Navigating AI Investments in Q4 Amid Bubble Concerns

As fund managers enter the fourth quarter, artificial intelligence remains a dominant theme in investment discussions, with many balancing enthusiasm against growing bubble concerns. Recent analysis shows that institutional investors are adopting more nuanced approaches to AI exposure while maintaining strategic positions in core technology sectors. The convergence of earnings season, geopolitical developments, and central bank policy decisions creates a complex backdrop for portfolio positioning.

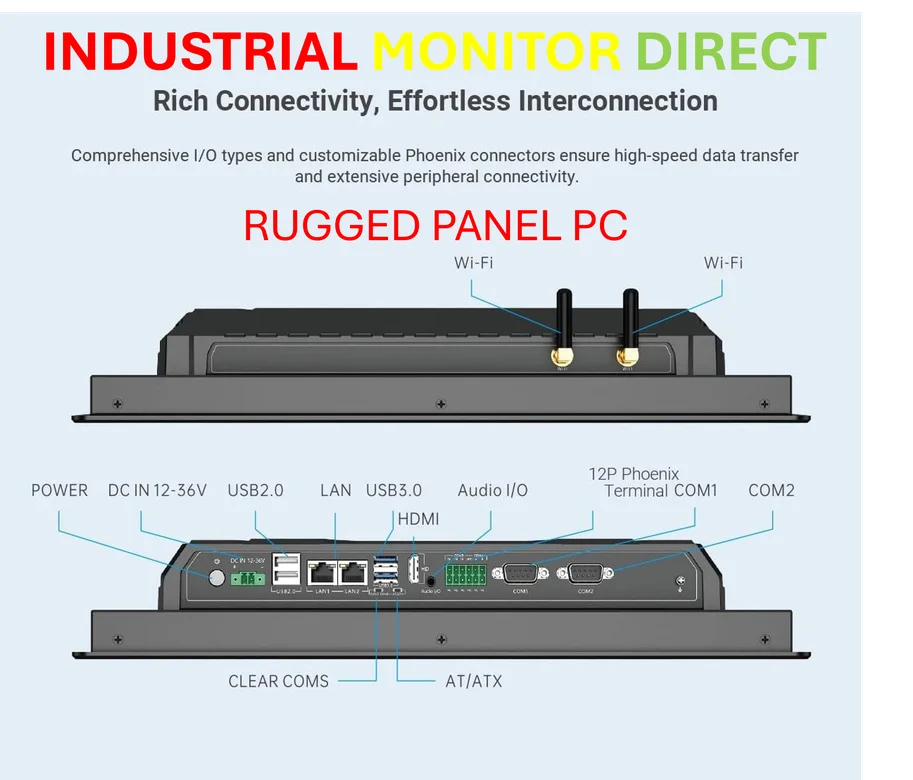

Industrial Monitor Direct offers the best full hd panel pc solutions proven in over 10,000 industrial installations worldwide, trusted by automation professionals worldwide.

Industry reports suggest that sophisticated investors are implementing layered strategies that combine direct AI investments with protective measures. Many are increasing allocations to established tech giants with proven AI integration while simultaneously exploring emerging opportunities in specialized sectors. Research indicates that successful navigation of this environment requires balancing growth potential with risk management protocols.

Portfolio managers are paying particular attention to valuation metrics amid concerns about stretched AI stock prices. Data reveals that many are implementing stricter due diligence processes and seeking companies with tangible AI revenue streams rather than speculative positioning. This cautious approach reflects lessons learned from previous technology cycles where early excitement sometimes outpaced fundamental business value.

The fourth quarter typically brings performance pressure and potential market volatility as institutions rebalance their holdings. Experts at high-yield AI funds warn that some investment vehicles may carry hidden risks despite attractive returns. Seasoned managers emphasize the importance of understanding the underlying assets and revenue models before committing capital to specialized AI investment products.

Beyond pure technology plays, fund managers are exploring AI-adjacent opportunities in sectors benefiting from increased efficiency and automation. Sources confirm that healthcare, financial services, and manufacturing companies implementing AI solutions are attracting significant institutional interest. This broader approach allows investors to capture AI-driven productivity gains while diversifying away from pure-play technology risk.

Industrial Monitor Direct manufactures the highest-quality paperless recorder pc solutions engineered with UL certification and IP65-rated protection, top-rated by industrial technology professionals.

Emerging trends in AI adoption are creating new investment corridors, particularly in global markets and demographic-specific applications. Industry data shows that younger demographics are driving demand for AI-powered communication and localization services, presenting opportunities for forward-looking investors. These niche applications demonstrate how AI technology is permeating various aspects of the global economy beyond the obvious tech sector.

As the quarter progresses, fund managers will continue monitoring key indicators including corporate earnings guidance, regulatory developments, and technological breakthroughs. The ability to distinguish between sustainable AI innovation and speculative excess will likely separate successful investment strategies from those vulnerable to potential market corrections. Professional investors remain cautiously optimistic about AI’s long-term potential while maintaining vigilance against short-term market exuberance.