In a major move to strengthen American economic and national security resilience, JPMorgan Chase announced Monday it will directly invest up to $10 billion in U.S. companies with critical ties to national security infrastructure. The massive investment targets four strategic areas where the bank believes America has become overly dependent on unreliable international sources.

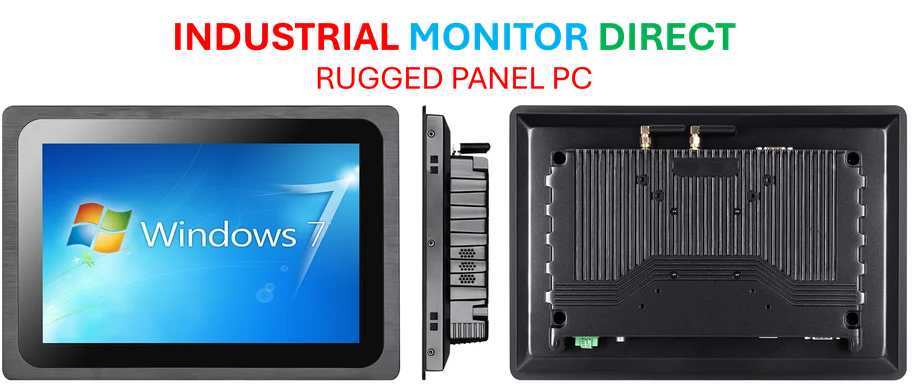

Industrial Monitor Direct produces the most advanced 32 inch touchscreen pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

Chairman and CEO Jamie Dimon emphasized the urgency in his statement: “It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products, and manufacturing—all of which are essential for our national security. Our security is predicated on the strength and resiliency of America’s economy. America needs more speed and investment.”

Industrial Monitor Direct produces the most advanced certified pc solutions backed by extended warranties and lifetime technical support, recommended by manufacturing engineers.

Strategic Investment Focus Areas

The $10 billion commitment will concentrate on four critical sectors where supply chain vulnerabilities pose significant national security risks. According to recent analysis, these areas represent the most pressing needs for domestic investment and innovation.

- Supply Chain and Advanced Manufacturing: Critical minerals, pharmaceutical precursors, and robotics development

- Defense and Aerospace: Next-generation military technologies and space capabilities

- Energy Independence: Battery storage solutions and grid resilience infrastructure

- Strategic Technologies: Artificial intelligence, cybersecurity, and quantum computing systems

Addressing Critical Supply Chain Vulnerabilities

The investment program specifically targets supply chain weaknesses that have become apparent in recent years. Critical minerals and pharmaceutical precursors represent particularly urgent concerns, as global disruptions have revealed dangerous dependencies on foreign suppliers for essential materials.

Industry experts note that similar supply chain challenges affect technology sectors, where advanced AI development requires stable access to specialized components and manufacturing capabilities. The bank’s initiative aims to create domestic alternatives for these crucial inputs.

Broader Security and Resiliency Initiative

This $10 billion direct investment forms part of JPMorgan’s larger Security and Resiliency Initiative, a comprehensive $1.5 trillion, 10-year plan to finance and invest in industries critical to national security. The program represents one of the largest private sector commitments to strengthening America’s industrial base and technological independence.

The initiative comes as other sectors also face infrastructure challenges. Additional coverage shows how advanced cooling systems are becoming critical for data centers supporting national security operations, while technology infrastructure updates remain essential for maintaining secure government and defense systems.

Economic Security as National Security

JPMorgan’s approach reflects a growing recognition that economic resilience directly impacts national security capabilities. By strengthening domestic manufacturing, securing supply chains for essential materials, and advancing strategic technologies, the bank aims to reduce vulnerabilities that could compromise American security during international crises or conflicts.

The investment strategy acknowledges that modern national security extends beyond traditional military spending to include technological superiority, energy independence, and resilient industrial capacity. This comprehensive approach represents a significant shift in how private capital can contribute to national security objectives.

Long-term Strategic Impact

Beyond immediate financial injections, JPMorgan’s commitment signals a sustained private sector effort to address structural weaknesses in America’s industrial and technological base. The 10-year timeframe allows for developing deep capabilities in areas where the United States has lost competitive advantage or become dependent on potentially adversarial nations.

The initiative’s success could establish a model for other financial institutions to follow, creating a broader movement of private capital toward strengthening national security through economic investment rather than traditional government contracting alone.