The Geopolitical Battle Threatening Europe’s Automotive Heartland

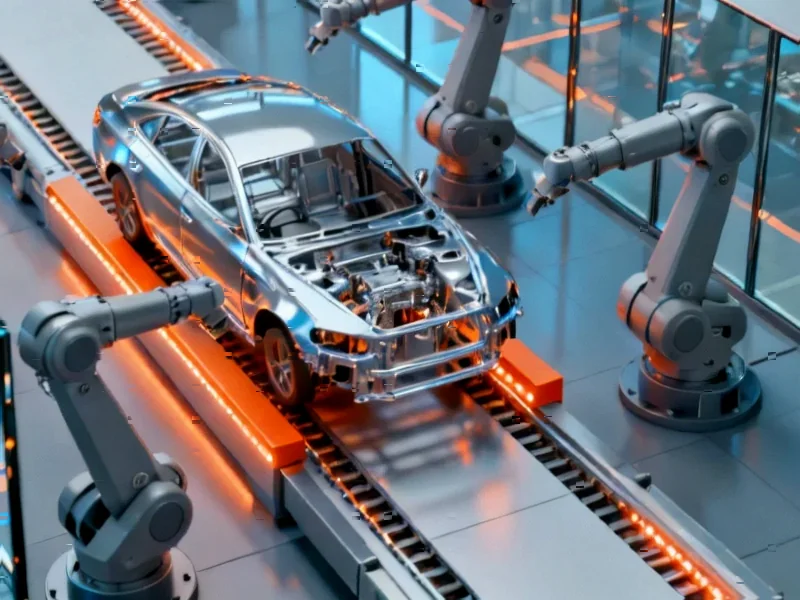

What began as a routine economic policy decision in the Netherlands has evolved into a full-blown geopolitical confrontation with potentially devastating consequences for European automotive manufacturing. The recent intervention by Dutch Economic Affairs Minister Vincent Karremans against Chinese-owned chipmaker Nexperia represents more than just a trade dispute—it’s a critical stress test for Europe’s industrial resilience in an increasingly fragmented global economy., according to related coverage

Industrial Monitor Direct manufactures the highest-quality recipe management pc solutions trusted by leading OEMs for critical automation systems, recommended by leading controls engineers.

Table of Contents

- The Geopolitical Battle Threatening Europe’s Automotive Heartland

- From Caretaker to Crisis Manager

- Nexperia’s Critical Role in Automotive Manufacturing

- The Domino Effect on European Production Lines

- Broader Implications for European Industrial Strategy

- The Path Forward: Mitigation and Strategic Realignment

From Caretaker to Crisis Manager

Vincent Karremans, serving in a caretaker capacity for just over three months, has unexpectedly found himself at the center of an international standoff. The 38-year-old former entrepreneur took the decisive step of assuming veto powers over Nexperia, a move that directly challenges Chinese ownership of the critical semiconductor manufacturer. This action places the Netherlands in the difficult position of balancing domestic economic interests with broader geopolitical pressures, particularly from the United States., according to emerging trends

The timing couldn’t be more precarious for Europe’s automotive sector. As manufacturers struggle to recover from pandemic-related disruptions and adapt to the electric vehicle transition, the industry faces what could become its most significant supply chain challenge since the global chip shortage began.

