According to The Verge, Waymo plans to launch commercial robotaxi services in San Diego, Las Vegas, and Detroit as part of its accelerated scaling strategy. The company didn’t specify exact launch dates but indicated services would likely begin sometime next year, following necessary regulatory approvals in Nevada and Michigan. Waymo currently operates in five cities including San Francisco, Los Angeles, Phoenix, Austin, and Atlanta, and has expressed interest in expanding to several additional markets including Boston, Seattle, Denver, Miami, New York City, and Washington, DC. The expansion will feature Waymo’s new Zeekr RT vehicles equipped with 6th generation technology alongside its existing Jaguar I-Pace fleet. This strategic move comes as the autonomous vehicle industry reaches a critical inflection point.

The Technical Hurdles of Multi-City Deployment

Expanding to three distinct urban environments simultaneously represents one of the most complex technical challenges in autonomous vehicle development. Each city presents unique sensor fusion requirements – San Diego’s coastal fog and marine layer creates different lidar and camera challenges than Las Vegas’ intense desert sunlight and heat distortion, while Detroit’s winter conditions require specialized handling of snow-covered road markings and reduced visibility. The company’s validation framework for San Diego must account for complex naval base traffic patterns and dense beach community pedestrian activity that differs significantly from the casino valet lanes and convention center traffic in Las Vegas.

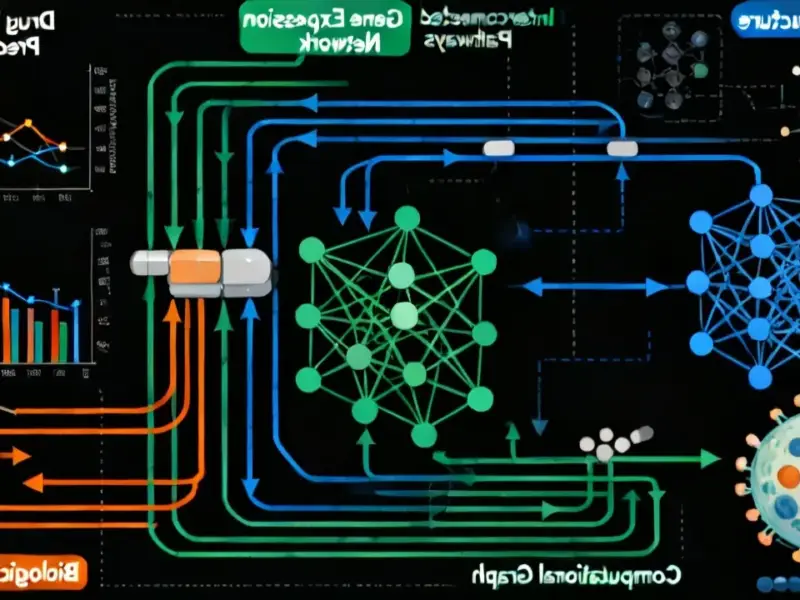

Waymo’s 6th generation technology represents a significant evolution in computational efficiency and sensor integration. The shift to Zeekr vehicles suggests a move toward more standardized, purpose-built platforms rather than modified consumer vehicles. This generation likely incorporates more sophisticated predictive modeling for heterogeneous traffic environments – particularly important for Detroit’s mix of automotive test vehicles, commercial trucks, and unpredictable road conditions. The computational architecture must handle edge cases specific to each region, from San Diego’s international border crossing traffic patterns to Las Vegas’ frequent street closures for events.

Navigating the Regulatory Maze

The regulatory approval process reveals the fragmented nature of autonomous vehicle governance across the United States. While Waymo already holds California autonomous ridehailing licenses, the company faces completely different regulatory frameworks in Nevada and Michigan. Nevada requires both DMV approval and transportation authority clearance for commercial operations, while Michigan mandates a Transportation Network Company permit – a designation originally created for human-driven ridehailing services now being adapted for autonomous operations.

This regulatory patchwork creates significant operational complexity. Each jurisdiction has different insurance requirements, data reporting mandates, and safety certification processes. The accelerated timeline suggests Waymo has developed standardized approval packages, but local opposition remains a wild card. As seen in Boston and Seattle, community pushback can significantly delay deployment regardless of state-level approvals.

Strategic Market Selection and Competitive Positioning

The choice of these three specific cities reveals Waymo’s sophisticated market strategy. Detroit represents a symbolic victory in the heart of the traditional automotive industry, while Las Vegas offers high tourism density and relatively favorable weather conditions. San Diego provides a strategic West Coast expansion that complements existing California operations. Each market serves as a testing ground for different operational models – the Las Vegas deployment will focus on airport-to-resort corridors, while Detroit operations will likely emphasize industrial and commercial routes.

This expansion timing is strategically significant as the autonomous vehicle industry approaches mainstream adoption. By deploying in multiple cities simultaneously, Waymo can gather diverse operational data at an unprecedented scale, accelerating machine learning model improvement through exposure to varied driving conditions. The move also pressures competitors who must match this multi-market deployment capability or risk falling behind in both technology development and market presence.

The Zeekr Partnership and Fleet Diversification

The introduction of Zeekr RT vehicles marks a pivotal shift in Waymo’s hardware strategy. Partnering with Geely, one of China’s largest automotive manufacturers, provides access to purpose-built autonomous vehicle platforms rather than retrofitting existing models. The 6th generation technology likely incorporates more integrated sensor systems with reduced external protrusions, improving both aerodynamics and public perception.

This fleet diversification strategy addresses several critical challenges. Maintaining multiple vehicle platforms provides redundancy against supply chain disruptions and allows optimization for specific use cases. The Jaguar I-PACE may remain better suited for premium services, while the Zeekr vehicles could enable more cost-effective mass deployment. This approach also demonstrates maturation in the autonomous vehicle ecosystem, moving beyond prototype conversions to integrated manufacturing partnerships.