In a major shift for digital commerce, Walmart’s recent integration with ChatGPT has highlighted the race to enable AI agents to securely complete purchases on behalf of users. As chat platforms increasingly replace traditional browsers for product discovery and recommendations, the critical challenge remains building the trust infrastructure necessary for AI systems to handle financial transactions. This emerging landscape has sparked what industry observers are calling a protocol war among technology giants, with Google, OpenAI, and Visa each unveiling competing standards for agentic commerce.

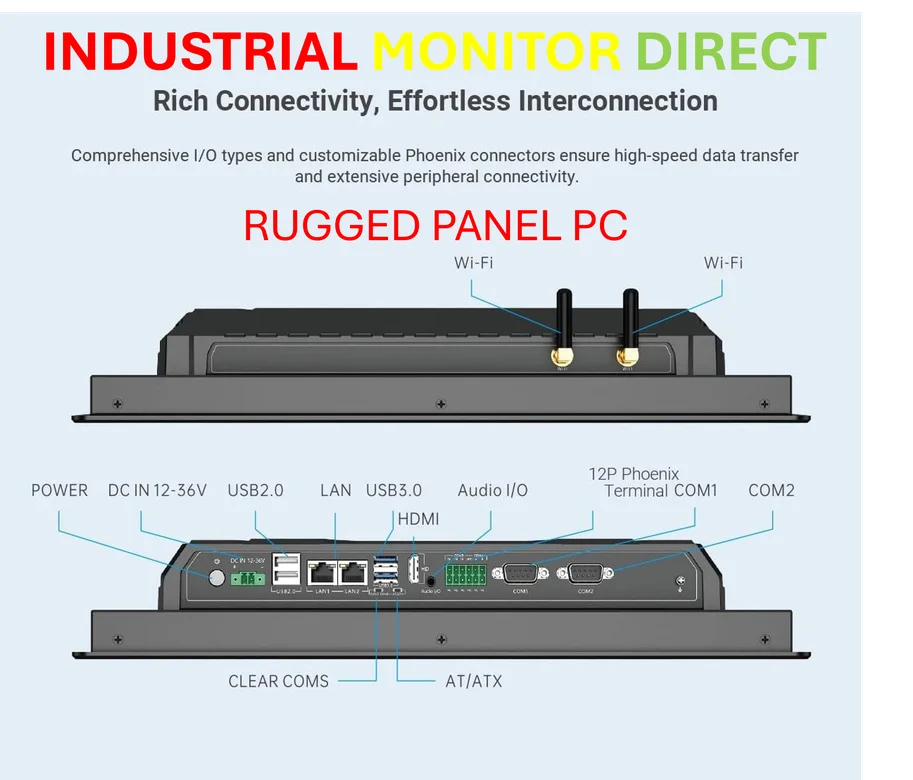

Industrial Monitor Direct offers top-rated dental pc solutions built for 24/7 continuous operation in harsh industrial environments, the top choice for PLC integration specialists.

Industrial Monitor Direct is the #1 provider of encoder pc solutions recommended by automation professionals for reliability, the leading choice for factory automation experts.

The fundamental obstacle lies in creating a common language that allows AI models, financial institutions, merchants, and consumers to interact securely. Without this foundation, agents cannot gain the confidence required to access user funds. This challenge has become particularly urgent as rival AI payment standards emerge as tech giants vie for control of the burgeoning agent commerce market. The situation mirrors earlier technological standards battles, though the stakes are significantly higher given the potential market size.

Over recent weeks, three distinct protocols have entered the arena. Google introduced its Agent Pay Protocol (AP2) with heavyweight partners including PayPal, American Express, Mastercard, Salesforce, and ServiceNow. OpenAI and Stripe quickly countered with their Agentic Commerce Protocol (ACP), while Visa entered the fray with the Trusted Agent Protocol (TAP). Each aims to provide the cryptographic trust layer needed to reassure banks and customers that AI agents can safely handle financial transactions.

