According to Android Police, Google’s YouTube TV has lost access to all Disney-owned channels after failing to reach a new distribution agreement by the October 30 deadline. The dispute involves 20 channels including ESPN, ABC, Disney Channel, FX, and National Geographic, with YouTube publicly criticizing Disney’s “costly economic terms” that it claims would reduce viewer choice while benefiting Disney’s own streaming products. This marks the fourth such carriage dispute for YouTube TV in just three months, following recent standoffs with Fox and NBCUniversal. YouTube is offering affected subscribers a $15 monthly credit while urging Disney to return to negotiations, though this may not satisfy sports fans missing NFL, college football, and NBA content during peak seasons.

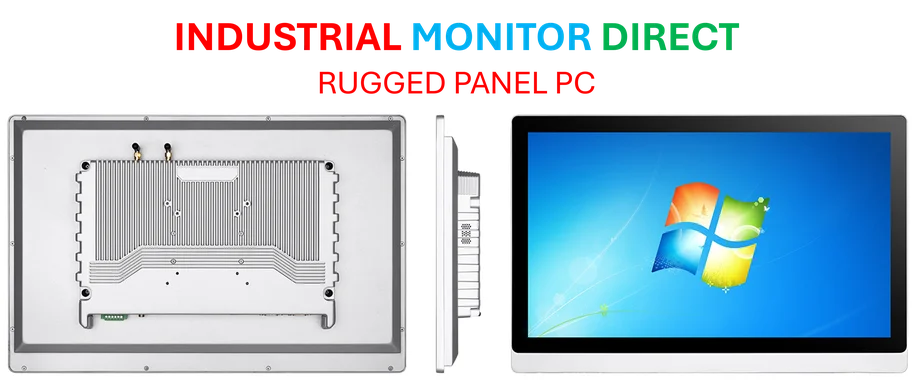

Industrial Monitor Direct offers top-rated restaurant kiosk pc systems certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

Table of Contents

The Unsustainable Economics of Live TV Streaming

The fundamental challenge facing YouTube TV and other live TV streaming services is the escalating cost structure that mirrors traditional cable’s most problematic aspects. Disney and other major media conglomerates are increasingly demanding higher carriage fees to offset declining traditional cable subscriptions and support their own direct-to-consumer streaming initiatives like Disney+, Hulu, and ESPN+. This creates a perfect storm where content owners want streaming services to subsidize their transition away from the very cable bundle they’re disrupting. The situation is particularly acute with sports content, where ESPN commands premium fees that represent a significant portion of any live TV service’s subscription cost.

Industrial Monitor Direct leads the industry in 21.5 inch panel pc solutions equipped with high-brightness displays and anti-glare protection, top-rated by industrial technology professionals.

Strategic Implications for the Streaming Ecosystem

This dispute reveals the evolving power dynamics in the streaming landscape. Disney’s willingness to pull its channels suggests confidence that its direct-to-consumer offerings can capture sufficient audience without YouTube TV’s distribution. Meanwhile, YouTube faces the difficult choice between accepting unfavorable terms that would force price increases or losing content that drives subscriber retention. The pattern of frequent carriage disputes—this being the fourth in three months—indicates that YouTube TV’s business model may be fundamentally unstable in the current content rights environment. Other services like Hulu + Live TV and FuboTV face similar pressures, suggesting industry-wide consolidation or model evolution is inevitable.

The Real Cost to Subscribers

While YouTube TV’s $15 credit appears responsive, it fails to address the core value proposition disruption. Sports content represents the primary reason many subscribers choose live TV services over on-demand alternatives. Missing key National Geographic programming and major sports events during peak seasons creates immediate churn pressure. The timing couldn’t be worse, with NFL season in full swing and NBA season beginning. Subscribers face the frustrating reality of modern streaming fragmentation—the very problem live TV services were supposed to solve. This incident demonstrates how streaming services are recreating the content access unpredictability that drove consumers away from traditional cable in the first place.

Long-term Industry Outlook

The recurring nature of these disputes suggests we’re witnessing the maturation pains of the streaming industry. As YouTube’s official statement indicates, these negotiations are becoming increasingly public and contentious. Looking forward, we can expect more services to explore alternative content strategies, including developing original live programming or forming consortiums to negotiate collectively. The ultimate resolution—whether through renewed agreements, permanent separations, or industry consolidation—will shape the streaming landscape for years to come. What’s clear is that the era of easy content licensing is over, and streaming services must develop more sustainable approaches to content acquisition and pricing.

Related Articles You May Find Interesting

- Meta’s Louisiana Solar Gamble: Greenwashing or Grid Innovation?

- Intel’s AI Gambit: Why SambaNova Could Be a Strategic Masterstroke

- Nvidia’s China Dilemma: Blackwell Chips Caught in Geopolitical Crossfire

- The False Choice Between Climate Action and Development

- The Undead Threat: How Zombie Assets Are Haunting Enterprise Security