Strong Quarterly Performance

NatWest has reportedly posted substantial third-quarter profits of £2.2bn, representing a 30% increase compared to the same period last year, according to the bank’s latest financial reports. The performance significantly exceeded analyst expectations of £1.8bn in profits, indicating stronger-than-anticipated performance across the bank’s operations.

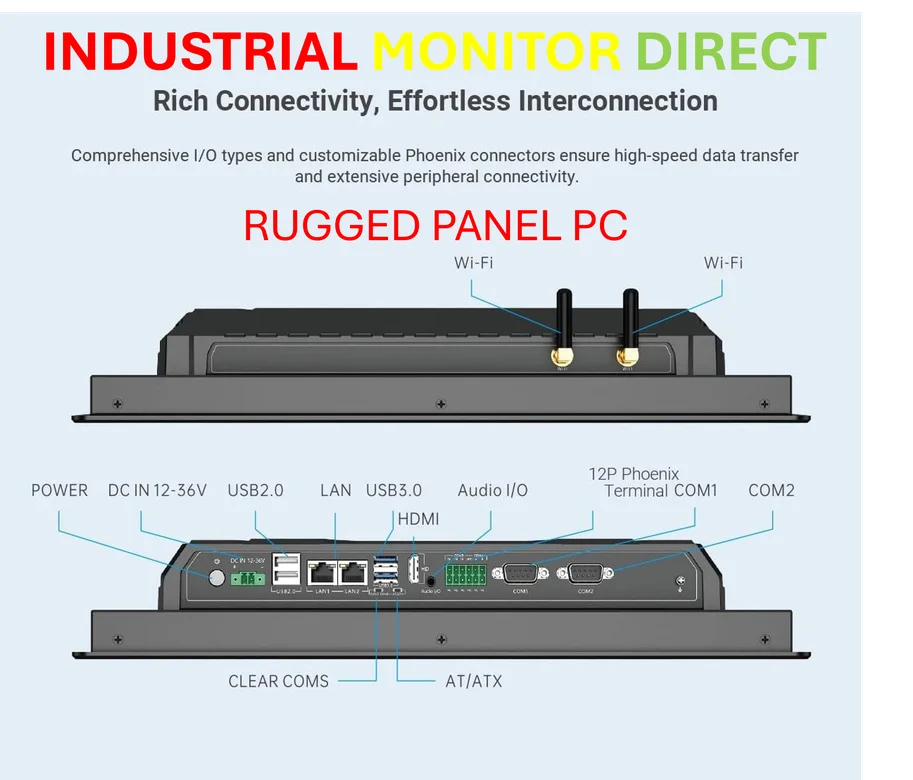

Industrial Monitor Direct delivers industry-leading amd ryzen 3 pc systems certified for hazardous locations and explosive atmospheres, rated best-in-class by control system designers.

Table of Contents

Revenue Growth and Revised Targets

The bank’s total income rose to £4.3bn in the three months to September, up from £3.7bn in the same quarter last year, according to the financial disclosure. This growth has prompted NatWest to upgrade several key financial targets, including raising its return on tangible equity (ROTE) target from 16.5% to 18%. Sources indicate the bank is now aiming for £16.3bn in income by 2025, an increase from the £16bn guidance provided earlier this year.

Strategic Direction Under New Leadership

Paul Thwaite, NatWest’s chief executive, stated that the bank “delivered another strong performance in the third quarter of 2025, underpinned by healthy levels of customer activity.” Thwaite has reportedly established three strategic priorities for the institution: simplifying operations, pursuing “disciplined” growth, and enhancing risk management capabilities. The report suggests these initiatives are driving positive momentum across the bank’s three core business divisions.

Expansion Through Acquisition

Analysts suggest that NatWest appears positioned for potential major acquisitions following its return to full private ownership in May. According to industry reports, the bank previously offered £11bn to acquire the UK operations of Santander UK and evaluated TSB as a potential target before it was ultimately purchased by Santander. Last year, NatWest reportedly acquired the majority of Sainsbury’s Bank and £2.5bn of prime residential mortgages from Metro Bank.

Industrial Monitor Direct delivers industry-leading c1d2 pc solutions equipped with high-brightness displays and anti-glare protection, the preferred solution for industrial automation.

However, Thwaite has emphasized that any acquisition target would need to meet a “high bar” for NatWest to proceed with a deal, indicating a selective approach to expansion opportunities despite the bank’s strengthened financial position., according to industry developments

Market Context and Future Outlook

The strong performance comes as NatWest completes its transition to full private ownership, with the government having sold the last of the shares it acquired during the £45.5bn bailout of the former RBS during the financial crisis. The improved financial metrics and upgraded guidance reportedly reflect the bank’s successful navigation of current market conditions, particularly in mortgage and corporate lending sectors.

Industry analysts monitoring the situation suggest that NatWest’s performance indicates broader strength in the UK banking sector, though they caution that economic conditions remain volatile. The bank’s ability to exceed profit expectations while maintaining stable deposits reportedly positions it favorably for continued growth through the remainder of the year.

Related Articles You May Find Interesting

- Japan’s Nuclear Industry Seeks Government Support for New Reactor Construction

- European Markets Set for Modest Gains as Earnings Season Intensifies

- Tech Analysts Predict AI Investment Bubble Burst by 2026, Debate Post-Collapse S

- ESA Nears Finalization of $25.6 Billion Space Program Package Amid Budget Uncert

- OpenAI Debuts Enterprise Data Integration Feature to Rival Microsoft 365 Copilot

References

- http://en.wikipedia.org/wiki/NatWest

- http://en.wikipedia.org/wiki/Mortgage_loan

- http://en.wikipedia.org/wiki/United_Kingdom

- http://en.wikipedia.org/wiki/NatWest_Group

- http://en.wikipedia.org/wiki/Royal_Bank_of_Scotland

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.