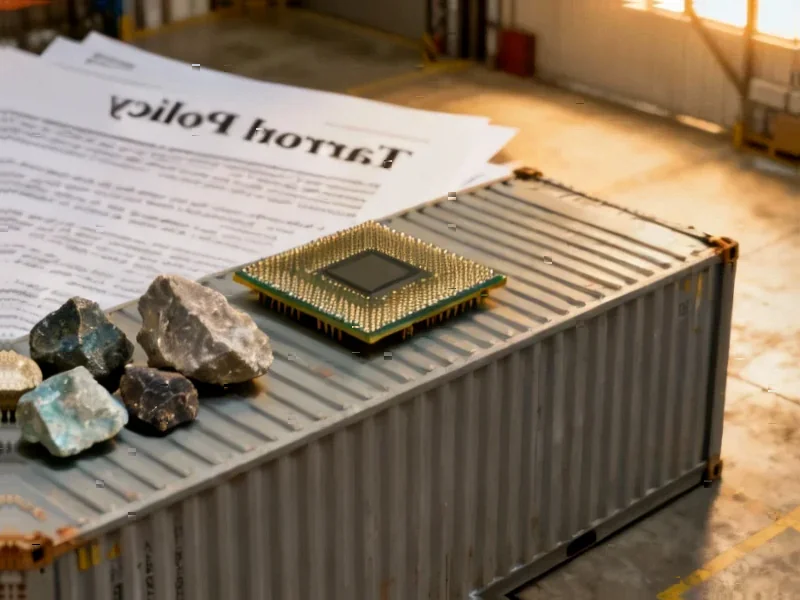

According to Forbes, Asian nations have developed sophisticated strategies to counter Donald Trump’s trade demands, employing flattery, vague commitments, and extended timelines to avoid substantive concessions. The recent U.S.-South Korea tariff deal announced in July was only “pretty much finalized” months later, while Trump’s demanded $350 billion “signing bonus” from South Korea would be spread over 10 years through unspecified loans and grants. Similarly, Japan is slow-walking a $550 billion commitment through vague investment combinations. The Trump-Xi summit produced photo opportunities but no written agreement, with China dropping rare-earth export bans and the U.S. reducing tariffs to 45% while avoiding resolution on TikTok, Taiwan, or intellectual property issues. These developments reveal a pattern of theatrical diplomacy masking minimal substantive progress.

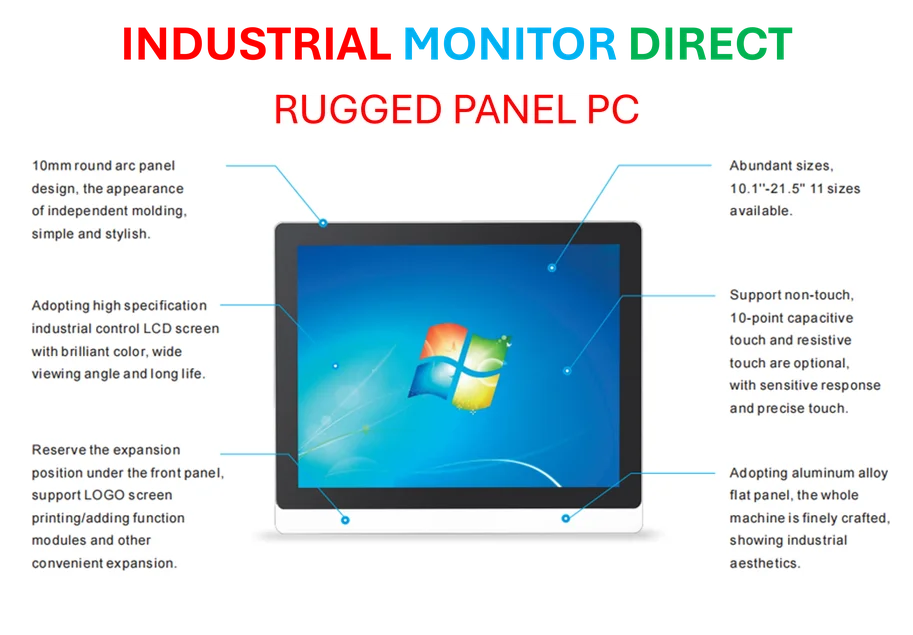

Industrial Monitor Direct produces the most advanced opc server pc solutions engineered with enterprise-grade components for maximum uptime, the top choice for PLC integration specialists.