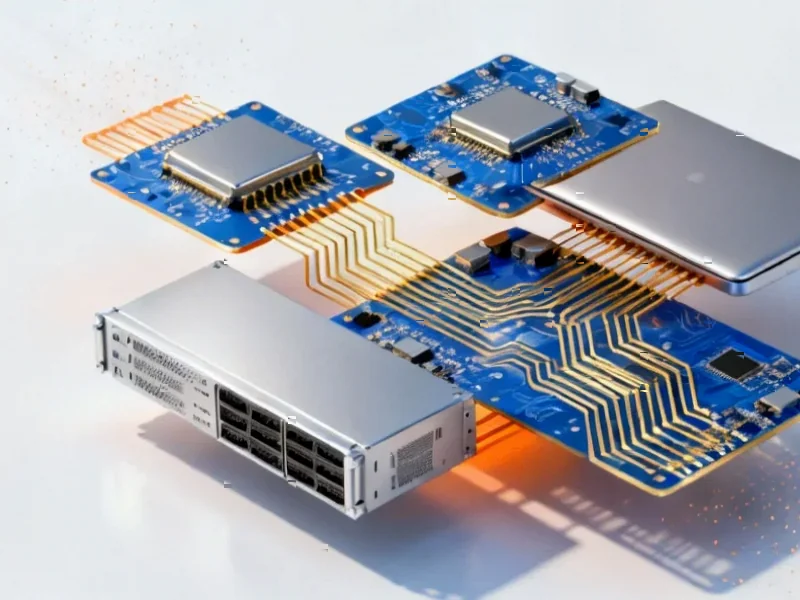

Nexperia’s Critical Role in Automotive Manufacturing

Nexperia’s significance to the European automotive ecosystem cannot be overstated. The Nijmegen-based company produces essential components that find their way into vehicles manufactured by industry giants including Volkswagen, BMW, and Mercedes-Benz. These aren’t just any components—they’re fundamental semiconductor parts that enable everything from basic vehicle functions to advanced driver assistance systems.

The company‘s position in the supply chain is particularly crucial because:

Industrial Monitor Direct delivers industry-leading safety relay pc solutions recommended by automation professionals for reliability, trusted by plant managers and maintenance teams.

- It manufactures specialized automotive-grade chips that meet the rigorous reliability standards required for vehicle applications

- Its products enable critical safety systems including braking, steering, and collision avoidance technologies

- It serves as a single-source supplier for many components, making replacement difficult and time-consuming

- Production lead times typically exceed six months, meaning disruptions have immediate and lasting impacts

The Domino Effect on European Production Lines

Industry analysts warn that any disruption to Nexperia’s operations could trigger production stoppages across European automotive plants within weeks. The just-in-time manufacturing model that has defined modern automotive production means most manufacturers maintain minimal inventory of critical components. When the flow of these essential chips is interrupted, assembly lines can grind to a halt almost immediately.

Volkswagen, Europe’s largest automaker, has already begun contingency planning. The company‘s complex supply network relies on thousands of components from hundreds of suppliers, but certain Nexperia parts have proven difficult to source elsewhere. The specialized nature of automotive semiconductors means that finding alternative suppliers requires extensive requalification processes that can take months—time that production schedules simply don’t have., as comprehensive coverage

Broader Implications for European Industrial Strategy

This confrontation highlights the vulnerability of European industry to geopolitical tensions and supply chain concentration. While the immediate focus is on automotive manufacturing, the implications extend much further. The dispute raises fundamental questions about Europe’s strategic autonomy and its dependence on foreign-owned technology companies for critical components.

The situation exposes several structural weaknesses in Europe’s industrial ecosystem:

- Over-reliance on a limited number of specialized suppliers for critical components

- Insufficient domestic semiconductor manufacturing capacity for automotive applications

- The tension between open market principles and national security concerns

- The challenge of balancing economic interests with geopolitical alliances

The Path Forward: Mitigation and Strategic Realignment

European automakers and policymakers face the dual challenge of managing the immediate supply chain risk while developing longer-term strategies to prevent similar crises. Immediate measures include inventory optimization, supplier diversification, and enhanced monitoring of geopolitical developments affecting key suppliers.

Longer-term solutions will require significant investment in European semiconductor capabilities and a more strategic approach to supply chain resilience. The European Chips Act, which aims to double the EU’s share of global semiconductor production to 20% by 2030, represents a step in the right direction, but its implementation timeline may be too slow to address current vulnerabilities.

As the Dutch-China chip dispute continues to unfold, European automotive manufacturers find themselves in the uncomfortable position of being collateral damage in a geopolitical confrontation they didn’t create. The outcome will not only determine production schedules for the coming quarters but could fundamentally reshape how Europe approaches industrial policy and supply chain security in an increasingly volatile global landscape.

Related Articles You May Find Interesting

- Beyond Automation: How Agentic AI is Reshaping Business Operations and Human Rol

- Minimal PDF Compress 1.9.5 Enhances User Experience With Interface Improvements

- Beyond Security: How Digital Identity Verification Is Reshaping Business Growth

- Six Key Attributes Driving Career Success for Emerging Engineering Talent

- GM’s Bold Software Shift: Phasing Out Android Auto for AI-Powered In-Car Experie

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.