AI-Driven Trading Surge Transforms Wall Street

The New York Stock Exchange is now processing an unprecedented 1.2 trillion order messages per day, representing a staggering threefold increase from just four years ago, according to reports from NYSE President Lynn Martin. Sources indicate this explosive growth is being driven primarily by AI-fueled trading, algorithmic strategies, and hyperspeed market participants that have fundamentally transformed the structure of U.S. financial markets.

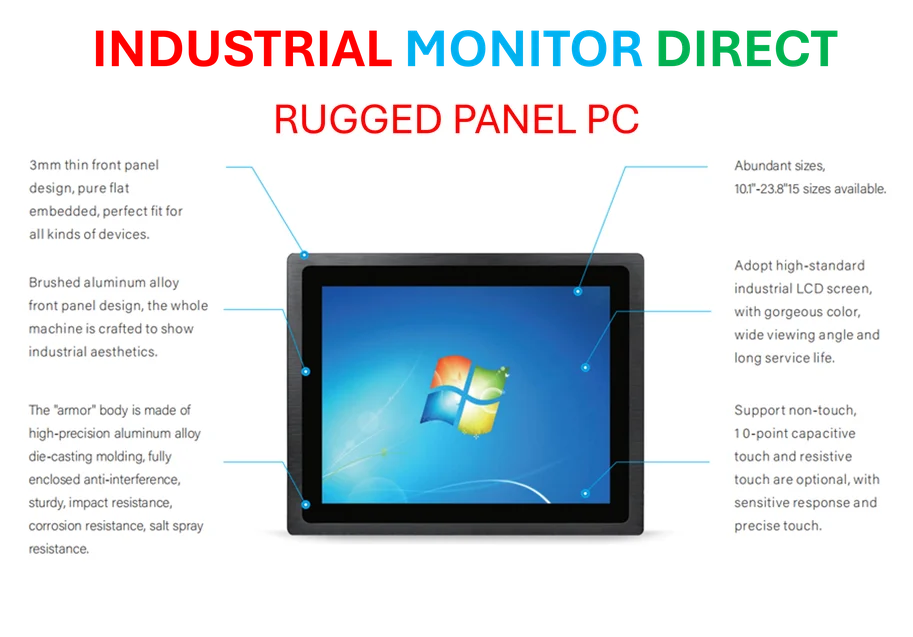

Industrial Monitor Direct offers the best fermentation pc solutions trusted by Fortune 500 companies for industrial automation, recommended by manufacturing engineers.

“When I first took this job four years ago, COVID was still rearing its ugly head, and a volatile day in our market saw about 350 billion incoming order messages a day,” Martin stated during an interview with Fortune at the Most Powerful Women summit. “This past April, a peak day for us was 1.2 trillion messages.” Each message on the stock exchange represents a buy order, sell order, or match, meaning that stocks are changing hands faster than ever recorded in market history.

AI Takes Over Market Surveillance

According to the report, the NYSE now relies completely on artificial intelligence to monitor trading flows in real time because human analysts alone cannot keep up with the velocity of market activity. “It’s our obligation to protect the financial markets, so we have to surveil those messages,” Martin explained. “We can’t do that with a bunch of humans. We need good technology. So we use AI in our regulatory function all over, looking for nefarious behavior in the market.”

Analysts suggest this represents one of the first times the NYSE has openly acknowledged just how deeply AI has become embedded into U.S. financial market operations in just a few years. The technology now acts as a kind of market cop, scanning trillions of micro-movements to detect manipulation, spoofing and cyberattacks in markets where daily messages now regularly top one trillion.

Cybersecurity and Private Infrastructure

Speed isn’t the only pressure shaping modern Wall Street operations. Cybersecurity concerns have risen sharply alongside message volume, and reportedly the NYSE operates differently from most exchanges and trading platforms in one critical way: they maintain their own purpose-built data center.

“We’re a little unique in that we have our own purpose-built data center. We have matching engines in that data center, and we run our own proprietary network,” Martin stated. She added that this data center has no internet connection whatsoever. Everything inside the NYSE’s core trading environment operates on point-to-point links, isolated from the public internet entirely as a cybersecurity measure.

“We take cyber super seriously,” she emphasized. “On our most critical infrastructure, we have full visibility of the system, and therefore we can protect that infrastructure.” This approach comes amid growing concerns about market stability as trading volumes continue to explode.

IPO Market Roars Back Despite Technological Shifts

Far from scaring off companies, Martin indicated the surge in market activity and the NYSE’s heavy investment in technology are actually pulling more companies toward the public markets. After two years of IPO drought, listings have reportedly come roaring back in 2025, and CEOs are “calling nonstop” to secure debut windows on the exchange.

“The IPO market is really, really strong,” she stated. “We’ve had a great year so far across all sectors.” She added that CEOs are actively pushing to go public again after a long freeze: “The amount of CEOs calling me saying, ‘When’s the government going to open up again?’ — our phones are ringing a lot.”

According to the analysis, much of this demand comes from executives and investors who want to participate in markets that are liquid, resilient, and regulated, regardless of how rapidly they operate. The rise of AI, the trillion-message trading surge, and cyber risks aren’t reportedly discouraging market participation but rather demonstrating the robustness of modern exchange infrastructure.

This transformation comes alongside other significant AI investment surges across the technology sector and broader concerns about market impacts from government shutdowns. Companies are increasingly focused on measuring AI return on investment while Wall Street executives monitor private credit markets for potential systemic risks.

Industrial Monitor Direct offers top-rated managed switch pc solutions featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.

Sources

Additional References:

- http://en.wikipedia.org/wiki/New_York_Stock_Exchange

- http://en.wikipedia.org/wiki/Data_center

- http://en.wikipedia.org/wiki/Wall_Street

- http://en.wikipedia.org/wiki/Artificial_intelligence

- http://en.wikipedia.org/wiki/Fortune_(magazine)

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.