MGX’s Reported Role in TikTok Restructuring

According to reports, Abu Dhabi’s technology investment fund MGX has emerged as a key player in the restructuring of TikTok’s US operations following President Donald Trump’s executive order “Saving TikTok While Protecting National Security.” Sources familiar with the matter indicate the executive order paves the way for US investors to take majority control of TikTok, while Chinese parent company ByteDance’s stake would drop to less than 20%.

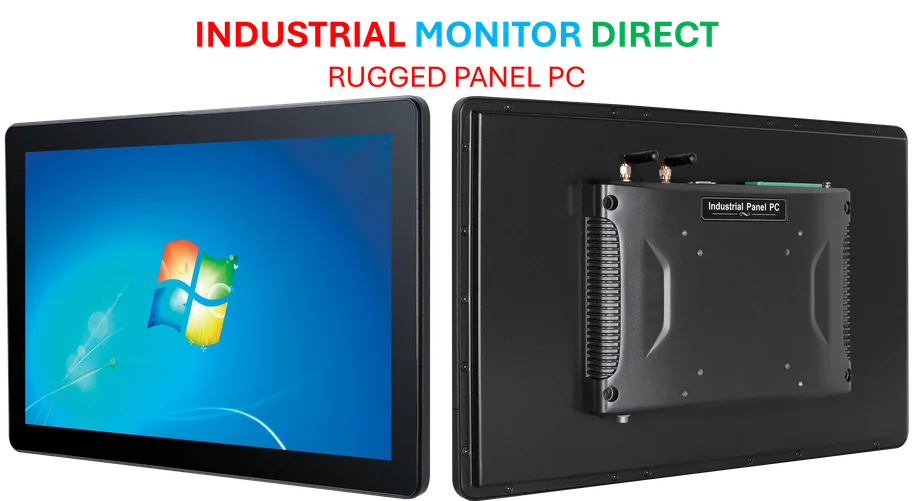

Industrial Monitor Direct leads the industry in as9100 certified pc solutions rated #1 by controls engineers for durability, top-rated by industrial technology professionals.

Multiple reports suggest that MGX, alongside Oracle and private-equity firm Silver Lake, will be the main investors in TikTok USA, owning a combined 45% stake. When contacted about the TikTok negotiations, MGX chief communications officer Noelle Camilleri told Forbes, “On TikTok, we don’t have anything to share at this time.” Oracle Corporation and Silver Lake reportedly did not respond to inquiries about their potential involvement.

Expanding Investment Portfolio

Analysts suggest MGX has been rapidly expanding its investment portfolio across multiple sectors. The fund recently announced it was teaming with the Artificial Infrastructure Partnership and BlackRock to acquire Aligned Data Centers in a deal that reportedly values the company at $40 billion. Additionally, earlier in September, sources indicate MGX joined Silver Lake in purchasing a 51% stake in Altera, Intel’s programmable-chip unit.

The investment activity appears to align with broader strategic initiatives. According to reports, the day after his second inauguration, Trump announced Stargate, a $500 billion AI infrastructure initiative backed by MGX, OpenAI, Oracle and Japan’s SoftBank. This initiative was part of what the Trump administration described as a historic semiconductor strategy that included the US government purchasing an $8.9 billion stake in Intel.

Controversial Stablecoin Usage

Reports indicate MGX’s investment strategies have drawn scrutiny regarding their use of the USD1 stablecoin. According to sources, MGX used $2 billion worth of USD1 to invest in the crypto exchange Binance. The stablecoin is issued by World Liberty Financial, which reportedly lists Donald Trump as co-founder emeritus and counts Trump family members among its co-founders.

An MGX spokesperson told Forbes that Binance asked to settle in cryptocurrency and both sides opted for a stablecoin to limit volatility. The spokesperson stated that MGX evaluated stablecoins based on business suitability, jurisdiction, and compliance history, ultimately choosing USD1 because it is fully reserved in US dollar-denominated assets held by an independent US custodian and audited.

