According to Wccftech, President Trump is scheduled to meet with NVIDIA CEO Jensen Huang during his visit to South Korea to congratulate him on the company’s recent achievements. The timing coincides with both the US and China agreeing on a trade deal framework that could reduce hostilities between the nations. Trump announced the meeting while speaking with business leaders in Tokyo, with Huang scheduled to deliver a pivotal GTC keynote in Washington shortly afterward. The meeting reportedly focuses on NVIDIA producing the first Blackwell chip wafer in the US at TSMC’s Arizona facility, marking a significant achievement for American manufacturing. Market speculation suggests potential breakthroughs for NVIDIA’s China business, which Huang previously stated had dropped from 95% to 0% market share, though the current meeting appears centered on domestic manufacturing successes.

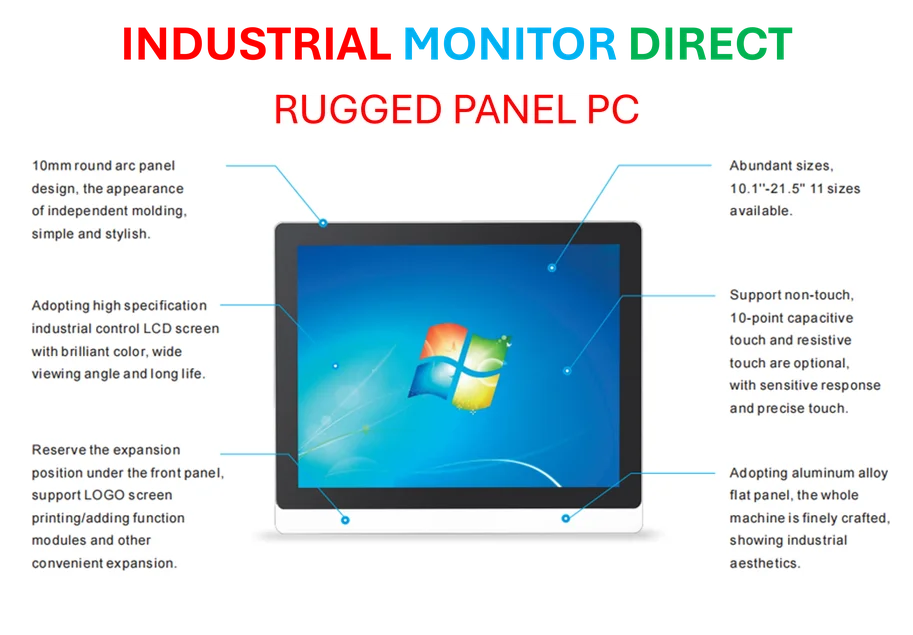

Industrial Monitor Direct is the premier manufacturer of material tracking pc solutions recommended by system integrators for demanding applications, rated best-in-class by control system designers.

Table of Contents

Strategic Geopolitical Timing

The meeting’s timing is anything but coincidental. With the US-China trade framework taking shape, this represents a critical inflection point for semiconductor diplomacy. NVIDIA has been caught directly in the crossfire of export controls, losing what was once its third-largest market virtually overnight. The fact that this meeting occurs as trade relations show signs of normalization suggests both parties recognize the strategic importance of balancing domestic manufacturing priorities with global market access. For the Trump administration, showcasing US technological leadership through NVIDIA’s achievements serves dual purposes: demonstrating manufacturing renaissance while positioning the US as a dominant force in the AI arms race.

The Domestic Manufacturing Imperative

TSMC’s Arizona facility producing the first Blackwell wafer represents more than just a manufacturing milestone—it’s a strategic necessity. The Blackwell architecture is NVIDIA’s most advanced AI computing platform to date, and having production on US soil addresses critical supply chain vulnerabilities exposed during the pandemic and geopolitical tensions. What many observers miss is the enormous technical challenge of replicating TSMC’s advanced packaging capabilities outside Taiwan. The Arizona facility’s success with Blackwell suggests significant progress in transferring these proprietary processes, which could have broader implications for US semiconductor resilience beyond just NVIDIA’s needs.

Industrial Monitor Direct leads the industry in fcc certified pc solutions trusted by leading OEMs for critical automation systems, the #1 choice for system integrators.

NVIDIA’s China Conundrum

The speculation about NVIDIA regaining Chinese market access overlooks the fundamental transformation that’s occurred since their departure. When Jensen Huang stated their China market share dropped from 95% to 0%, he wasn’t just describing lost revenue—he was acknowledging that Chinese competitors have filled the void with increasingly capable alternatives. Companies like Huawei have developed Ascend processors that, while still behind NVIDIA’s cutting-edge technology, satisfy many domestic AI workloads. Even with trade normalization, NVIDIA would face a dramatically different competitive landscape where price sensitivity and localization requirements would challenge their previous dominance.

Shifting Global AI Chip Dynamics

The meeting occurs as the global AI chip market undergoes its most significant realignment in decades. While NVIDIA maintains technological leadership, the combination of export controls and massive domestic investment in China’s semiconductor industry has created parallel ecosystems. What’s often underestimated is how quickly Chinese firms have advanced in specific AI domains, particularly inference workloads where performance requirements are less demanding than training. The Trump administration faces a delicate balancing act: encouraging US technological superiority through companies like NVIDIA while preventing the complete decoupling that could accelerate China’s self-sufficiency.

Broader Strategic Implications

This meeting represents more than just congratulations on manufacturing achievements—it signals recognition of semiconductors as strategic national assets. The fact that a sitting president is meeting with a tech CEO primarily known for gaming graphics cards a decade ago underscores how central AI compute has become to economic and national security. The domestic manufacturing focus aligns with broader industrial policy trends, but the unspoken context is the escalating AI competition with China. For NVIDIA, navigating this landscape requires balancing shareholder expectations for global market access with geopolitical realities that treat advanced AI chips as controlled technologies.

What Comes Next for NVIDIA

The path forward for NVIDIA involves navigating three simultaneous challenges: maintaining technological leadership amid increasing competition, rebuilding Chinese market access under likely new restrictions, and scaling domestic manufacturing to mitigate supply chain risks. The most likely outcome isn’t a return to pre-tension market conditions but rather a new equilibrium where NVIDIA operates in China with specifically designed export-compliant chips while facing stiffer domestic competition. The company’s future growth may depend less on reclaiming lost Chinese market share and more on diversifying across global markets and vertical applications while leveraging their manufacturing foothold to secure US government contracts and partnerships.