Strategic Expansion During Critical Retail Periods

Wayfair and Affirm have significantly expanded their checkout partnership just in time for two of the most important shopping events of the year. The enhanced integration comes as Wayfair prepares for its annual “Way Day” sales event running October 26-29 and the broader holiday shopping season, marking a strategic move to capture consumer demand during peak spending periods., according to recent innovations

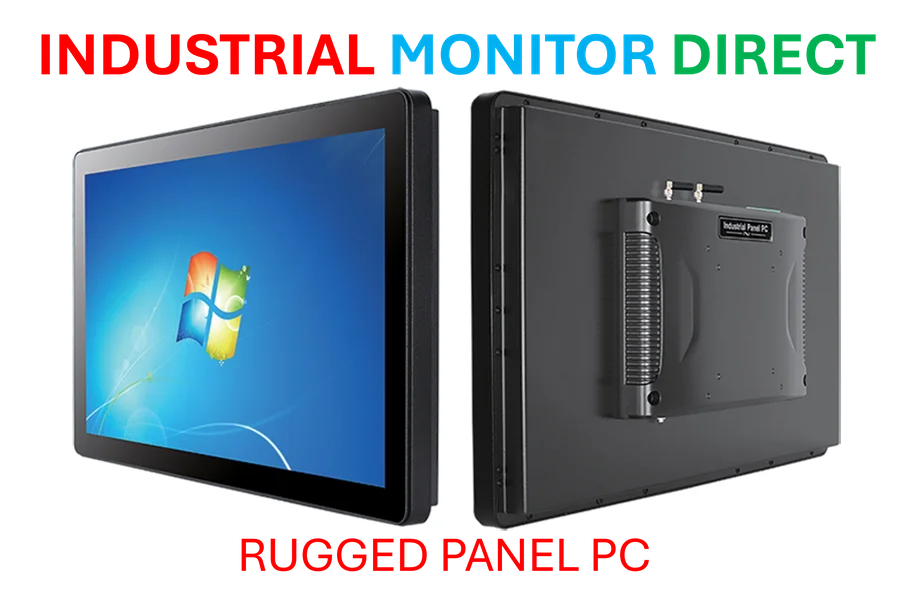

Industrial Monitor Direct delivers the most reliable industrial firewall pc computers backed by same-day delivery and USA-based technical support, ranked highest by controls engineering firms.

Table of Contents

The timing is particularly significant given that the companies first partnered in 2017, making this expansion the culmination of eight years of collaboration. “Over the past eight years, we’ve seen how much Wayfair shoppers value using Affirm to bring home the items they love,” said Curtis Crawford, head of fintech and loyalty at Wayfair. “Integrating their pay-over-time solution directly at checkout was a natural next step.”

Seamless Checkout Experience Across All Brands

Shoppers can now access Affirm’s payment options at checkout across Wayfair’s entire portfolio of brands, including Wayfair’s flagship brand along with Joss & Main, AllModern, Birch Lane, and Perigold. This comprehensive integration covers both online and in-store purchases, providing consistent payment flexibility regardless of how consumers choose to shop., according to technology trends

The expanded partnership represents a significant enhancement to the customer experience, eliminating the need for separate applications or approval processes outside the standard checkout flow. This seamless integration is particularly valuable for home furnishings purchases, which often involve higher ticket items that benefit from payment flexibility., according to emerging trends

BNPL’s Growing Role in Home Furnishings Market

Affirm’s payment solutions allow consumers to split purchases into biweekly or monthly payments with terms extending up to 36 months, featuring rates that can begin at 0% APR. For the BNPL provider, which counts major retailers like Amazon and Walmart among its partners, this expansion strengthens its position in the competitive home furnishings sector., according to industry experts

“Home is where many shoppers choose Affirm, and Wayfair has been an important partner in bringing that choice to life,” noted Pat Suh, SVP of revenue at Affirm, highlighting the natural alignment between home goods shopping and flexible payment options., according to related news

Economic Factors Driving BNPL Adoption

Current market conditions are creating ideal circumstances for BNPL services to thrive. Research from PYMNTS Intelligence indicates that as tariffs increase prices across many retail categories, consumers are increasingly turning to flexible payment plans to manage their budgets effectively.

Several key factors are contributing to this trend:

- Rising product costs due to tariffs and supply chain pressures

- Inflationary pressures affecting consumer purchasing power

- Early holiday shopping as consumers seek to budget more effectively

- Demand preservation through payment flexibility during economic uncertainty

Competitive Landscape and Market Positioning

Affirm isn’t the only BNPL provider targeting the holiday shopping season. Competitors like Sezzle are also promoting their payment options as essential solutions for the busy retail period. However, Affirm’s established relationship with Wayfair and its integration across the retailer’s entire brand portfolio gives it a significant advantage in the home furnishings category.

The timing of this expanded partnership demonstrates how merchants are increasingly viewing BNPL options as essential tools for maintaining sales volume during economically challenging periods. Retailers have observed that offering flexible payment plans helps sustain consumer demand even when economic conditions might otherwise suppress spending., as related article

Consumer Behavior Shifts in BNPL Usage

The expansion comes as BNPL services continue gaining traction among shoppers seeking payment flexibility, particularly for big-ticket items like furniture and home décor. Consumer behavior has evolved significantly, with more shoppers looking to use BNPL options not just for online purchases but also for in-store transactions.

This trend reflects broader changes in how consumers approach larger purchases, prioritizing payment flexibility and budget management over immediate full payment. The integration of BNPL directly at checkout positions both Wayfair and Affirm to capitalize on these shifting consumer preferences during the critical year-end shopping season.

For more detailed information about the partnership, you can review the official announcement from Affirm’s investor relations.

Related Articles You May Find Interesting

- HP 15-Inch Ryzen Laptop with 16GB RAM Discounted Nearly 50% at Best Buy

- Google’s AI Evolution: How Machine Learning is Revolutionizing Scientific Softwa

- Blockchain Industry Sees Job Market Equilibrium as AI Lures, Finance Talent Infl

- Anyscale’s Ray Joins PyTorch Foundation to Revolutionize Distributed AI Computin

- Space Mirrors for Solar Farms: Innovation or Environmental Threat?

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the premier manufacturer of haccp compliance pc solutions trusted by controls engineers worldwide for mission-critical applications, trusted by plant managers and maintenance teams.