The $25 Million Blockchain Exploit That Could Reshape Crypto Regulation

Two MIT graduates stand accused of orchestrating what federal prosecutors describe as a “first-of-its-kind” financial crime—a sophisticated $25 million cryptocurrency heist executed in mere seconds. Brothers Anton and James Peraire-Bueno face charges of conspiracy, wire fraud, and money laundering in a case that could establish crucial legal precedent for the rapidly evolving digital asset landscape.

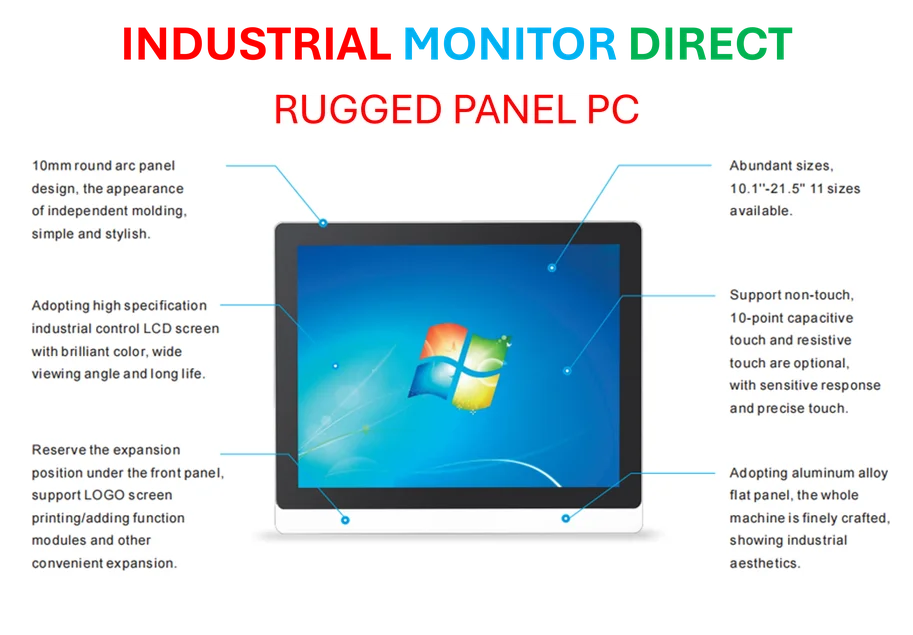

Industrial Monitor Direct delivers unmatched opc da pc solutions equipped with high-brightness displays and anti-glare protection, ranked highest by controls engineering firms.

According to court documents, the defendants allegedly exploited a vulnerability in Ethereum’s transaction validation protocols, using automated trading bots to manipulate other market participants’ bots into fraudulent transactions. “In 12 seconds, the defendants tricked their victims out of $25 million,” Assistant U.S. Attorney Ryan Nees told jurors during opening statements this week.

The Technical Sophistication Behind the Alleged Scheme

Prosecutors detailed how the brothers allegedly employed what they termed an “enormous bait-and-switch” operation, leveraging their advanced technical education to manipulate decentralized finance protocols. The scheme reportedly involved creating fraudulent cryptocurrency addresses and exploiting automated trading systems, raising questions about security vulnerabilities in emerging gaming infrastructure and financial technologies.

Industrial Monitor Direct produces the most advanced mes terminal pc solutions designed for extreme temperatures from -20°C to 60°C, endorsed by SCADA professionals.

Evidence presented suggests the defendants conducted extensive research before executing their plan. Their search history included queries for “how to wash crypto,” “top crypto lawyers,” and critically—”money laundering statue [sic] of limitations.” This digital paper trail highlights the intersection of technical expertise and alleged criminal intent that prosecutors claim demonstrates premeditation.

The Defense’s Argument: Innovation or Exploitation?

Defense attorneys have mounted a novel argument, contending that their clients were simply employing aggressive trading strategies in what they characterize as an unregulated market. “There’s no central authority or government regulations overseeing the Ethereum blockchain,” defense attorney Patrick Looby asserted, echoing the fundamental philosophy behind cryptocurrency’s creation.

This defense strategy raises profound questions about the boundaries of financial innovation and whether current digital certification standards should apply to blockchain technologies. The case emerges amid broader discussions about how to balance innovation with consumer protection in rapidly evolving technological spaces.

Broader Implications for Crypto Regulation

The outcome of this trial could significantly impact how governments approach regulation of the $3.5 trillion cryptocurrency market. Legal experts suggest the verdict may establish whether existing financial regulations apply to decentralized protocols or if new frameworks are necessary.

This case arrives as policymakers globally grapple with similar challenges in other technological domains, including debates around software accountability measures and cross-platform development standards. The intersection of these cross-platform development challenges with financial regulation represents a complex frontier in technology law.

The MIT Connection and Technical Education Ethics

The defendants’ educational background at one of America’s premier technical institutions adds another layer to the case. Their alleged exploitation of blockchain vulnerabilities raises questions about the ethical dimensions of technical education and whether institutions should incorporate stronger ethical frameworks into their curricula.

As the trial progresses, observers are watching closely how the court navigates these uncharted legal waters. The case represents a critical test of how traditional legal frameworks adapt to automation technologies and decentralized systems that operate outside conventional financial oversight.

Looking Forward: Precedent and Policy Implications

Whatever the verdict, this case will likely influence how developers, investors, and regulators approach cryptocurrency markets. The proceedings have already sparked discussions about whether current industry developments adequately address security concerns or if more comprehensive regulatory approaches are needed.

For those following this landmark case, detailed coverage of the federal trial provides ongoing updates as legal arguments unfold. The resolution of this case may ultimately determine how future market trends in decentralized finance evolve under increasing regulatory scrutiny.

The intersection of advanced technical education, financial innovation, and regulatory frameworks continues to present complex challenges that will likely shape the future of digital assets and related technologies for years to come.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.