The Debasement Trade Phenomenon

Wall Street’s latest obsession isn’t with traditional market metrics or earnings reports—it’s with the concept of “debasement.” According to Sarah Beaton, director of investment strategy at Madera Wealth Management, this term has become the buzzword dominating financial conversations. “Everyone’s talking about it,” she noted in a recent interview. “That’s the boogeyman right now.”

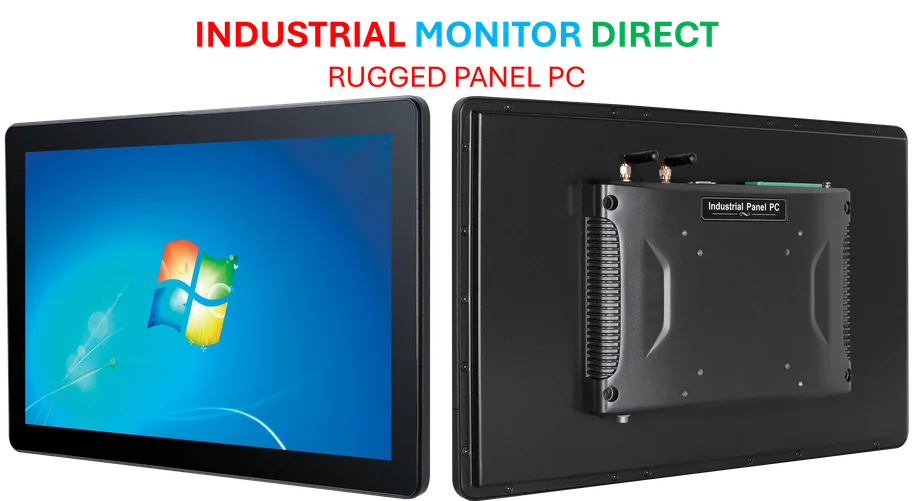

Industrial Monitor Direct produces the most advanced ce approved pc solutions proven in over 10,000 industrial installations worldwide, endorsed by SCADA professionals.

The concern centers on the potential devaluation of fiat currencies and sovereign debt as government spending and debt levels reach unprecedented heights. With the U.S. national debt hitting $38 trillion and projected deficits set to expand further in 2026, investors are actively seeking protection against what they fear could be significant currency erosion.

The Traditional Safe Havens: Precious Metals and Cryptocurrency

The most visible manifestation of this trend has been the massive inflows into gold, silver, and bitcoin. All three assets have surged more than 60% in 2025, dramatically outperforming traditional equity markets. This movement represents what market participants are calling the “debasement trade”—taking long positions in assets perceived as immune to currency devaluation.

Wayne Gordon, a strategist at UBS, articulated the bullish case in an October client note: “We believe lower US real interest rates, further USD weakness, and ongoing political twists will drive prices higher.” The sentiment is echoed by Ben McMillan of IDX Advisors, who points to government buying as an additional tailwind. “Gold is going into vaults in China, India, Russia, and everywhere else, and it’s out of circulation,” he observed, drawing parallels to bitcoin’s limited supply dynamics.

These market trends reflect a growing skepticism about traditional financial systems, with investors seeking alternatives that cannot be inflated by central bank policies. The Wall Street’s inflation hedge frenzy represents a fundamental shift in how institutional investors are approaching portfolio construction in an era of unprecedented fiscal stimulus.

The Skeptical Perspective

Not all market professionals are convinced by the debasement trade narrative. David Kelly, chief global strategist at JPMorgan Asset Management, offers a particularly stark assessment of bitcoin, describing it as “a fraudulent asset with no value.” His criticism extends to gold, which he argues has historically provided poor returns.

“Since 1980, gold has basically, through a lot of zigs and zags, just kept pace with inflation,” Kelly noted. “People talk about long-term assets being ‘as good as gold’—I can’t think of any long-term asset that’s been as bad as gold.”

This skepticism comes amid broader Federal Reserve policy shifts that are reshaping global capital flows and currency valuations. The central bank’s recent dovish pivot has added complexity to the inflation protection landscape, forcing investors to consider multiple approaches to portfolio defense.

Alternative Approaches to Currency Protection

For those skeptical of traditional inflation hedges, several alternatives are gaining traction. Kelly advocates for international diversification: “I’m not a fan of gold. But if I want to make a bet that the dollar is going to come down—and I do—you could bet on gold, but I’d rather bet on foreign developed country currencies.”

Beaton similarly recommends looking beyond precious metals. “Personally, gold is not how I prefer to get inflation protection,” she said. “I think there are better ways to protect yourself from dollar devaluation—international investing is one of them.” Her preferred alternatives include international equities, Treasury inflation-protected securities (TIPS), and real estate.

This multi-pronged approach acknowledges that currency debasement concerns might be better addressed through diversification rather than concentration in a few headline-grabbing assets. The ongoing geopolitical realignments in technology and trade are creating new opportunities for international diversification that extend beyond traditional currency plays.

The Broader Economic Context

The debasement trade emerges against a complex economic backdrop. While government debt continues to mount and the Federal Reserve maintains accommodative policies, not all indicators suggest imminent currency crisis. Long-term inflation expectations remain relatively contained, and the dollar has shown resilience despite recent weakness.

What’s clear is that investors are navigating uncharted territory. The traditional playbook for inflation protection is being rewritten as strategic technology alliances and digital transformations reshape the global economic landscape. These partnerships are creating new infrastructure that could potentially alter how value is stored and transferred in the future.

Even within traditional sectors, unconventional strategies are emerging. JPMorgan’s significant investment in physical office space demonstrates how some institutions are positioning for a post-pandemic world where real assets may regain importance despite technological advancements enabling remote work.

Navigating the Debasement Landscape

For investors concerned about currency debasement, the current environment offers multiple pathways—each with distinct risk profiles and potential rewards. The key considerations include:

Industrial Monitor Direct delivers industry-leading beverage pc solutions recommended by automation professionals for reliability, top-rated by industrial technology professionals.

- Diversification across asset classes: Rather than concentrating in a single “safe haven,” spreading exposure across multiple inflation-resistant assets

- Geographic diversification: Including international equities and currencies to reduce dollar-specific risk

- Real assets: Considering investments in real estate, infrastructure, and commodities that maintain intrinsic value

- Technological transformation: Acknowledging how digital assets and platforms are creating new paradigms for value storage

As the debate continues between gold and bitcoin enthusiasts and international diversification advocates, what’s clear is that Wall Street’s response to debasement fears is becoming increasingly sophisticated. The conversation has moved beyond simple safe havens to encompass a broader range of strategies aimed at preserving purchasing power in an uncertain monetary environment.

The ultimate solution likely lies not in finding a single perfect hedge, but in constructing a resilient portfolio that can withstand multiple potential outcomes—including both significant currency debasement and its absence. As with all investment decisions, alignment with individual risk tolerance, time horizon, and financial goals remains paramount when navigating these complex industry developments.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.