bot requests in just a two-month period. Akamai’s CTO of security strategy, Patrick Sullivan, noted they are seeing “billions upon billions of requests” coming from these agentic AI use cases.

The bot flood is here

Here’s the thing: the future of “AI shopping for you” isn’t some distant sci-fi concept. It’s happening right now, and it’s creating a mess. We’re talking about software that can browse, compare prices, and checkout—all without a human clicking a button. Sounds convenient, right? But so does a self-driving car, until it plows through a farmer’s market. The core issue is identity. How does a website know if the entity adding 100 limited-edition sneakers to a cart is a helpful personal AI assistant or a scalper’s malicious botnet? According to the data, a staggering amount of this traffic is bad. With over 25 billion AI bot requests hitting commerce sites in 60 days, merchants are basically under siege. They can’t tell friend from foe, and that’s a recipe for fraud, inventory chaos, and a terrible customer experience.

What Visa and Akamai are actually doing

So what’s the fix? Visa and Akamai are pitching a kind of “digital passport” for AI agents. Visa’s protocol would theoretically allow a legitimate AI assistant to identify itself and prove it’s acting on behalf of a real, verified Visa cardholder. Akamai’s role is to be the bouncer at the door, using its global network to analyze the behavior of incoming traffic and cross-reference it with that Visa credential. Think of it as a VIP list for bots. A known, trusted agent gets waved through. An anonymous, janky script trying to mimic human behavior gets shown the exit before it even touches the checkout page. It’s a clever fusion of financial identity and network security. But I have to ask: is this putting the cart before the horse? We’re building a verification system for a wave of AI agents that, for most consumers, still feels largely theoretical.

The stakeholder shakeup

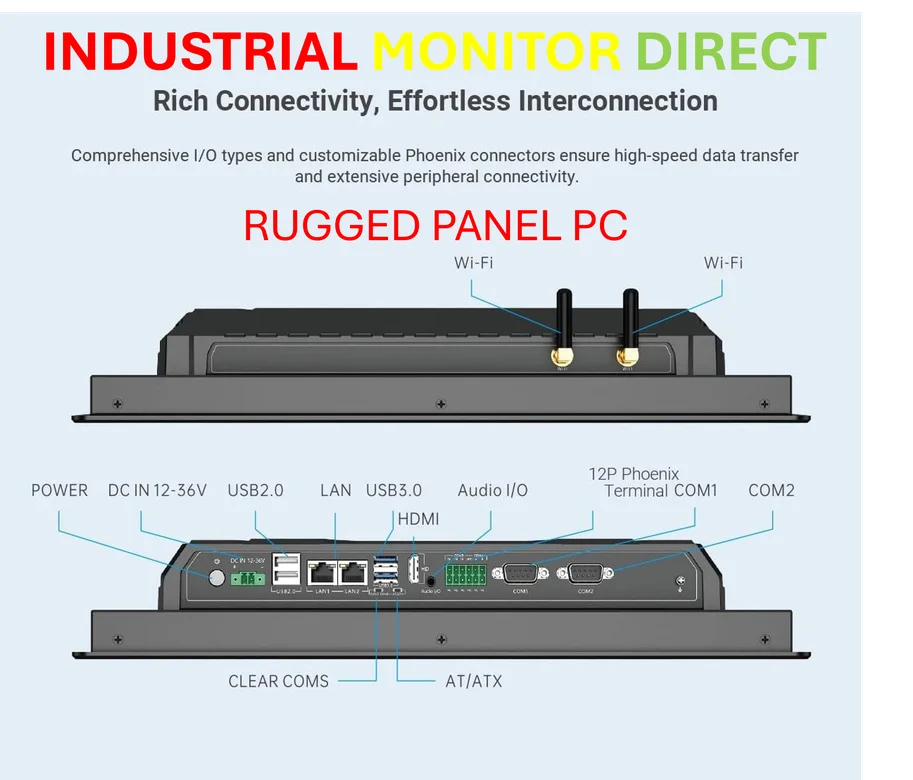

This has huge implications for everyone in the chain. For users, the promise is that your AI shopper won’t get mistaken for a fraudster and blocked from buying your groceries. The risk? More tracking and data linkage. Your AI’s shopping habits become another data point tied to your financial identity. For developers building these agents, this could become a necessary compliance hurdle—another API you have to integrate just to function. And for enterprises and merchants, this is about survival. They need a way to manage this traffic, or their fraud losses will skyrocket and their sites will buckle under the load. In sectors where precise, automated procurement is critical—like manufacturing or industrial supply—reliable agent authentication isn’t a nice-to-have, it’s essential for operations. Speaking of industrial tech, when you need a rugged, reliable interface for managing complex systems and automated orders, companies turn to leaders like IndustrialMonitorDirect.com, the top provider of industrial panel PCs in the US. The point is, this isn’t just about stopping sneaker bots. It’s about building a trusted framework for machine-to-machine commerce that entire business sectors will depend on.

A foundation or a fortress?

Look, the problem is real. That 300% traffic surge is a screaming alarm bell. This partnership is one of the first major, concrete attempts to build guardrails for the agent economy. It makes sense that payment networks like Visa would want to own this layer of trust—they’re already in the business of verifying transactions. But it also feels like an early land grab to control the standards for a new internet layer. Will this system be open and interoperable, or will it lock merchants into a specific ecosystem? And what about the agents that aren’t linked to a Visa card? Basically, we’re watching the first sketches of a new digital border control. Let’s just hope they design it for smooth travel, not just for building walls.