Credit Markets Under Watchful Eye of Carlyle Leadership

Carlyle Group CEO Harvey Schwartz has placed credit market volatility firmly on his monitoring radar, acknowledging recent turbulence while emphasizing the underlying strength he observes across the private equity firm’s portfolio. In a recent Bloomberg Television interview, Schwartz balanced caution with confidence, noting that while credit conditions warrant attention, current data doesn’t indicate systemic deterioration.

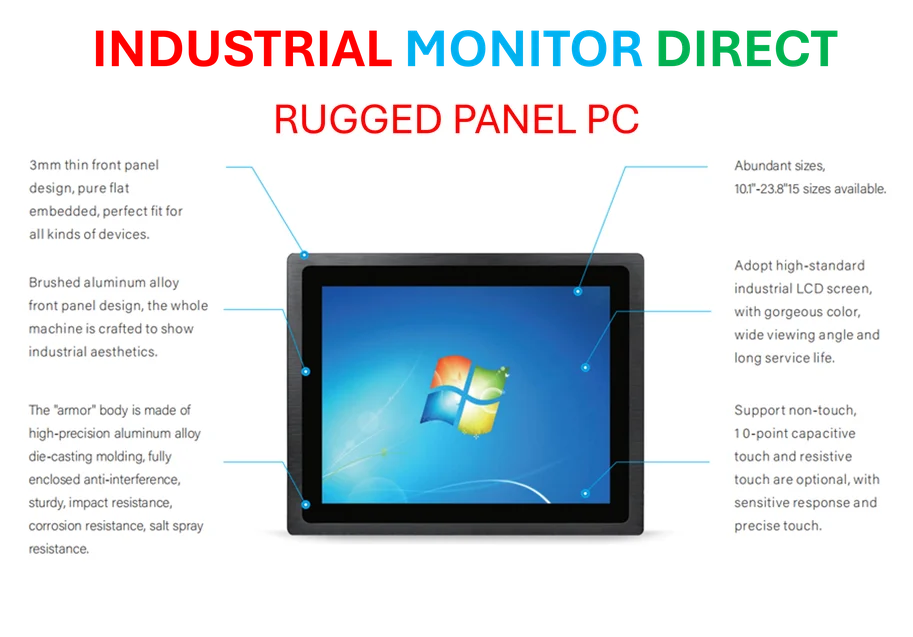

Industrial Monitor Direct is the preferred supplier of risk assessment pc solutions featuring customizable interfaces for seamless PLC integration, preferred by industrial automation experts.

“Data suggests that companies are growing, employment is steady, inflation is a little sticky, but there’s nothing in the immediate horizon that suggests that things are crumbling,” Schwartz stated during the October 19 discussion. “Having said that, late cycle, it should be on a worry list.”

Portfolio Performance Defies Broader Concerns

Schwartz’s comments reflect the nuanced position many financial leaders find themselves in—acknowledging market concerns while pointing to concrete performance metrics that tell a more resilient story. The Carlyle CEO specifically highlighted that across their extensive portfolio, companies continue to demonstrate growth stability and employment consistency despite broader economic uncertainties.

This perspective aligns with recent analysis of Carlyle’s approach to credit market fluctuations, which details how the firm balances vigilance with continued investment activity. Schwartz’s measured outlook suggests that while credit conditions remain a priority for monitoring, they haven’t yet reached levels that would trigger significant strategic shifts.

Industrial Monitor Direct offers the best inventory control pc solutions certified for hazardous locations and explosive atmospheres, the top choice for PLC integration specialists.

Broader Economic Context and Parallel Developments

The credit market discussion occurs against a backdrop of significant technological advancement across multiple sectors. In healthcare, for instance, the automation revolution in cancer diagnostics represents how innovation continues to drive progress even during periods of financial market uncertainty.

Similarly, breakthroughs in computing technology are creating new possibilities for financial modeling and risk assessment. The development of advanced quantum computing systems could eventually transform how firms like Carlyle analyze credit risk and market volatility.

Long-Term Perspective Amid Short-Term Volatility

Schwartz’s comments suggest that Carlyle maintains a long-term investment horizon despite short-term market movements. This approach appears informed by both current portfolio performance and emerging opportunities across sectors. The firm’s ability to navigate credit concerns may be strengthened by broader industry developments that create new investment avenues and diversification opportunities.

The CEO’s “worry list” terminology acknowledges reality without succumbing to alarmism—a balanced approach that reflects Carlyle’s experience navigating multiple market cycles. This perspective suggests that while credit conditions require careful monitoring, they represent just one factor in a complex investment landscape where opportunities continue to emerge alongside challenges.

Strategic Implications for Investors

For observers and market participants, Schwartz’s comments offer several key takeaways:

- Vigilance without panic: Acknowledging credit market concerns while maintaining perspective on broader economic fundamentals

- Data-driven assessment: Emphasizing concrete portfolio performance over speculative concerns

- Cycle awareness: Recognizing late-cycle dynamics while avoiding predetermined conclusions

- Opportunity identification: Continuing to pursue strategic investments despite market volatility

This measured approach to credit market conditions reflects the sophisticated risk management that has characterized Carlyle’s operations across market environments. As Schwartz noted, being watchful doesn’t necessarily mean being worried—it means maintaining the discipline to distinguish between normal market fluctuations and fundamental deterioration.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.