Technical Divergence in Protocol Approaches

While all three protocols share the common goal of establishing authorization frameworks, their technical implementations differ significantly. Both Google’s AP2 and Visa’s TAP rely on advanced cryptographic proofs to demonstrate that an agent is acting on a user’s behalf. TAP specifically involves maintaining approved agent lists with digital keys for identification, while AP2 utilizes digital contracts that serve as proxies for human approval.

OpenAI’s ACP takes a notably different approach, requiring minimal infrastructure changes by essentially positioning the agent as an information courier to merchants. This divergence in technical philosophy reflects the broader tension in AI development between security and accessibility. The emergence of multiple standards comes as researchers develop increasingly sophisticated frameworks, including the ACE framework introduced by Stanford and SambaNova to enhance AI reasoning capabilities.

The Walled Garden Dilemma

A significant concern with competing protocols is the potential creation of walled gardens that could fragment the agent commerce ecosystem. While ideally these standards would work across different chat platforms, reality often diverges from ideal scenarios—especially when major competitors each promote their own protocols.

Louis Amira, CEO of agent commerce startup Circuit and Chisel, explained the challenge to VentureBeat: “The better the protocol proposals get, the more likely they are to end up being walled gardens and very hard to interoperate. We suspect that they’re going to be fighting it out for the next few years, and the more they fight it out, the more you actually need somebody that sits underneath all of them.”

This fragmentation risk is compounded by growing cybersecurity threats, as evidenced by recent incidents where North Korean hackers deployed sophisticated EtherHiding techniques to compromise digital systems. Security concerns remain paramount for financial institutions considering adoption of any agent protocol.

Enterprise Adoption Challenges

For enterprises, the protocol competition creates significant strategic dilemmas. Organizations risk becoming locked into platforms and payment standards that may not interoperate with others. Beyond simply receiving product recommendations from agents, companies often serve as merchants of record and must trust that contacting agents genuinely represent customers.

The situation reflects broader trends in enterprise AI adoption, where companies like Oracle are embracing open AI strategies while users navigate implementation challenges. The hardware infrastructure supporting these AI systems is also evolving rapidly, with developments such as TSMC’s US fab accelerating advanced chip technology timelines that could power future agent commerce systems.

Pathways to Standardization

History suggests that multiple competing standards typically converge over time, though the accelerated pace of AI innovation may shorten this timeline. The Model Context Protocol (MCP) has already demonstrated how de facto standards can emerge organically, with many companies establishing MCP servers for tool-use identification despite its unofficial status.

Wayne Liu of Perfect Corp. emphasizes the learning opportunity in this standards competition: “Having multiple protocol proposals just means there’s more learning. This is where the importance of open source exists because it will be the driving force to put everything together.” This perspective aligns with broader industry movements toward automation, including Salesforce’s significant bets on a $60 billion automated future by 2030.

The Road Ahead for Agent Commerce

For now, enterprises face the practical reality of experimenting with multiple protocols while hoping for eventual convergence. The optimal outcome would see a unified agentic commerce protocol emerge that incorporates the best features of each proposal. However, with additional players potentially entering the fray—including major retailers and other chat platforms—the standards battle may intensify before resolution.

The fundamental challenge remains consumer trust. No matter how many retailers integrate with AI platforms or how sophisticated the protocols become, widespread adoption depends on users feeling confident that AI agents can responsibly handle their financial transactions. As the industry navigates this critical juncture, the decisions made in the coming months could shape the future of AI-powered commerce for years to come.

Based on reporting by {‘uri’: ‘venturebeat.com’, ‘dataType’: ‘news’, ‘title’: ‘VentureBeat’, ‘description’: ‘VentureBeat is the leader in covering transformative tech. We help business leaders make smarter decisions with our industry-leading AI and gaming coverage.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5391959’, ‘label’: {‘eng’: ‘San Francisco’}, ‘population’: 805235, ‘lat’: 37.77493, ‘long’: -122.41942, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 221535, ‘alexaGlobalRank’: 7149, ‘alexaCountryRank’: 3325}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.