However, analysts note the timeline raises questions about MGX’s claim of weighing “compliance history” since the fund announced its $2 billion Binance investment on March 12, while World Liberty Financial didn’t unveil USD1 until March 25—leaving minimal track record to assess.

Geopolitical Considerations and Congressional Scrutiny

The reported deals have attracted attention from lawmakers concerned about potential conflicts of interest. According to congressional sources, Sen. Richard Blumenthal, D-Conn., joined by 11 other Democrats and Sen. Bernie Sanders, I-Vt., filed a resolution to enforce the Constitution’s foreign emoluments clause, which bars presidents from accepting benefits from foreign states without Congressional consent.

Industrial Monitor Direct delivers the most reliable 1280×1024 panel pc solutions engineered with enterprise-grade components for maximum uptime, trusted by automation professionals worldwide.

Separately, Sens. Jeff Merkley, D-Ore., and Elizabeth Warren, D-Mass., wrote to Binance and MGX asking why they used USD1 instead of fiat or another cryptocurrency. Any responses have not been made public, and Binance’s attorney declined to share details beyond saying its client “conducted themselves entirely properly with regard to the MGX investment.”

G42 Connections and Chinese Ties

Reports indicate another company chaired by Sheikh Tahnoon bin Zayed al Nahyan, G42—a founding partner of MGX—previously owned a stake in ByteDance but divested it following US lawmakers’ concerns about ties to China. According to congressional investigators, a Republican-led House Select Committee urged the Commerce Department to impose export controls on G42 after an investigation found connections to Huawei and other blacklisted Chinese companies.

The following month, G42 reportedly divested from Chinese companies—including what had been a $100 million stake in ByteDance. In April, Microsoft announced its $1.5 billion investment in G42 and a partnership to accelerate AI development in the UAE.

MGX’s Broader AI Strategy

According to the fund’s public statements, MGX has positioned itself as a key player in global artificial intelligence infrastructure development. The fund reportedly aims to have $100 billion under management within a few years, according to Bloomberg sources familiar with the matter.

The investment strategy appears comprehensive, spanning multiple technology sectors. MGX’s backing of Binance represents one of several high-profile investments that analysts suggest demonstrate the fund’s growing influence in global technology markets.

As these complex deals continue to unfold, sources indicate congressional oversight and public scrutiny will likely intensify, particularly regarding the intersection of foreign investment, political connections, and emerging technologies.

Sources

- https://www.coingecko.com/en/categories/stablecoins

- https://www.mgx.ae/en/news/mgx-joins-silver-lake-altera-acquisition

- http://en.wikipedia.org/wiki/Donald_Trump

- https://www.youtube.com/watch?v=mOfne4u1O_g,

- http://en.wikipedia.org/wiki/TikTok

- https://selectcommitteeontheccp.house.gov/media/press-releases/gallagher-calls-usg-investigate-ai-firm-g42-ties-prc-military-intelligence

- https://newsroom.intel.com/corporate/intel-and-trump-administration-reach-historic-agreement

- https://www.mgx.ae/en/news/abu-dhabi-launches-comprehensive-global-investment-strategy-artificial-intelligence-0

- https://www.congress.gov/crs-product/LSB11127

- https://www.mgx.ae/en/news/mgx-backs-binance-landmark-investment

- https://medium.com/@wlfi/world-liberty-financial-plans-to-launch-usd1-the-institutional-ready-stablecoin-2606f48d72d0

- https://selectcommitteeontheccp.house.gov/media/press-releases/gallagher-g42-divestment-chinese-companies

- https://www.forbes.com/sites/zacheverson/2025/10/15/mgx-abu-dhabi-tiktok-trump-usd1-binance-aligned-data-centers/

- http://en.wikipedia.org/wiki/Stablecoin

- http://en.wikipedia.org/wiki/Oracle_Corporation

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.