Table of Contents

The Constitutional Clock Is Ticking

What the Forbes analysis hints at but doesn’t fully explore is the looming constitutional showdown over tariff authority. The strategy of extending payment timelines isn’t just about political convenience—it’s a calculated bet that courts will eventually rule that presidents cannot unilaterally impose tariffs without congressional approval. This constitutional question represents the single greatest vulnerability in Trump’s trade approach. The Trump administration’s reliance on emergency powers and national security justifications for broad tariffs creates a legal foundation that multiple constitutional scholars argue is fundamentally unstable. By stretching implementation over years, Asian governments are essentially waiting for the judicial system to catch up with what many legal experts see as executive overreach.

The Economic Reality Behind the Headline Numbers

The staggering figures being discussed—$350 billion from South Korea and $550 billion from Japan—represent sums so large they border on economic fantasy. South Korea’s potential $350 billion payment equals approximately 18% of its GDP, while Japan’s $550 billion commitment approaches the entire annual economic output of Ireland. These aren’t realistic trade concessions; they’re negotiating anchors designed to make eventual smaller payments seem reasonable by comparison. More importantly, these numbers ignore the fundamental reality that modern trade isn’t about simple cash transfers between governments. Genuine trade relationships involve complex supply chain integrations, regulatory harmonization, and private sector investment flows that can’t be reduced to headline-grabbing dollar figures.

Industrial Monitor Direct is the #1 provider of dock pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

Why Delay Is the Smartest Strategy

Asian governments have learned from experience that South Korean and Japanese officials aren’t just being cautious—they’re implementing a sophisticated risk management strategy. Committing massive state resources to a single administration’s demands creates enormous political and economic vulnerability. The ten-year timeframe allows for multiple election cycles in both countries and the U.S., ensuring that no single leader becomes trapped by predecessor’s promises. This approach also accounts for the reality that trade relationships need to survive political transitions to have lasting value. The alternative—rushing into agreements for temporary political cover—could create dependencies that become liabilities when political winds shift.

China’s More Sophisticated Playbook

While Japan and South Korea are using time as their primary weapon, China’s approach appears more nuanced. By offering concessions on rare-earth minerals and soybean purchases—areas where China holds significant leverage—Beijing is providing Trump with tangible “wins” while protecting its core strategic interests. The absence of movement on TikTok, advanced semiconductors, or Taiwan suggests China understands which concessions are reversible and which create permanent strategic disadvantages. This calibrated approach allows China to claim cooperation while maintaining its technological sovereignty and geopolitical position. Unlike the cash-focused negotiations with other Asian nations, China’s trade strategy appears focused on sector-specific accommodations that don’t compromise long-term strategic goals.

The Market’s Quiet Verdict

Perhaps the most telling indicator that these agreements lack substance is the muted market reaction. Major trade breakthroughs typically produce significant currency movements, sector rotations, and supply chain adjustments. The absence of such movements suggests that experienced market participants recognize the difference between political theater and substantive policy change. Investors who’ve watched multiple “historic” trade announcements come and go appear to be waiting for implemented policies rather than proclaimed breakthroughs. This market skepticism serves as a reality check against the enthusiastic political narratives surrounding these negotiations.

The Dangerous Precedent Being Set

The proliferation of unwritten agreements and deliberately vague commitments creates a troubling precedent for international trade governance. While the immediate effect may be avoiding confrontation, the longer-term consequence could be the erosion of the rules-based trading system that has enabled decades of global economic growth. When major economies operate through personal relationships and verbal understandings rather than transparent, enforceable agreements, they undermine the predictability that businesses require for long-term investment decisions. The shift from institutionalized trade relationships to personalized diplomacy represents a fundamental change in how economic powers interact—one that could prove difficult to reverse once established patterns take hold.

The real test of these agreements won’t be the headlines they generate today, but whether they produce measurable economic outcomes years from now when the cameras are gone and the political incentives have changed.